Analysis

March 24, 2023

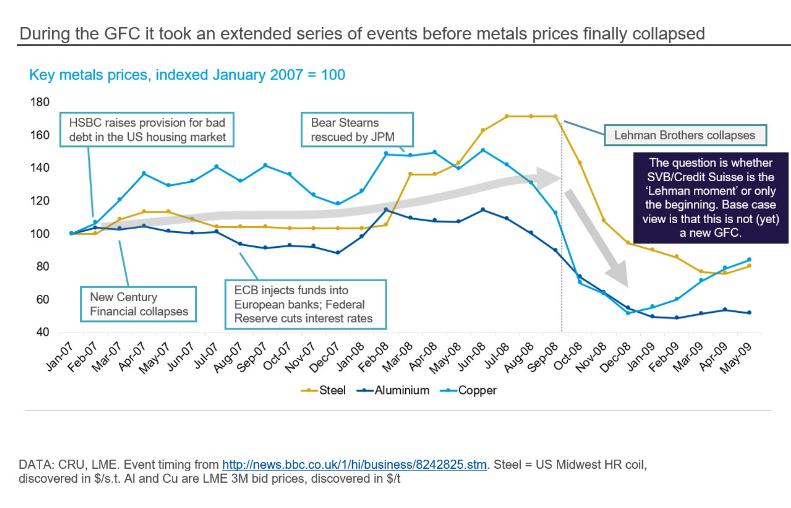

CRU: The Metals Price Collapse During the GFC Was Not Immediate

Written by Laura Miller

The failure of Silicon Valley Bank (SVB) and acquisition of Credit Suisse are unlikely to cause severe financial disturbance on the scale of the global financial crisis (GFC). However, these events further amplify the probability of recession in the US and Europe, and they have certainly got the market talking about whether a new GFC is imminent.

Looking back at 2008 we can see that although the failure of Lehman Brothers was the event that triggered a final collapse in metals prices, multiple events connected to the US subprime crisis occurred over a long timeframe before that, during which time metals prices largely continued to increase. Base metals prices did drop ahead of Lehman, but for steel the party (or denial) continued right up until the last moment.

Editor’s note: Click on the table below to enlarge.

See recent insights, ‘Bank failures underline recession risks‘ and ‘Banking sector’s woes cause oil prices to plummet‘ from the CRU Economics team for further analysis of the ongoing crisis.

By CRU Principal Analyst Matthew Watkins

This article was originally published on March 22 by CRU, SMU’s parent company.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com.