Prices

November 16, 2022

US Monthly Raw Steel Production Slows Through September

Written by Brett Linton

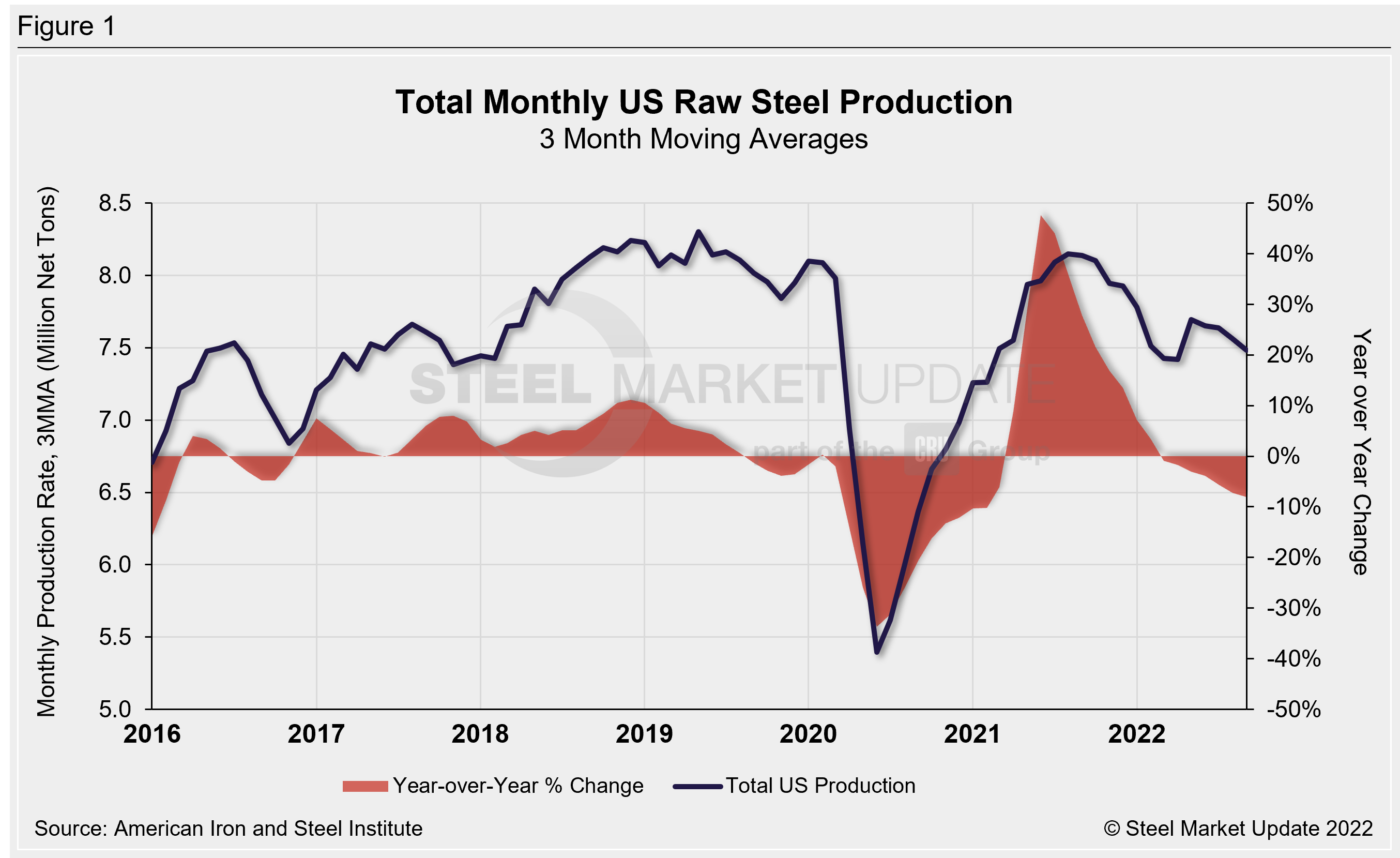

US raw steel production slipped 400,000 net tons to 7.22 million tons in September, down 5% from August, according to recently released American Iron and Steel Institute (AISI) data. September represents the third lowest monthly production rate seen since 2020, behind February 2021 and February 2022.

Production continues to trend downward since peaking in mid-2021. Recall that August 2021 production reached a 20-month high of 8.29 million tons. September production is down 670,000 tons, or 8%, compared to the same month last year.

Note that AISI’s monthly production estimates are different than the weekly estimates SMU reports each Tuesday. The monthly estimates are based on over 75% of domestic mills reporting versus only 50% reporting weekly estimates.

Figure 1 compares monthly production data on a three-month moving average (3MMA) basis to smooth out month-to-month fluctuations. Raw steel production averaged 7.48 million tons between July and September 2022, down 8% from the same quarter in 2021. The average production rate for Q3 2022 is down 2% versus the previous quarter, up 1% versus Q1 2022, and down 6% from Q4 2021. Recall that Q2 2020 production plunged to the lowest 3MMA level in our 12-year history at 5.39 million tons.

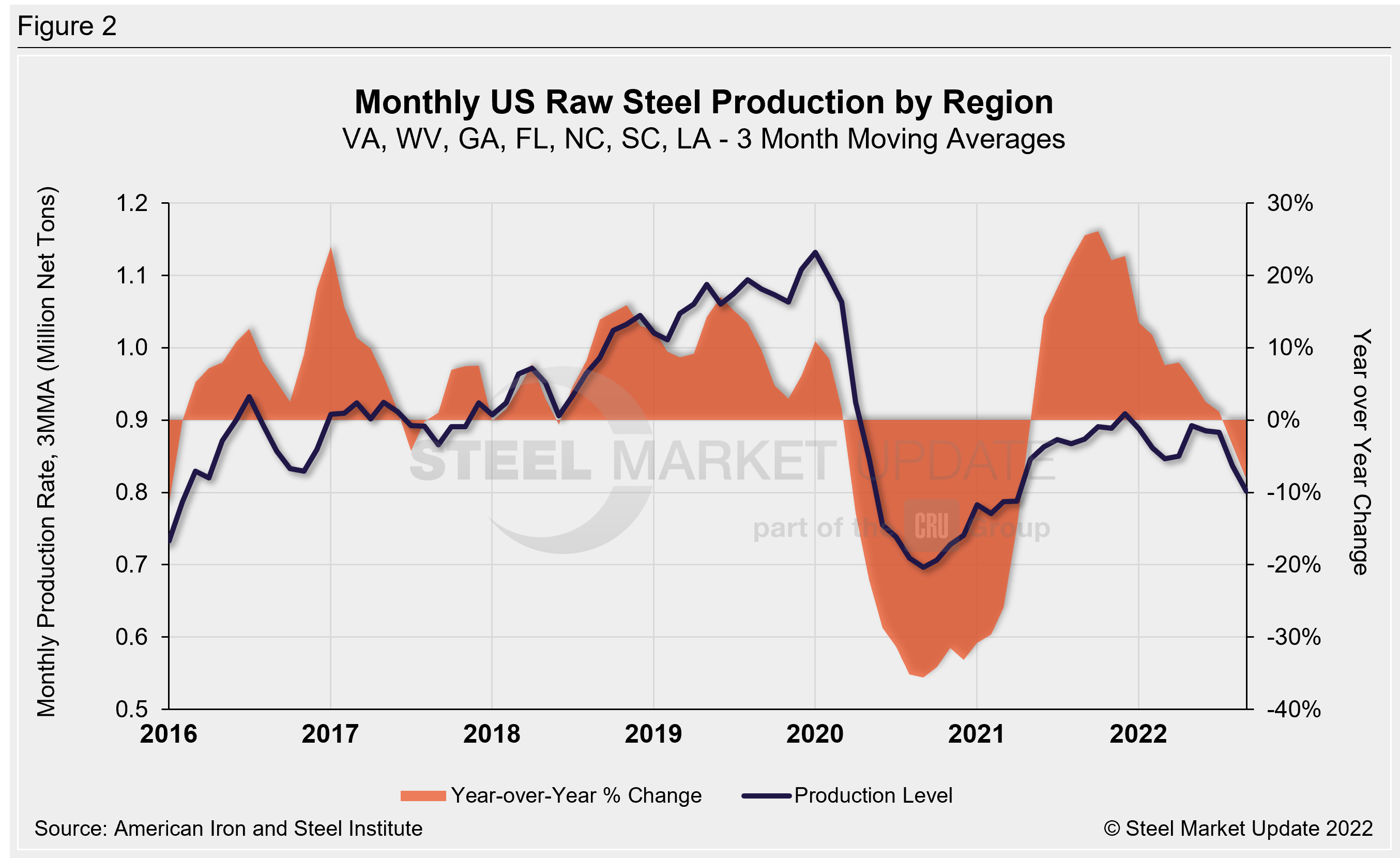

SMU publishes regional steel production data for the four regions responsible for 10% or more of total domestic production. Figure 2 shows 3MMA production history from the combined states of Virginia, West Virginia, Georgia, Florida, North Carolina, South Carolina and Louisiana. The latest 3MMA for September is 802,000 tons, down 8% compared to the same period last year and the lowest rate seen since April 2021.

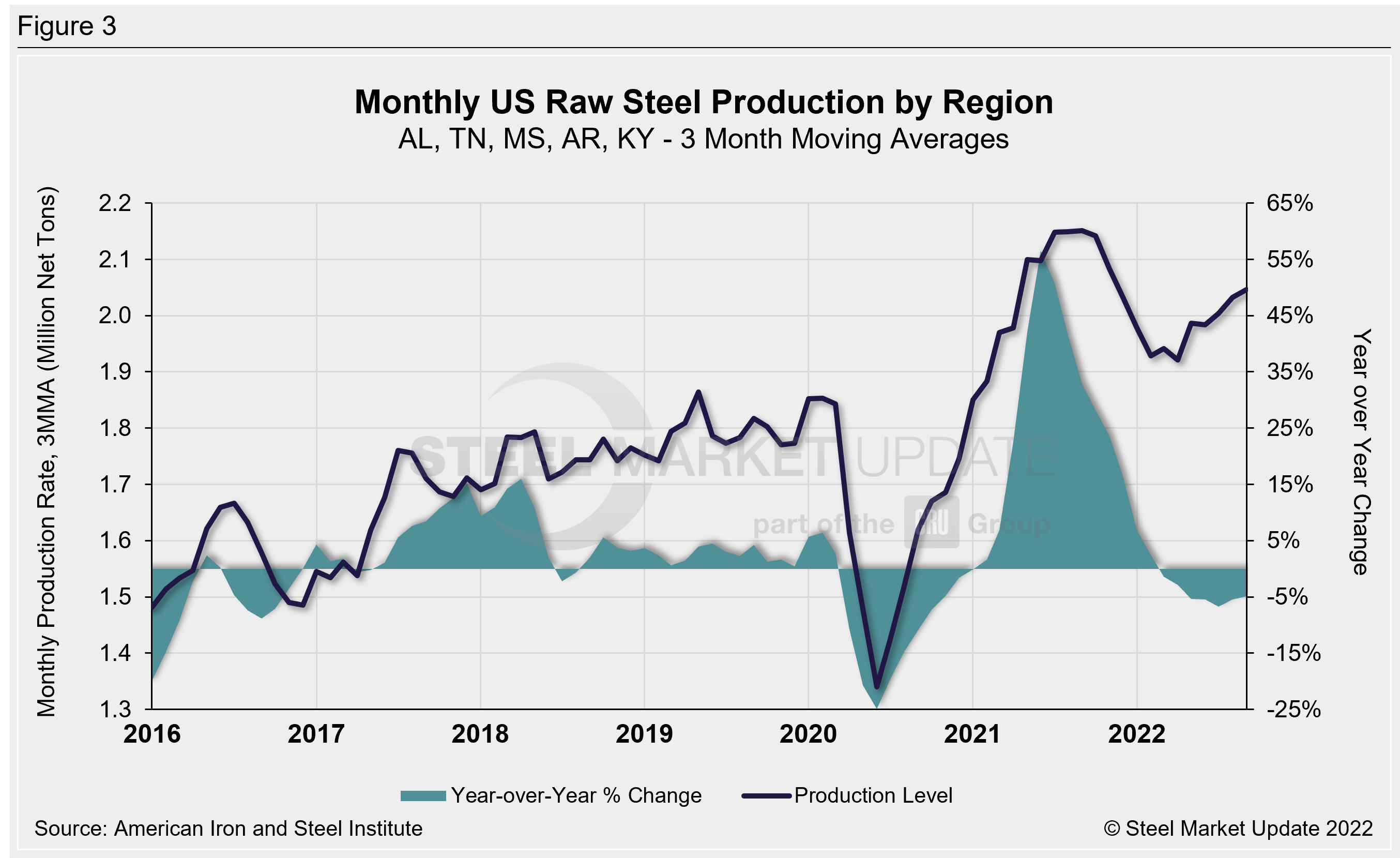

Figure 3 shows the combined production in Alabama, Tennessee, Mississippi, Arkansas, and Kentucky. The September 3MMA for this region has increased for the majority of the year, now up to 2.05 million tons. September production is down 5% compared to levels one year prior when we saw the highest 3MMA rate in SMU’s recorded history at 2.15 million tons.

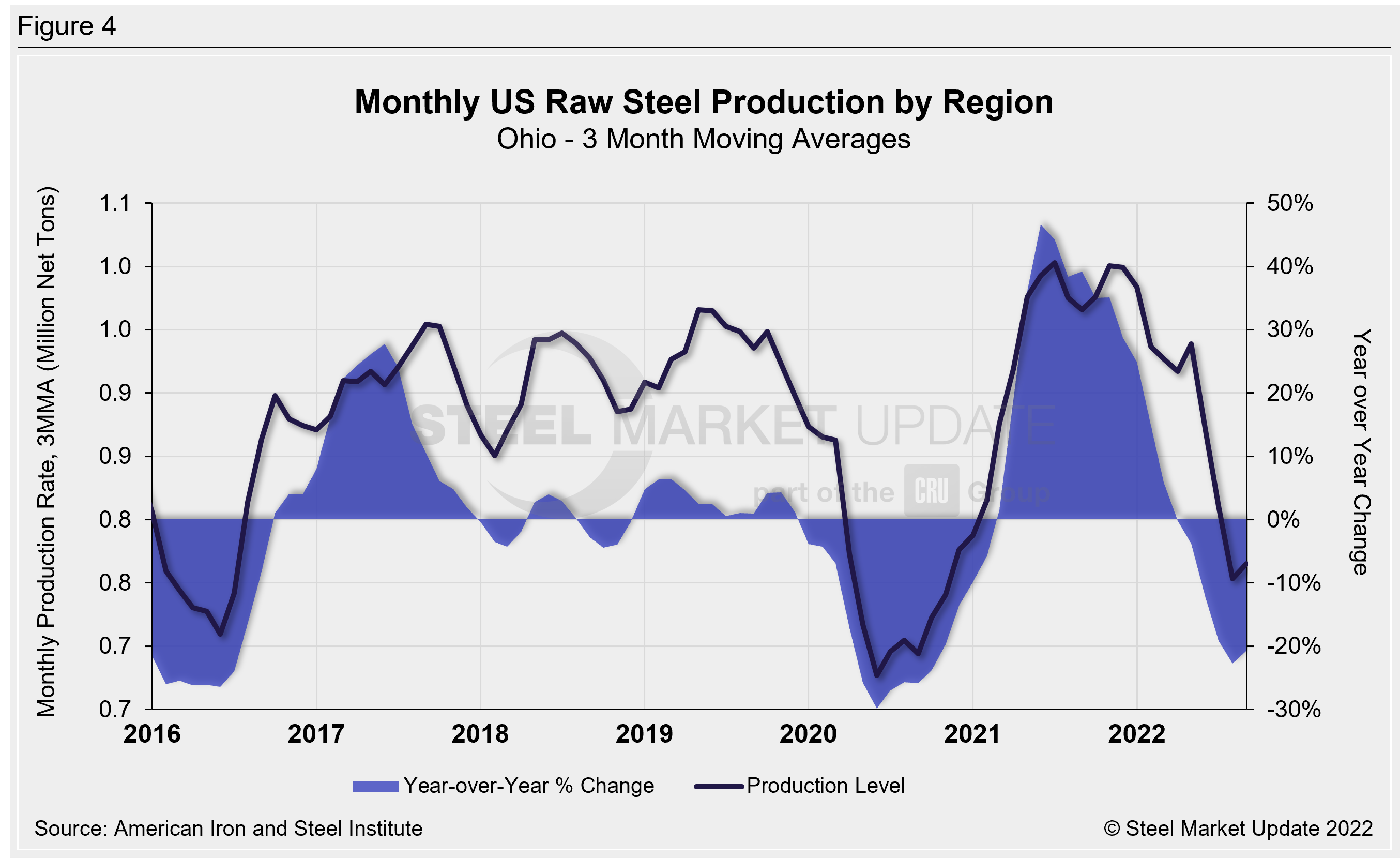

Figure 4 displays 3MMA production from Ohio, currently at 765,000 tons through September and down 21% over the same period in 2021. Production reached 753,000 tons just one month prior, the lowest 3MMA recorded since November 2020.

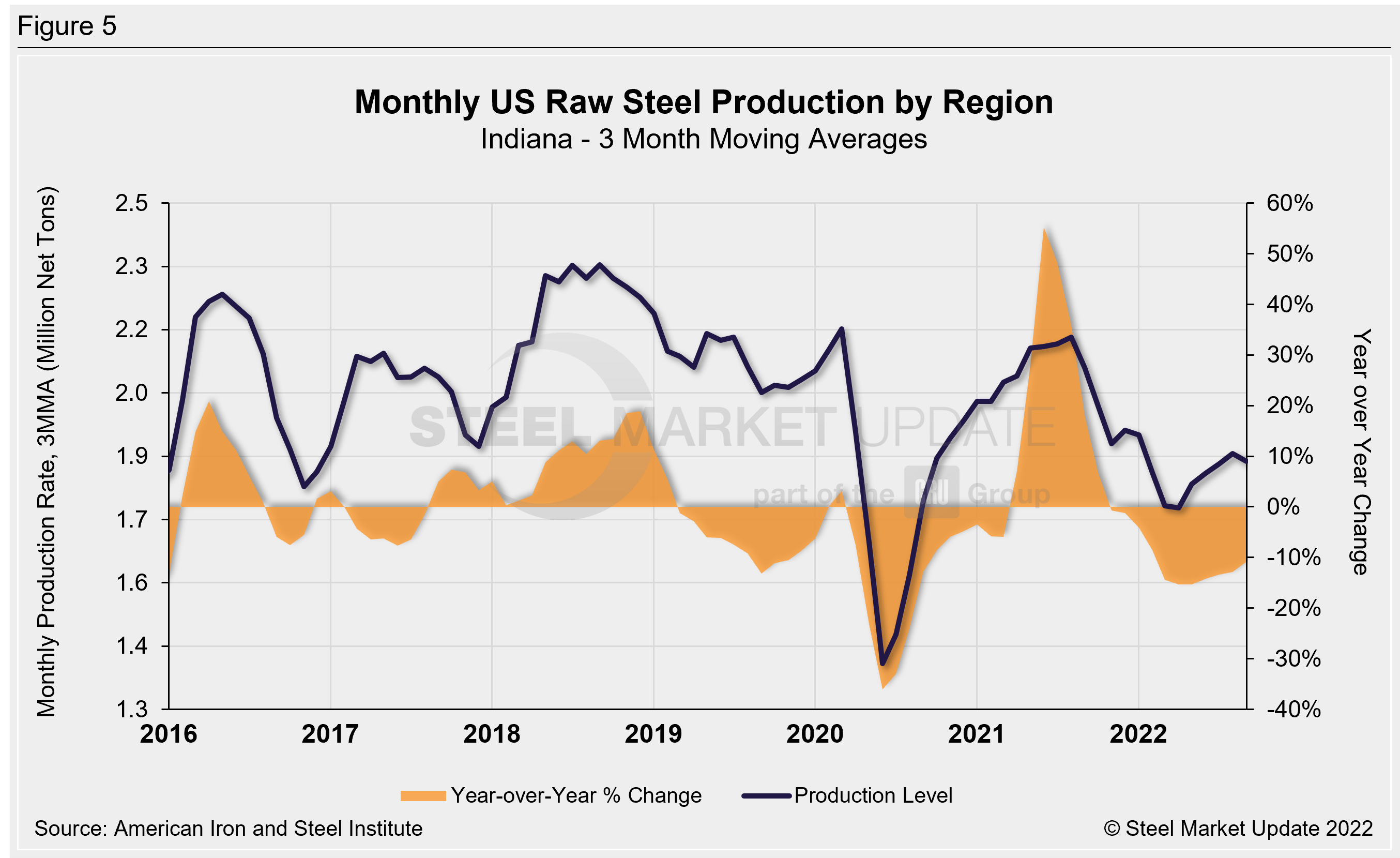

Figure 5 shows the 3MMA production levels from the state of Indiana through September. Production is now at 1.84 million tons, the third highest 3MMA rate of 2022 but down 11% from levels one year prior.

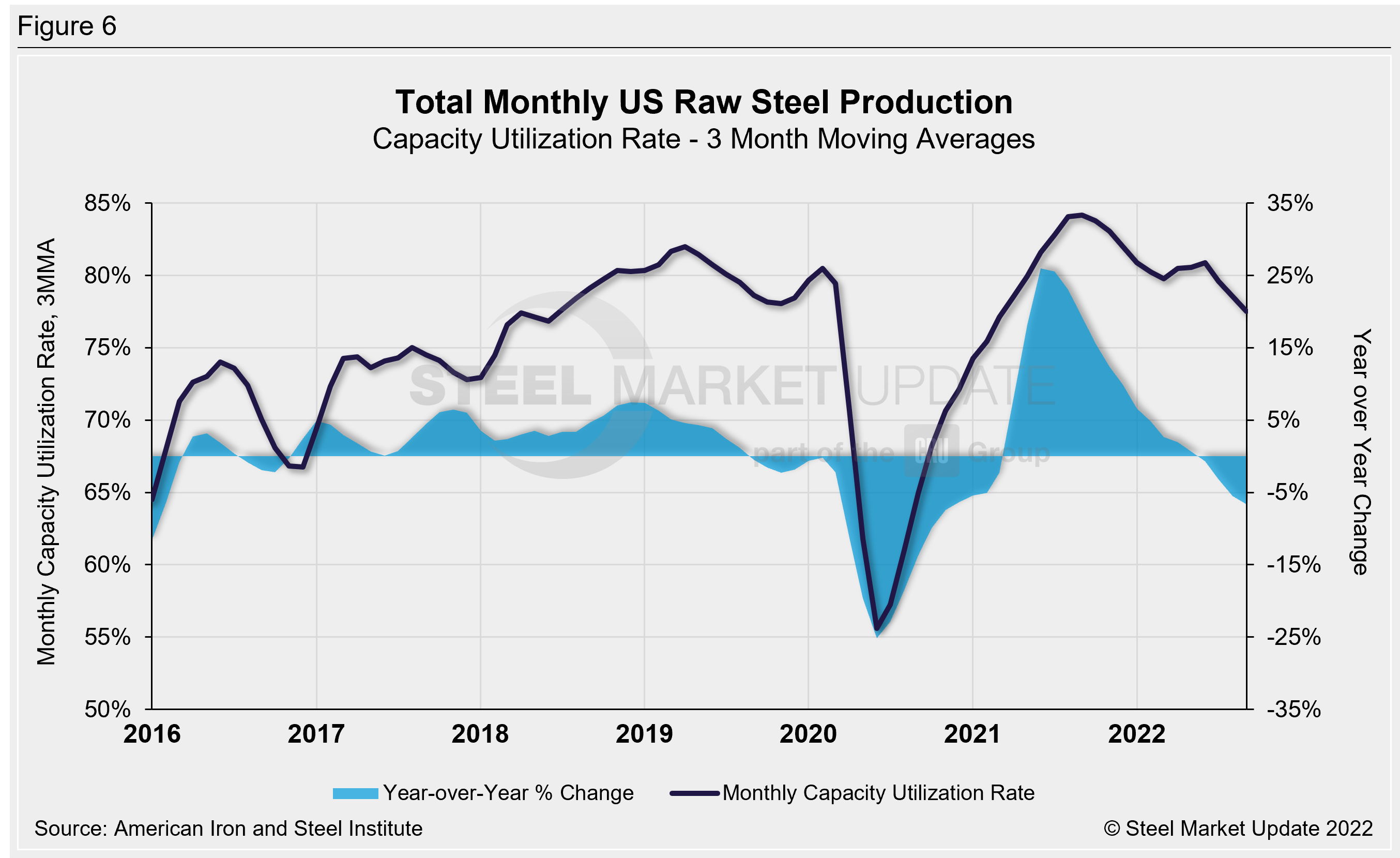

The average mill capacity utilization rate for September was 76.4%, down from 78.0% in August and down from 83.3% one year ago. This is the lowest monthly rate seen since December 2020.

The average capacity utilization rate for 2022 is now 79.4%, down from 81.0% in the first nine months of 2021, but up from 66.8% in the same period of 2020.

As shown in Figure 6, the capacity utilization rate on a 3MMA basis through September fell to an 18-month low of 77.5%. This is down 7% compared to the same period one year prior, when the 3MMA utilization rate had reached a 12+ year high of 84.2%.

SMU Note: Additional raw steel production graphics are available in the Analysis section of our website here. If you need assistance logging into or navigating the website, contact us at info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com