Analysis

April 30, 2023

Final Thoughts

Written by Michael Cowden

Feelings are running high with prices inflecting downward from historically high levels. I’ve had producers say that we’ve written too negatively about higher prices. I’ve also had consumers say that we’ve written too positively about higher prices.

For the record: SMU doesn’t have a position on prices. We aim to report what’s happening in the market – and to be as balanced to all sides as we can be.

So, that caveat aside, I’m not trying to be “negative” about prices here. Simply put, the picture emerging from our latest survey data, channel checks, and industry developments is of sheet prices reversing course after rising throughout most of the first quarter.

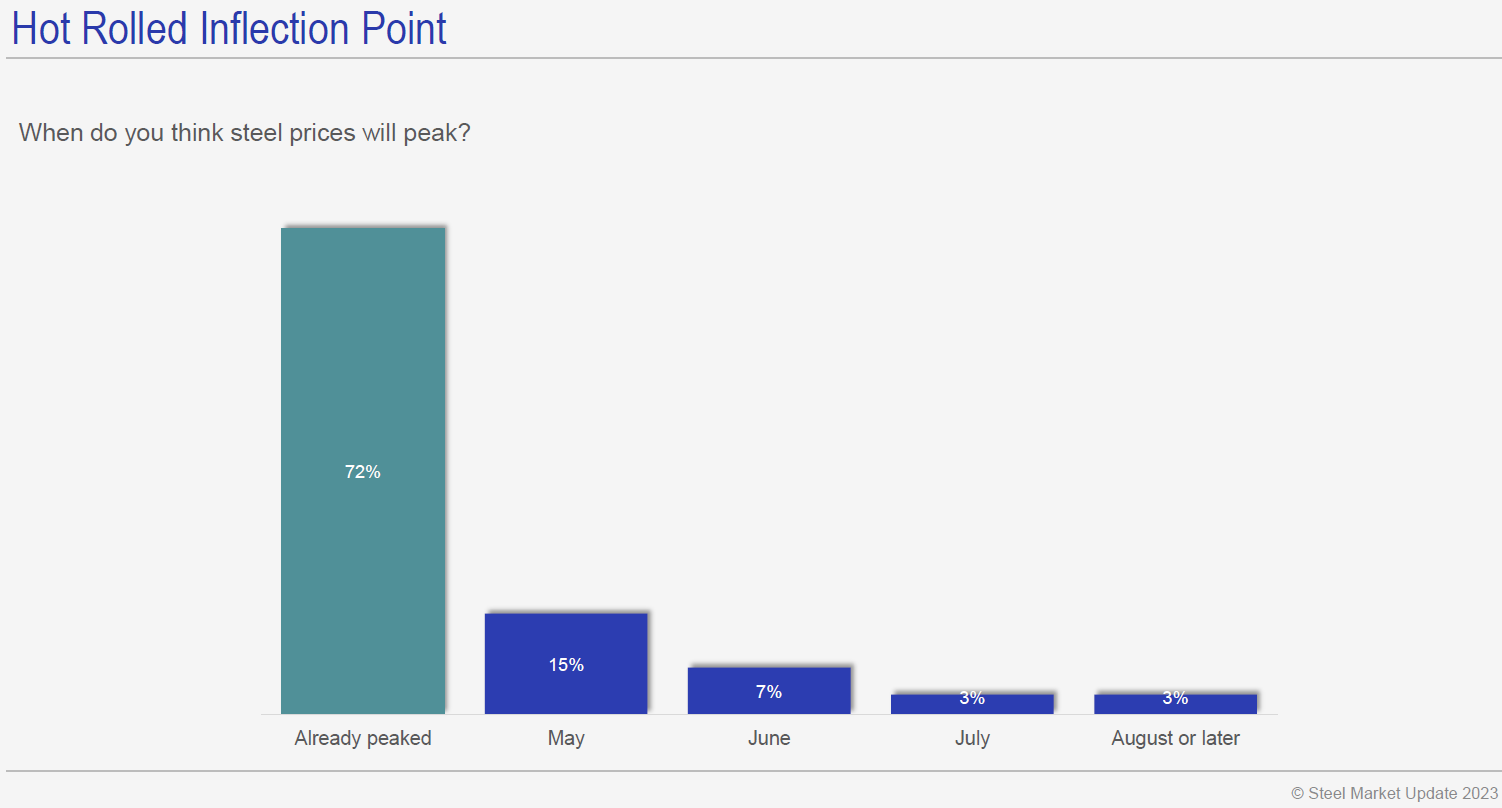

Case in point: 72% of respondents to our latest steel market survey reported that HRC prices have “already peaked,” up from 30% in mid-April.

It shouldn’t come as a total surprise. As we noted in articles in our newsletter last week, prices continue to slip, lead times continue to come in, and most sheet mills are willing to negotiate lower prices to secure orders – the reverse of trends we saw throughout most of the first quarter.

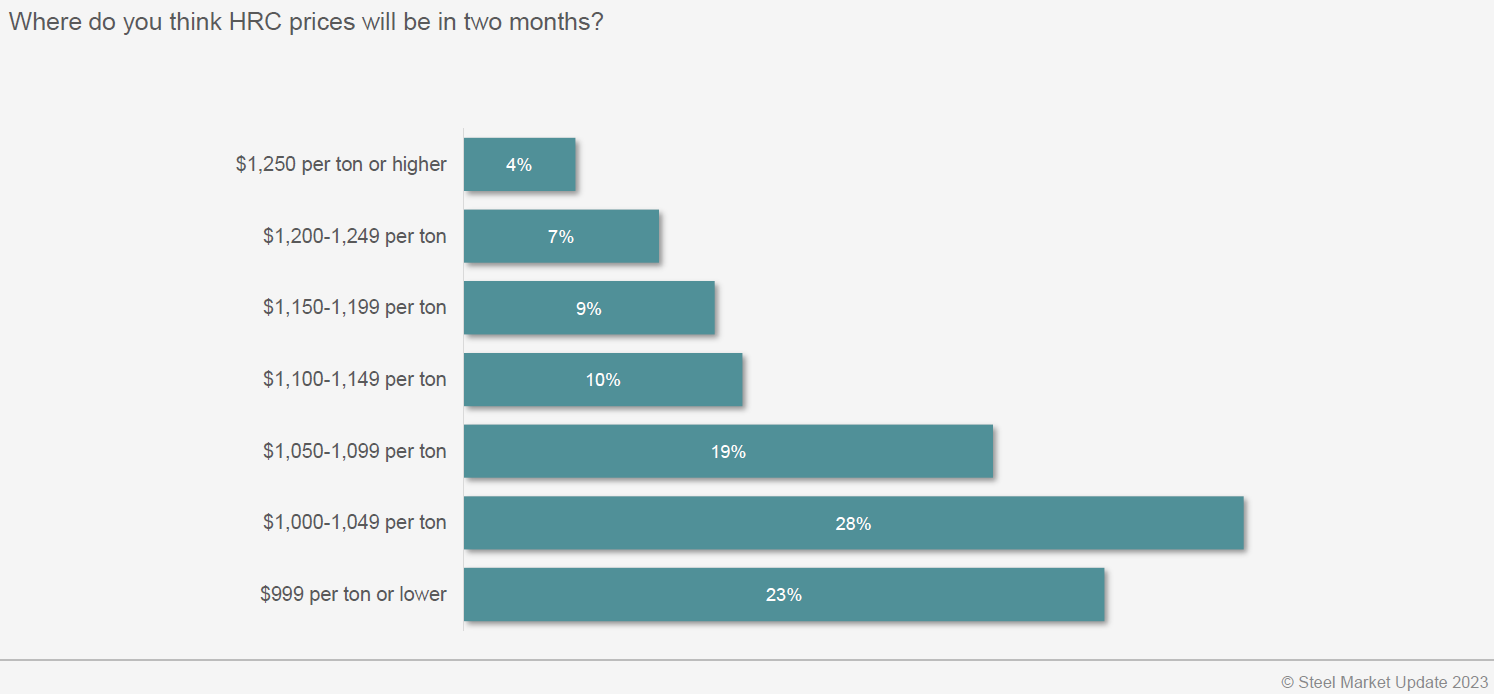

Does this mean there are no mills still trying to get $1,200 per ton ($60 per cwt)? Recall that’s the figure that was publicly announced by some when they last increased prices. No, some are still trying to hold the line there. Are they having much luck? According to the data we’re collecting and what we’re hearing anecdotally, no.

Here’s just one anecdote: We’re told mills are calling more often to look for orders, something many hadn’t been doing earlier in the year. As for the data, take a look at this:

A narrow majority of survey respondents, 51%, now think prices will be below $1,050 per ton in two months, up from 27% just two weeks ago. Why the big shift? Channel checks indicate that some mills continue to offer HR at $54-55/cwt. That’s roughly where the current low end of our HR price range is, so that’s not a surprise. What I did not expect was some market participants reporting that base prices for larger orders for galvanized product might be in roughly the same range.

That might square with our lead time data. HR lead times are at exactly six weeks. Galvanized lead times are at roughly 7.3 weeks. That spread is a little tighter than usual. Scroll back to this time last year, which you can do here, and you’ll see that galv typically carried a lead time ~2-2.5 weeks longer than that for HR. What happens next: Do we see the lead time between HR and galvanize continue to compress, or could we see HR lead times start to lose their grip on 6 weeks?

With prices falling, the natural next question is, “Where do we bottom out?” I don’t know. I mentioned in my last Final Thoughts that we’d heard of HR imports as low as $850 per ton for delivery to the Gulf Coast in August. I’ve since heard figures a little lower than that. That might explain in part the $848 per ton settlement we saw on Friday for August futures. Does that number predict the future? No. Does it reflect informed opinions on future market conditions? Yes.

The gap between current prices and future expectations might explain why we see more buyers on the sidelines of the spot market. With current spot prices high and the risks of declines high too, some consumers have told me that they’d rather buy from another service center and have the material available within a matter of days than buy from a mill and wait 1-2 months for it to arrive.

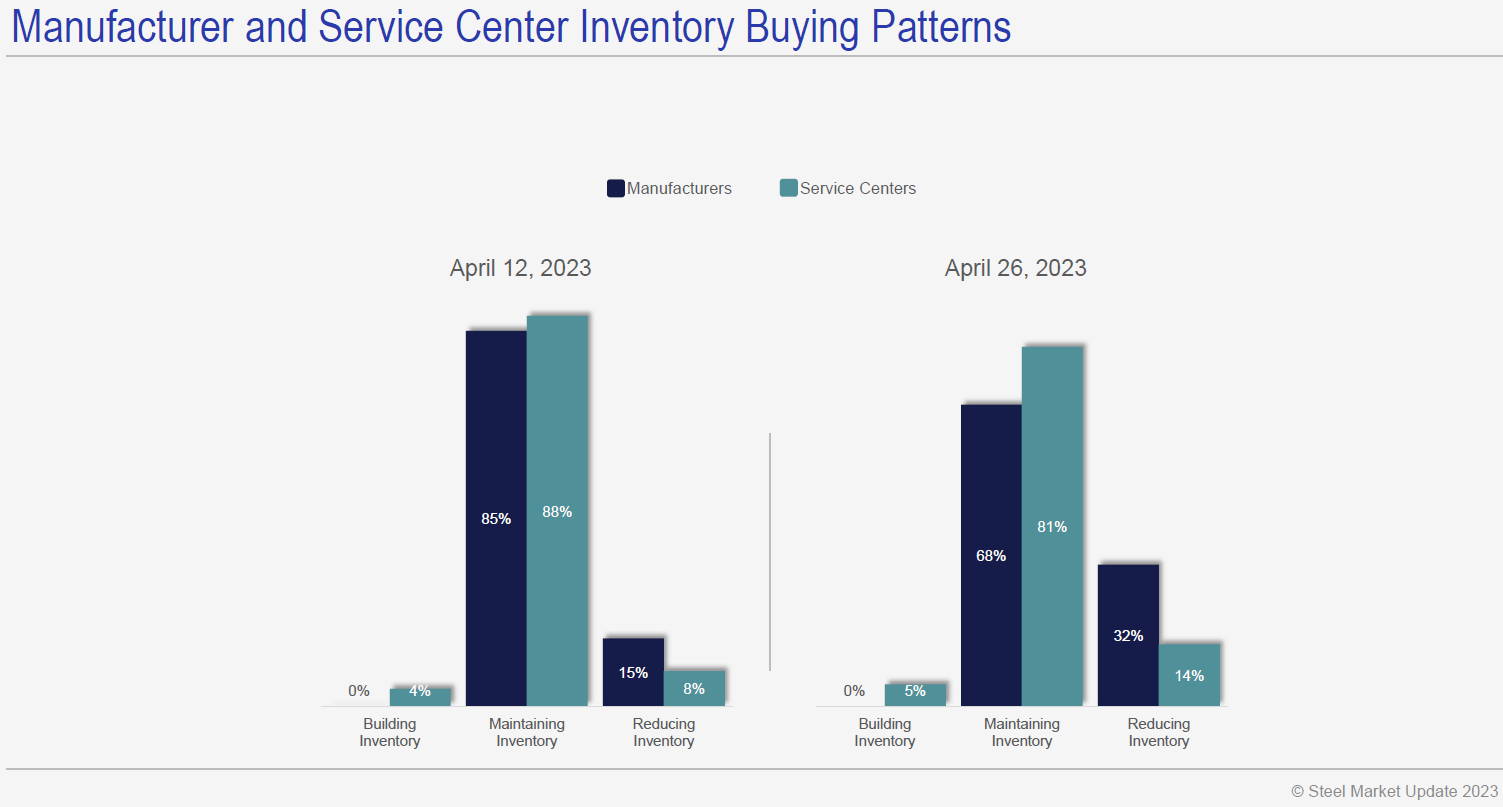

We won’t have April service center inventory data available until mid-May. But we can see directionally what’s happening from our latest survey results:

Most companies are maintaining inventories. That’s been the case for a while now. What’s new is that we’re seeing more reducing inventories.

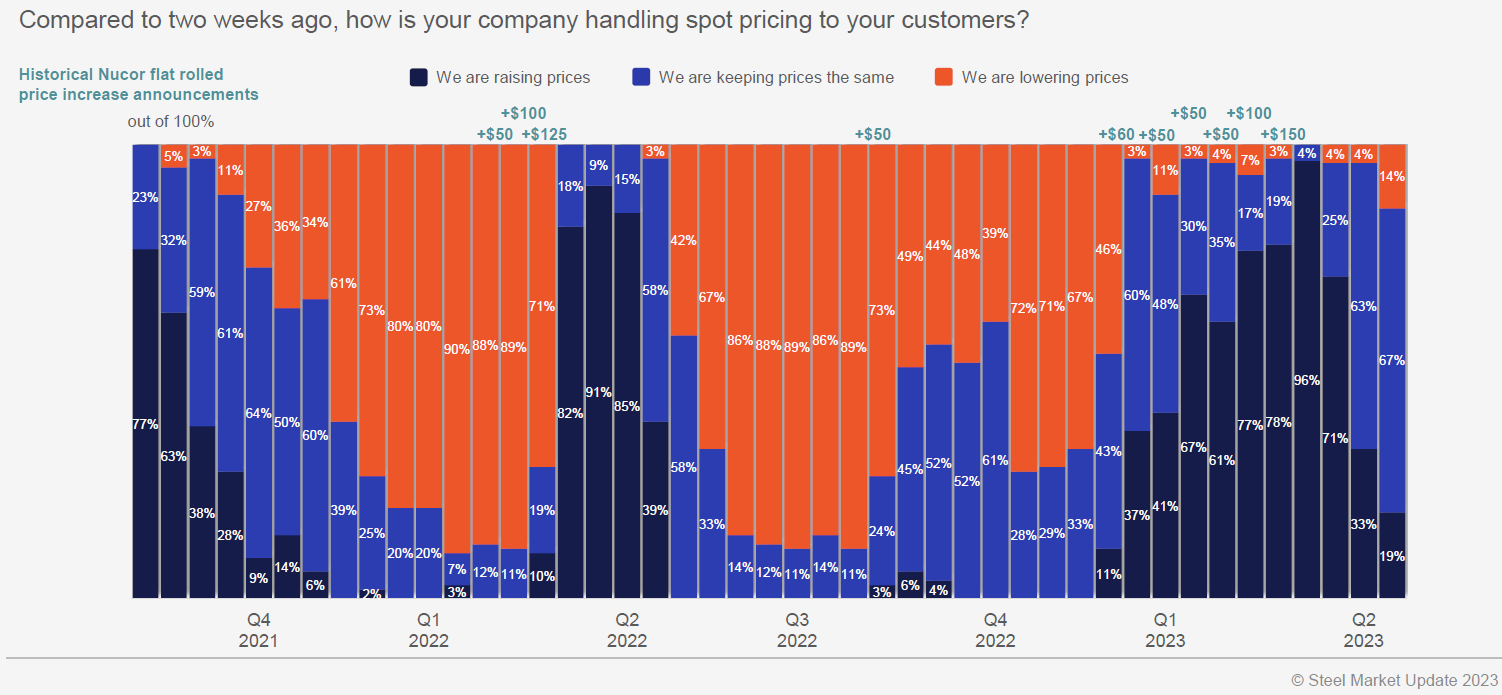

Another notable change is that we’re seeing more service centers reducing prices. It’s not a big jump. But it’s worth watching:

Most, 67%, are keeping prices unchanged. But 14% are cutting prices, up from 4% a month ago. Only 19% are increasing prices, down from 71% a month ago.

There are also some stubborn facts that could keep this trend of lower prices in place: Capacity utilization continues to increase, scrap prices are expected to fall in May, and US Steel has restarted idled capacity as new capacity continues to ramp up.

Also, the labor contracts between the “Big Three” Detroit-area automakers (General Motors, Ford and Stellantis) and the United Autoworkers Union (UAW) are set to expire on Sept. 14, 2023. Rhetoric from the UAW has been heated, as it often is while negotiations are ongoing. I’m not going to handicap the risk of a strike. But remember that this time last year, the concern was about a potential United Steelworkers (USW) strike. A USW strike risked tightening supply. A UAW strike risks the opposite.

Does this mean this trend of downward pricing will continue? If things continue as they are, probably. Is that a guarantee? Of course not.

There are fewer blast furnaces running now than in the past, and many consumers run with less inventory than they used to. So just one unplanned outage – as we saw with AHMSA in December/January – can tighten up supply quickly. I’m not saying that’s likely. But as we’ve learned from the last three years, it’s important not to get complacent about the direction of prices.

SMU Community Chat

Don’t forget to register for our next Community Chat on Wednesday, May 3, at 11 am ET with Reibus CEO and founder John Armstrong. We’ll talk about market conditions in steel and in the broader economy, why recent layoffs at the company were necessary, and the opportunities Reibus sees in the months and years ahead.

By Michael Cowden, michael@steelmarketupdate.com