Market Data

January 4, 2023

CRU 2023 Insights: Steel Expectations and Outliers

Written by Josh Spoores

At the start of each year, CRU continues to feature top expectations and outliers for the year ahead. This annual list of expectations is a thought piece, meant to stimulate internal discussions, scenario analysis, and strategic planning around potential risks to the markets we cover. This 2023 edition covers six expectations and three potential outliers.

Last Year’s Expectations

Perhaps the best place to start for our expectations and potential outliers for 2023 is by reviewing our “top calls” for 2022. Last year, we covered 10 expectations, which are listed below.

Seven of these 10 were realized. Perhaps the most important was the expectation that prices would fall towards cost. The industry, as a whole, at the end of last year found this to be the most contrarian view. A few of the other expectations did not get fully realized – i.e., La Niña did not fully disrupt the steel supply chain. This weather phenomenon is now in a rare third year, and it is possible to still be a factor in early 2023. While no significant disruption was recorded in 2022, one might argue that floods in Australia – which have limited coal production and exports in late 2022 – may qualify here as coming to fruition.

Realized

- Steel prices will fall towards cost

- Chinese steel demand to keep falling in 2022

- Auto output will support sheet demand more as the year goes on

- Balance will return to supply chains

- New import orders have peaked for North America and Europe

- Iron ore and metallurgical coal will return to earth

- The decarbonization trend will continue… and accelerate

Not Fully Realized

- Demand for steel will be at a record level outside China

- Scrap demand will hit a new record high

- Steel supply chain will be hit by La Niña

Here are CRU’s expectations for 2023:

Metallics Demand Is in a Bull Market

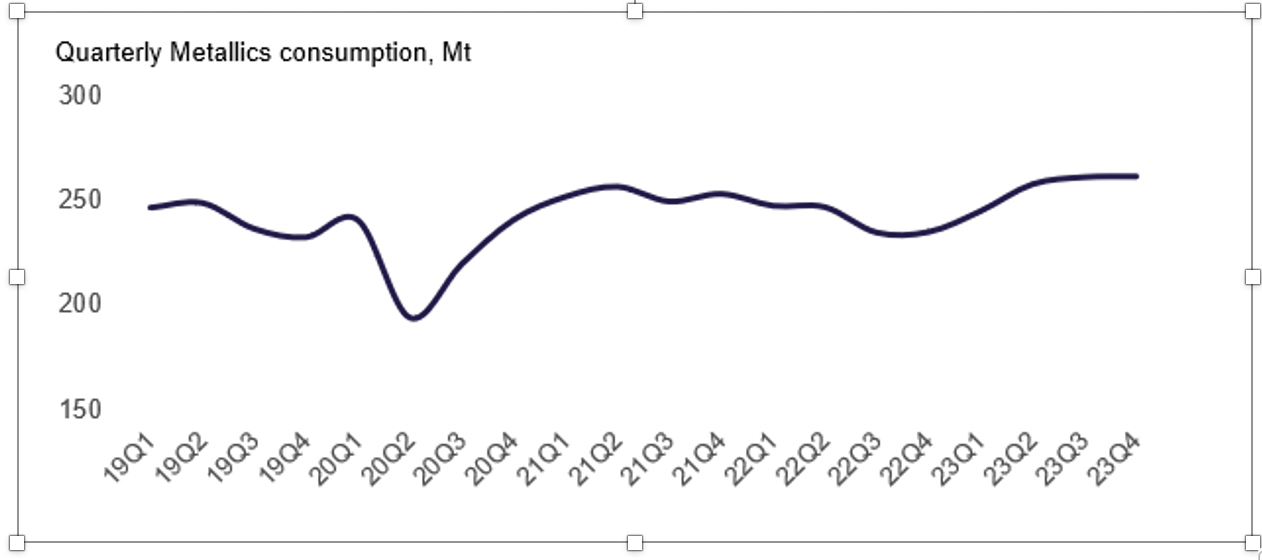

Global metallic markets will rebound from late-2022 lows due to a multitude of factors. One such factor is the new electric-arc furnace (EAF)-based steelmaking capacity coming online – particularly the ramp-up of newly built capacity in the United States. Globally, metallics supply will tighten as new EAFs come online, while at the same time, blast-furnace (BF)-based producers use more scrap in their basic-oxygen-furnace (BOF) mix to lower emissions.

Due to this demand increase, some regions may enact export controls for steel scrap or other metallics. Traditional pig iron supply will remain limited due to the war in Ukraine as well as sanctions or tariffs on Russian supply. However, India – with the elimination of the temporary export duties – will gain significant share in the merchant pig iron market.

Metallics Consumption to Rebound from 2022 Q4 Low

Easing of Pandemic Restrictions in China Will Lead to Stronger Year-On-Year Demand for Steel and Steelmaking Raw Materials

Near the end of 2022, China already eased pandemic restrictions at a faster pace than anticipated. We expect this easing will continue to lead to increased economic activity and renew demand for steel and steelmaking raw materials. Although construction activity in China will remain under pressure and limit the growth rate of overall steel consumption, there is a possibility the government may provide new backing to this sector if economic performance disappoints. This would further support the steel market.

Continued Online…

The full insight, including our expectations for 2023 is available for free at the following link. You may need to register to gain access.

https://www.crugroup.com/knowledge-and-insights/insights/2022/2023-steel-expectations-outliers/