Overseas

May 24, 2022

CRU: 15% Tax Imposed on Indian Steel Exports

Written by CRU Americas

By CRU Senior Analyst Puneet Paliwal, from CRU’s Global Steel Trade Service, May 23

The Indian government’s sudden move to levy a 15% tax on most exported steel products has surprised the steel industry. While an attempt has been made to soften the impact by exempting import tariff on coking coal/coke and raising export tax on iron ore, steelmakers are lamenting the potential loss of export sales. Given the limited scope of diverting export volumes to domestic market, mills are expected to make near term production cuts. Large steelmakers also plan to put capex plans under review.

What has happened?

Indian government acts to stem rising inflation

The Indian government has announced measures to stem rising inflation. On 21 May 2022, the Indian government announced changes to import and export duties on steel and steelmaking raw materials. Changes were effective on 22 May 2022. Other measures include an excise duty cut on auto fuels (petrol and diesel), a customs duty cut on plastics, and restrictions on wheat exports.

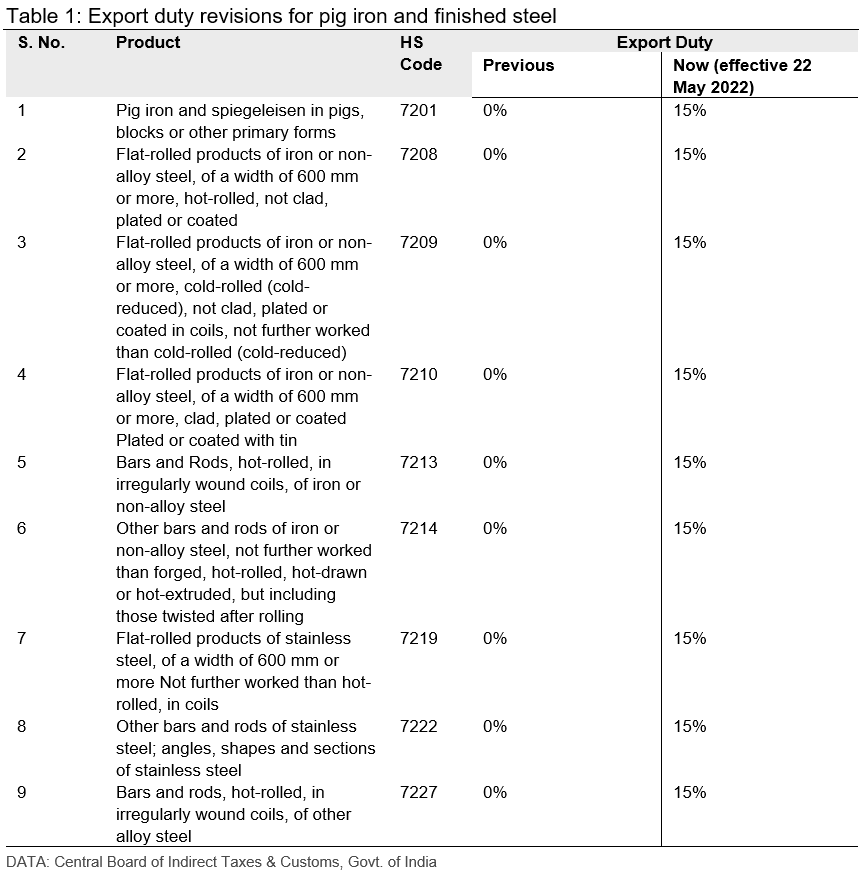

15% export duty levied on most steel exports

Pig iron, finished, and stainless steel products now attract an export duty of 15% – effective 22 May 2022 (see Table 1). These products made up >90% of Indian iron and steel exports over the last year.

Indian exports have increased in recent years but so has capacity

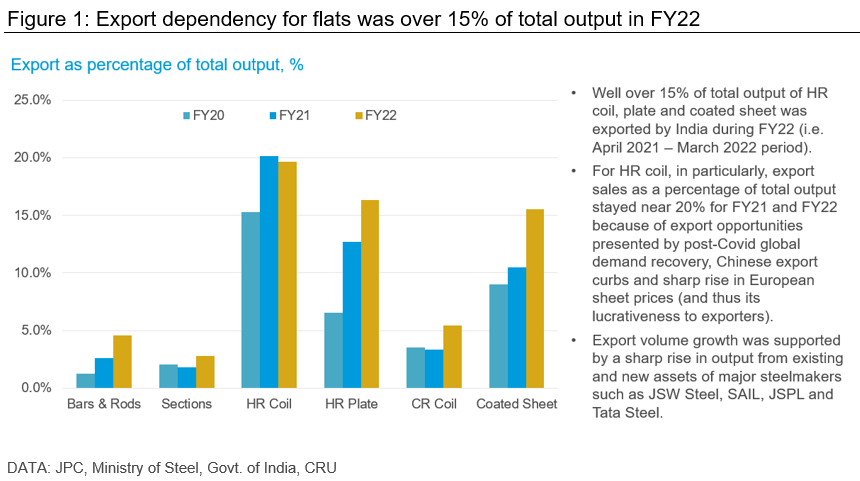

Indian steel capacity has increased more than domestic demand in recent years, making producers more reliant on exports. Major Indian steelmakers have increased their exposure to the export market over the past three years (see chart) as mills added new capacity and raised utilisation rates at existing assets. A potential decline in export sales due to these duties may force them to reduce operating rates in the near term to manage inventory and support prices at a high level – and the domestic market may not be able to absorb these additional volumes.

Semi-finished and alloy flat steel exempt

Semi-finished steel (i.e., slabs and billets/blooms) remains free of any export tax. A rise in Indian semi-finished steel exports will depend on seaborne demand for the same. Much will depend on demand from China – historically the largest importer – and the attractiveness of margins compared to finished steel sales. Boron-added HR coil (HS code 7225) is also excluded from the new taxes. This may present export opportunities, similar to the loophole used by Chinese mills in 2014 to use an export tax rebate.

Iron ore and coal tax changes favourable to steelmakers

Import tax revoked for coking coal and coke

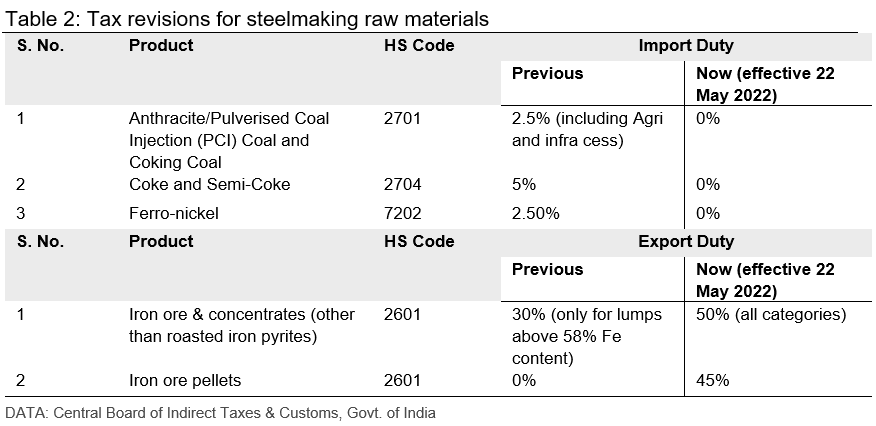

To ease inflation, the Indian government has exempted import tax on coking coal, PCI coal, coke, semi-coke and ferro-nickel (see Table 2). This will also reduce costs for steelmakers.

Higher export taxes for iron ore

Export tax has been raised substantially on iron ore lumps, fines, concentrates and pellets (see Table 2) to discourage exports and improve its availability to local steelmakers.

While these taxation changes in steelmaking raw materials may ease input costs, margins for steelmakers will be dictated by the supply-demand balance and their ability to keep prices supported. CRU believes that the export tax levy on pig iron and finished steel has the potential to lower steel prices substantially in the domestic market, as availability is expected to rise. However, there are some options steelmakers may avail to temper the impact of this development on prices.

Possible reactions by steelmakers

All things considered, the hastiness of these taxation changes by the Indian government, (i.e., date of implementation being the day next to the announcement date) has perplexed steelmakers. While some are citing concerns around the sales impact on export volumes in transit or in various stages of production, others are concerned about the impact on prices and steelmaking margins when these “export earmarked” volumes are offered to the domestic market, adding to the oversupply.

CRU understands from market contacts that steelmakers have petitioned to the government to exempt already booked export volumes (which are approximately to the tune of 2 Mt) from these taxes. Several of the steelmakers are supposedly left with no choice but to lower capacity utilisation at mills until the end of the lean monsoon period. Moreover, some steelmakers are also heard to be exploring the option to bear the incremental cost associated with these new duties to fulfil their export commitments, while actively discussing a recourse of sharing cost burden with buyers.

We believe that Indian steel exports to price-sensitive export destinations, such as Southeast Asia and the Middle East, will fall as the increase in steel export duties outweighs the cost savings. Nevertheless, Indian exports may continue to make way into the relatively lucrative European export market, as the impact on export margins will be less severe.

Furthermore, major steelmakers are also planning to put their capex plans under review as the pace of execution of these expansion projects could slow down, with weakening mill cash flows if this export duty remains in place over the medium term.

It is too early to comment on whether the government will be compelled to roll back or relax these measures in the near term, but this move does put an immediate downward pressure on domestic steel prices.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com