Analysis

June 17, 2022

US Light Vehicle Sales Down 11.2% in May

Written by David Schollaert

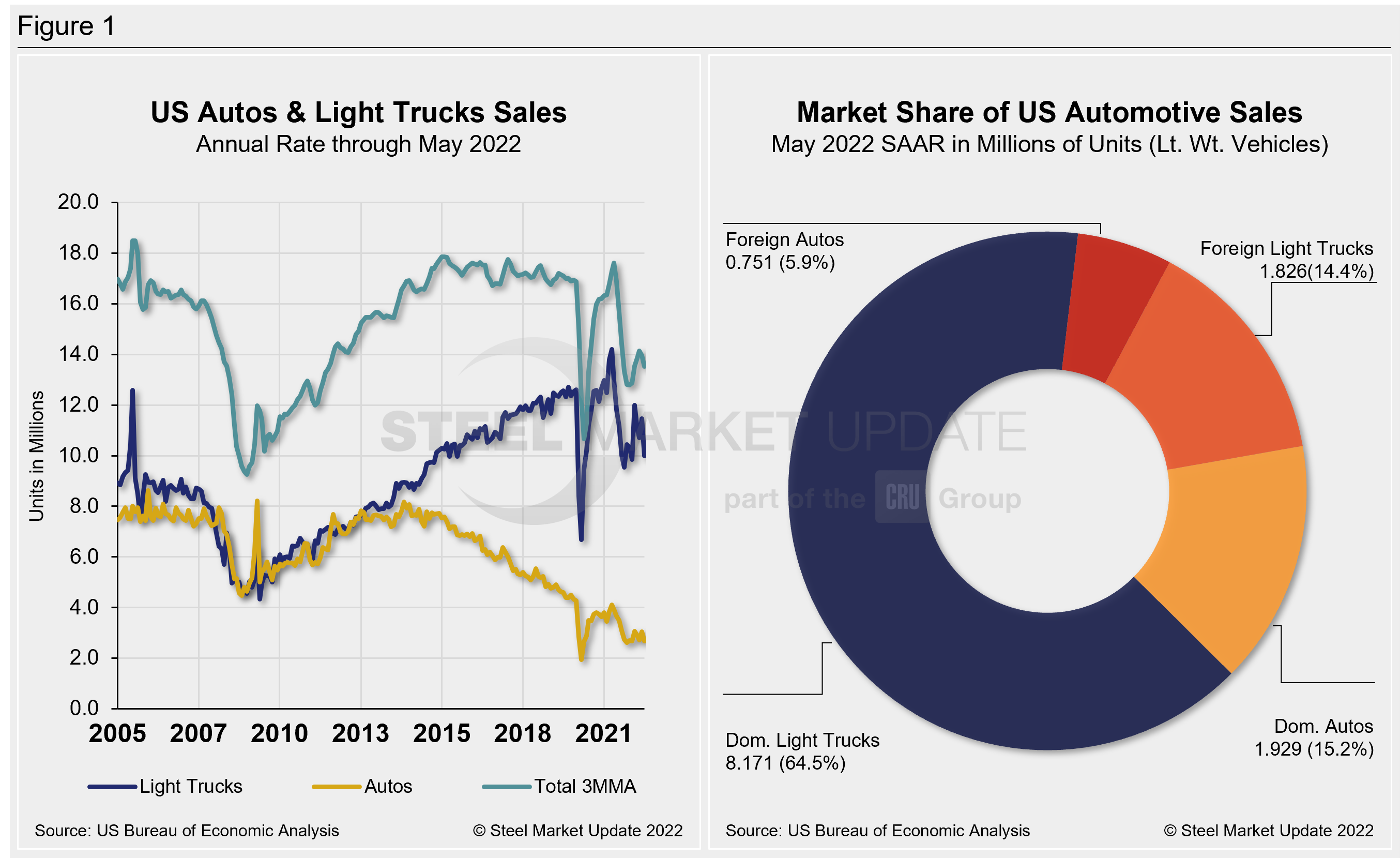

US light vehicle sales fell to 1.11 million units in May, down 11.2% from 1.25 million units in April. LV sales in the US shrank by 29.2% year-on-year (YoY). The annualized selling rate fell to 12.68 million units last month from 14.50 million units in April, the US Bureau of Economic Analysis (BEA) reported.

The annual comparison was hurt by two fewer selling days than in May 2021, and a high base effect. That said, it was still a poor result, as Memorial Day sales failed to provide a boost to the market. Though headwinds include higher interest rates, low incentives, and higher starting prices, what’s holding sales back is supply rather than demand. The tumble in domestic sales in May was again driven by extremely tight inventories.

Supply bottlenecks remain the key issue for the global automotive industry, with manufacturers unable to meet demand in most regions. Sales were down 10% YoY.

In China, the reopening of manufacturing facilities in mid-April supported a stronger bound in sales, while the US industry is struggling in the face of record-high transaction prices, low inventory, and low incentives, according to LMC Automotive.

Below in Figure 1 is the long-term picture of sales of autos and lightweight trucks in the US from 2005 through May 2022, as well as the market share sales breakdown of April’s 12.68 million vehicles at a seasonally adjusted annual rate.

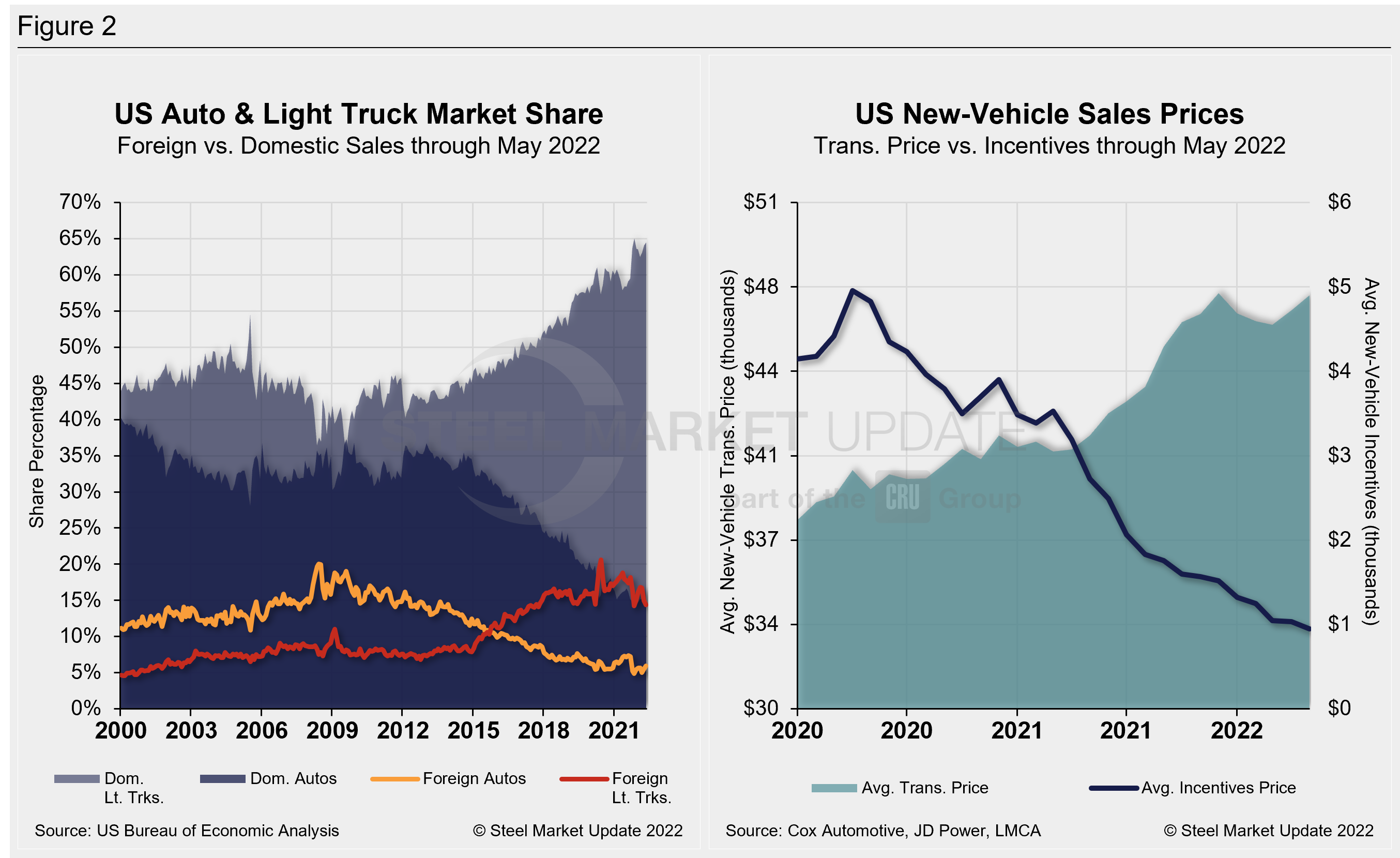

Microchip and parts shortages continue to hinder automotive production, resulting in tight inventories and high transaction prices. The run-up in the average transaction price (ATP) continues to coincide with historically low incentives.

New-vehicle ATPs rose to $47,148 in May, rising for the second straight month, and just below the record high of $47,243 set in December 2021. Prices were up 1.3% (+$622) in May versus the prior month and are 14.1% (+$5,818) above the year-ago period, according to Cox Automotive data.

Incentives dropped to a record low of $950 in May, falling below the $1,000 mark for the first time in recent history, and roughly 2% of the average transaction price. Incentives are down 65.2%, or $1,776 YoY.

In May, the annualized selling rate of light trucks was 9.997 million units, down 12.8% versus the prior month and down 22.9% YoY. Auto annualized selling rates were similar during the same periods: down 11.8% and down 31.8%, respectively.

Figure 2 details US auto and light-truck market share since 2010 and the divergence between average transaction prices and incentives in the US market since 2020.

Canada and Mexico saw varying dynamics in May. In Canada, light-vehicle sales declined by 6.9% YoY in April to 144,000 units. The selling rate picked up slightly to 1.47 million units annually in May, from 1.46 million units per year in April. Despite the slight uptick, this is the first time in two years that the rate failed to reach 1.5 million units per year for two consecutive months. The market remains sluggish, largely due to tight inventories.

On the other hand, Mexican auto sales grew by 6.3% YoY in May, at 91,000 units, up from 83,000 units in April. The selling rate accelerated to 1.18 million units per year, from 1.14 million units per year in March and the highest rate since February 2020.

Editor’s Note: This report is based on data from the US Bureau of Economic Analysis (BEA), LMC Automotive, JD Power, and Cox Automotive for automotive sales in the US, Canada, and Mexico. In specific, the report describes light vehicle sales in the US.

By David Schollaert, David@SteelMarketUpdate.com