Analysis

July 19, 2022

NAHB: Housing Starts Fall Again in June

Written by David Schollaert

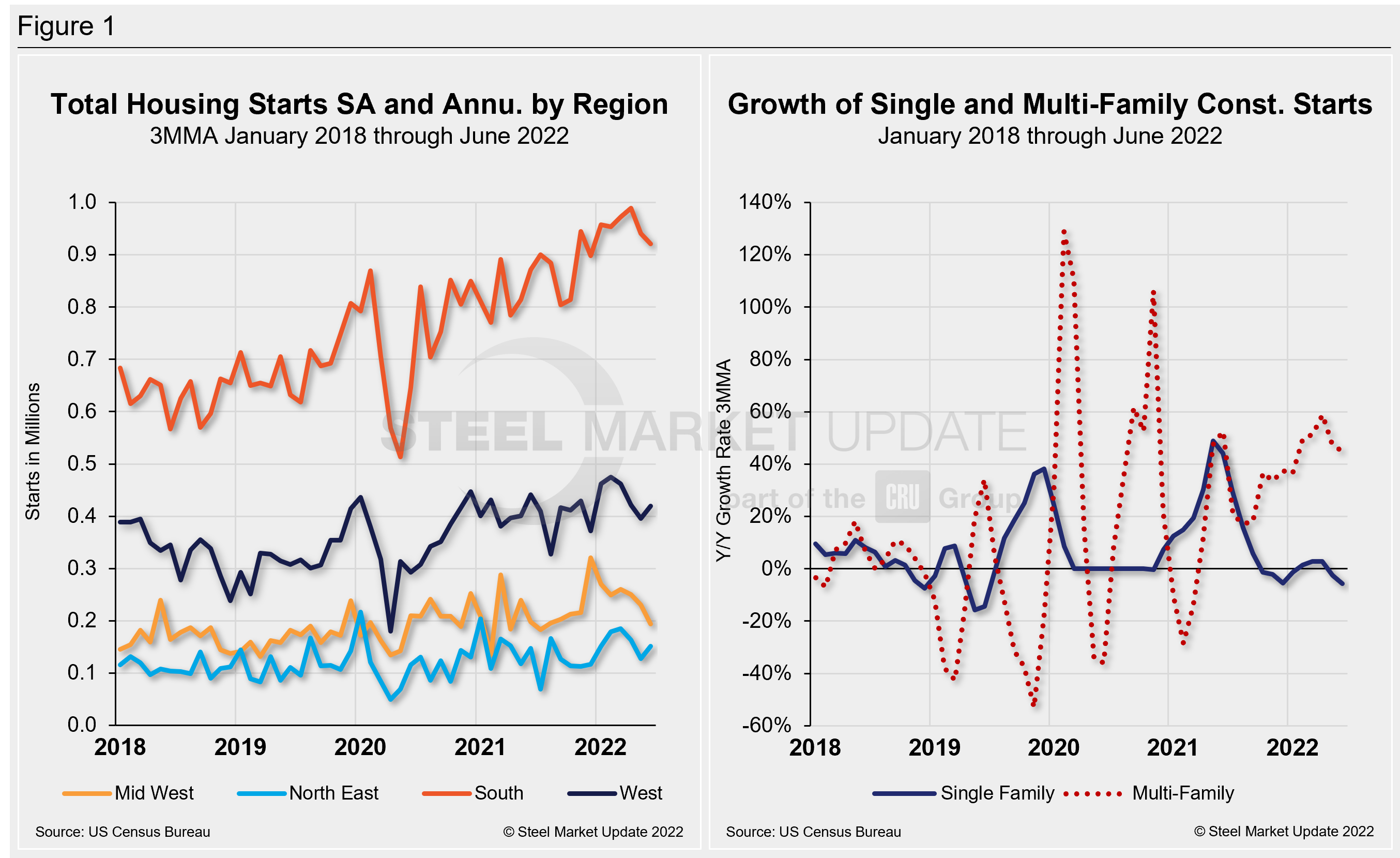

Housing starts shrank in June and single-family starts hit a two-year low as the construction sector continues to face compounding headwinds. Rising interest rates, ongoing building material supply chain troubles, and ballooning construction costs put a damper on the single-family housing market.

For the first time since June 2020, both single-family starts and permits fell below a 1 million annual pace, according to the latest data from the US Census Bureau and the Department of Housing and Urban Development.

Overall housing starts fell 2% to a seasonally adjusted annual rate of 1.56 million units in June from an upwardly revised reading in May. Last month’s reading of 1.56 million starts – indicating the number of housing units builders would begin if development kept this pace for the next 12 months – was driven by a 10.3% drop in the multi-family sector to an annualized 577,000 pace. Single-family starts fell 8.1% to a 982,000 seasonally adjusted annual rate.

“Single-family starts are retreating on higher construction costs and interest rates, and this decline is reflected in our latest builder surveys, which show a steep drop in builder sentiment for the single-family market,” said Jerry Konter, the National Association of Home Builders’ chairman and a home builder and developer in Savannah, Ga. “Builders are reporting weakening traffic as housing affordability declines.”

On a regional year-to-date basis, combined single-family and multi-family starts varied. The Northeast and the West regions were down 4.4% and 0.4%, respectively. The Midwest and South saw growth over the same period, improving by 1.2% and 12.9%, respectively.

“While the multi-family market remains strong on solid rental housing demand, the softening of single-family construction data should send a strong signal to the Federal Reserve that tighter financial conditions are producing a housing downturn,” said Robert Dietz, NAHB’s chief economist. “Price growth will slow significantly this year, but a housing deficit relative to demographic need will persist through this ongoing cyclical downturn.”

Overall permits slipped 0.6% to a 1.69-million-unit annualized rate in June. Single-family permits fell by 8% to a 967,000-unit rate. This is the lowest pace for single-family permits since June 2020. Multi-family permits increased 11.5% to an annualized 718,000 pace.

Compared to the previous year, regional permit data shows that permits are 5.1% lower in the Northeast, while they are 2.5% higher in the Midwest, 2.9% higher in the South, and 3% higher in the West.

There are now 148,900 single-family permits authorized but not yet started, a 3.0% year-over-year gain because of higher construction costs and material delays slowing previously permitted projects.

By David Schollaert, David@SteelMarketUpdate.com