Analysis

January 25, 2023

US Apparent Steel Supply Falls in November

Written by Becca Moczygemba

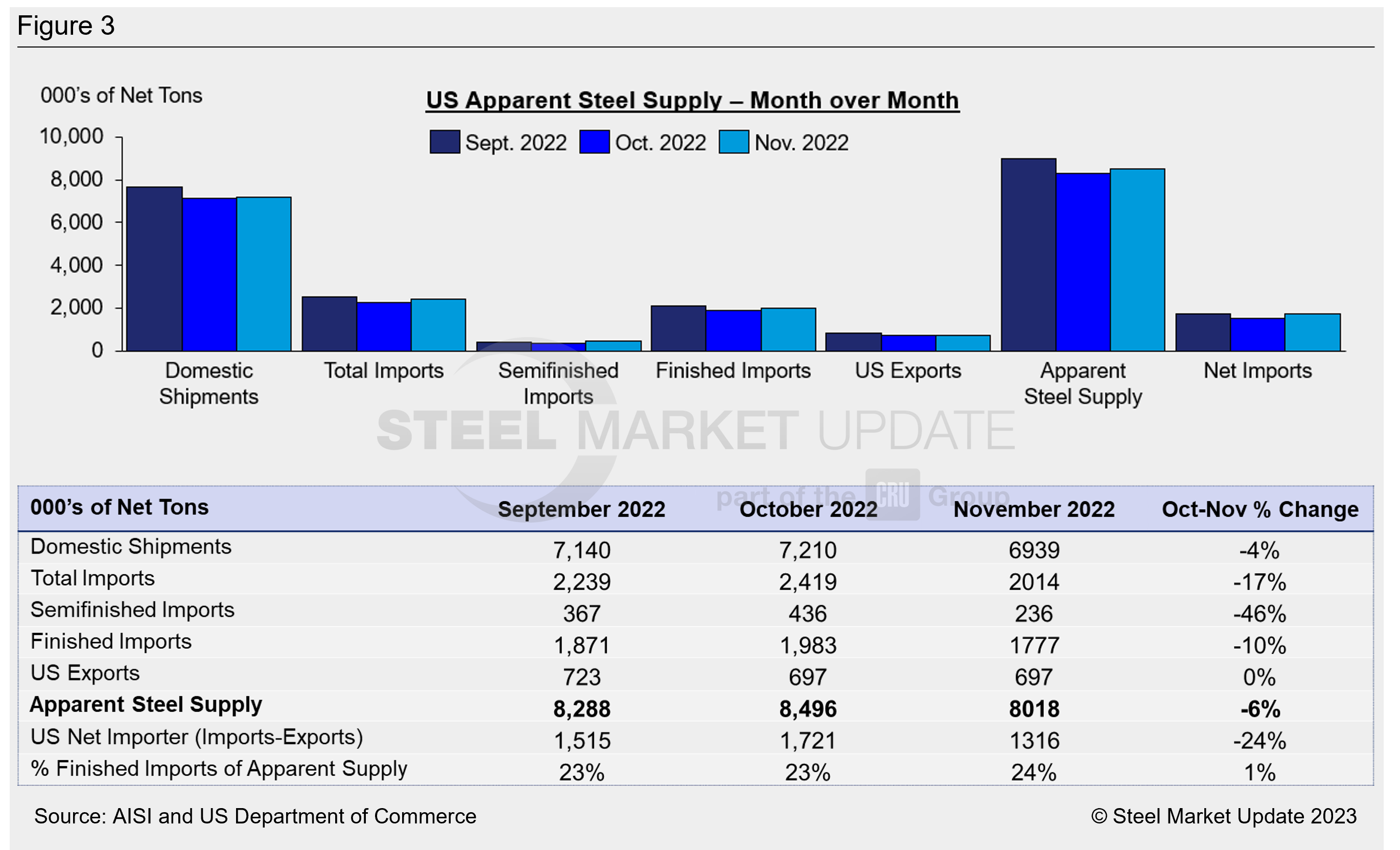

US apparent steel supply dropped 6% in November to 8 million net tons compared to the previous month, according to data from the US Department of Commerce and the American Iron and Steel Institute (AISI).

Apparent steel supply is determined by combining domestic steel mill shipments and finished US steel imports, then deducting total US steel exports.

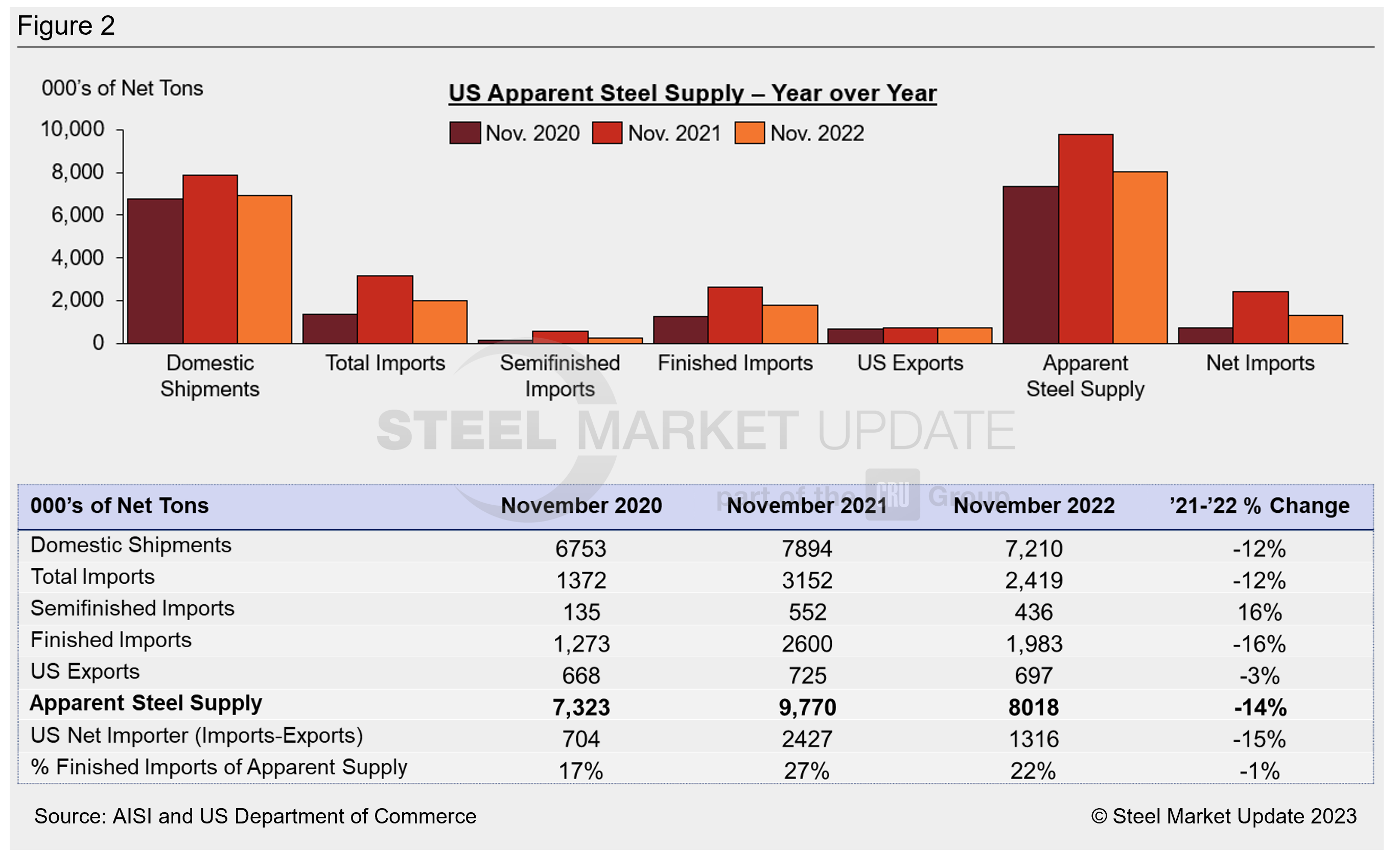

November apparent supply total was 1.75 million tons lower than the same month one year ago when supply stood at 9.77 million tons. Figure 2 shows November trade statistics year over year (YOY) for each of the past three years.

Apparent steel supply has been mixed since September. Figure 3 shows monthly statistics over the last three months.

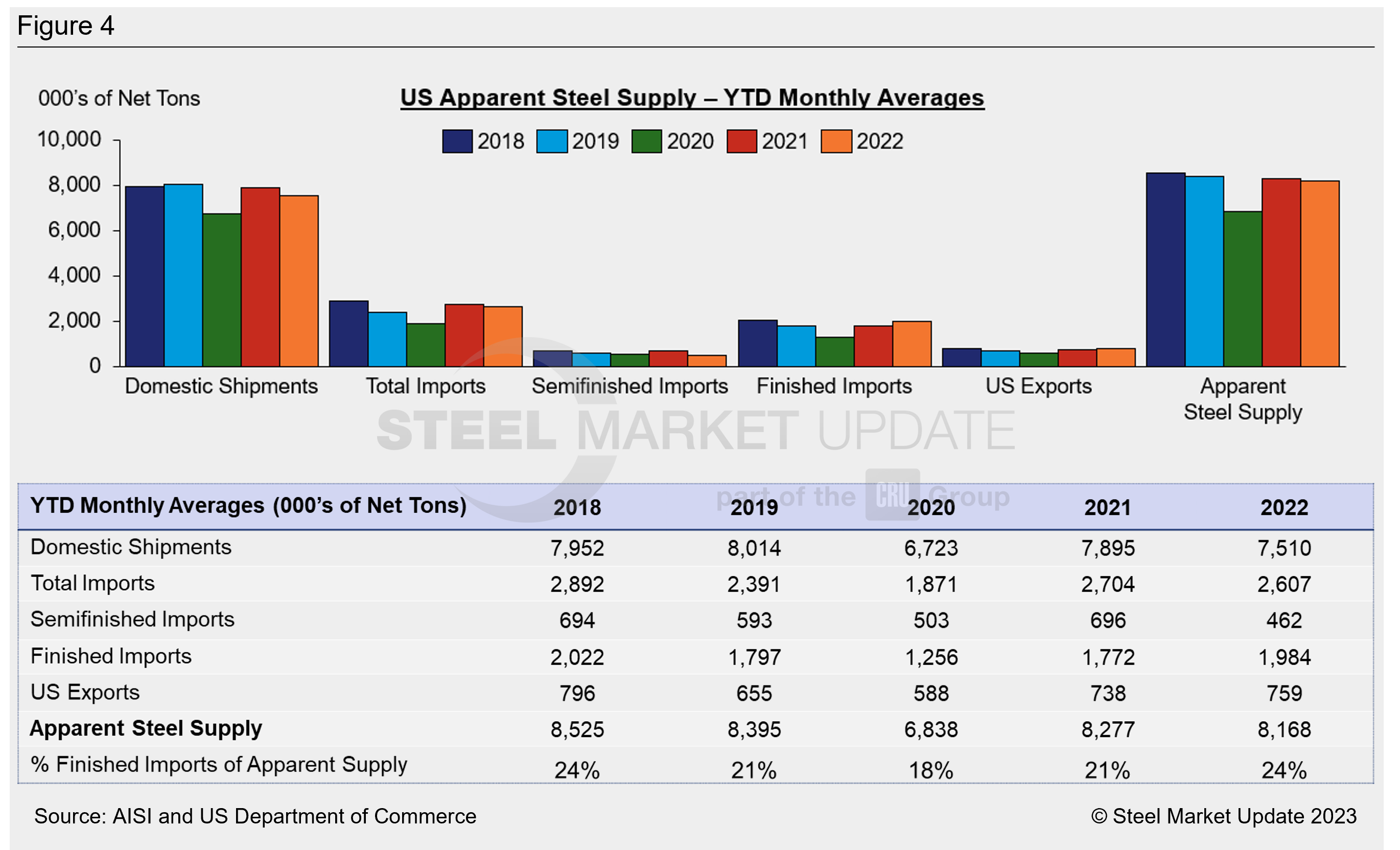

Figure 4 shows year-to-date (YTD) monthly averages for each statistic over the last five years. The average monthly apparent supply level for the first eleven months of 2022 is now 8.17 million tons.

Though numbers for November dropped, finished imports made up the highest percentage of apparent supply since 2018.

To see an interactive graphic of our Apparent Steel Supply history, visit the Apparent Steel Supply page in the Analysis section of the SMU website. If you need any assistance logging into or navigating the website, contact us at info@SteelMarketUpdate.com.

By Becca Moczygemba, becca@steelmarketupdate.com