Prices

August 25, 2023

Steel Summit: Analysts Weigh in On 2024 Price Outlook

Written by Ethan Bernard

Three prominent steel analysts proposed their outlooks for next year in the ‘Steel Price Forecast: Boom or Bust in 2024?’ panel at Steel Summit 2023 in Atlanta.

Josh Spoores, principal analyst, steel, at CRU; John Anton, director, S&P Global Market Intelligence; and Timna Tanners, managing director at Wolfe Research, sat down with SMU senior analyst and editor David Schollaert to present their forecasts.

Josh Spoores

Spoores’ presentation was titled “Post-pandemic Weakness Gives Way to a Strong 2025.”

He said that 2024 might be a “year to forget,” and “2025 might be a better use of our time.”

“We’re probably entering six to 10 months of slower economic industrial activity,” Spoores said, “and that’s going to be hurting demand just as capacity is starting up.”

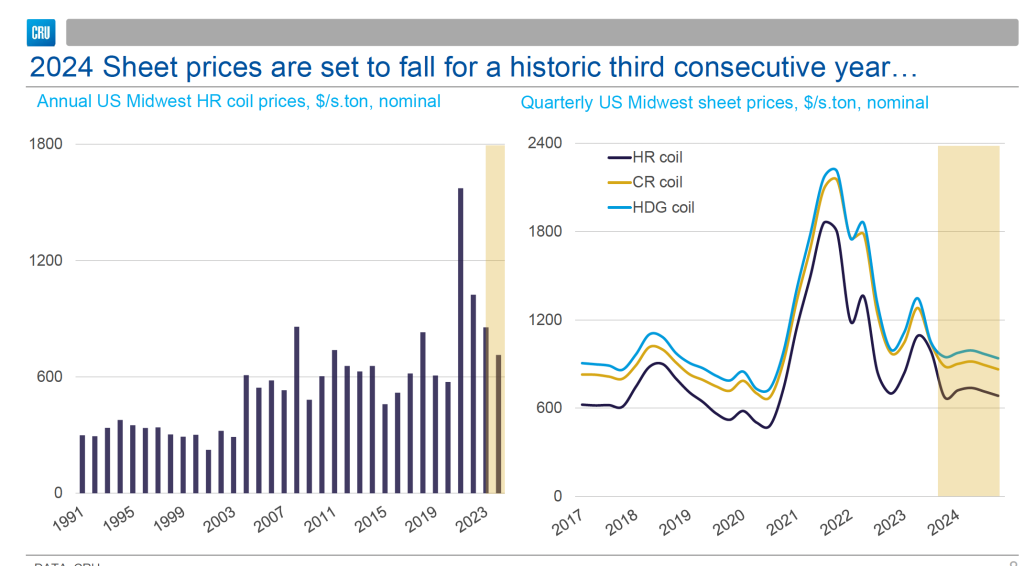

He said for steel prices, the expectation is for them to come down, which would be for the third consecutive year. However, he said, “We should have some pretty strong prices in 2025.”

Here is his price forecast:

John Anton

Anton’s outlook was from a steel buyer’s point of view for 2024. For sheet prices, he said they are too high in the US, but they don’t have far to go. “Sheet is boring, which is good,” he said.

In his presentation he said a floor for sheet is assumed at $760-780 per net ton, and mills would still be profitable at $720.

He noted that demand will remain weak, so no upside pricing pressure, but mills are maintaining production discipline, so prices are unlikely to fall further.

One caveat he gave is that electrical steel is in short supply and will be a “continuing problem.”

Anton was adamant. He advised to ignore price, and “secure at any cost.”

Timna Tanners

Tanners began her presentation saying long products may be stronger than sheet going forward.

“The biggest story for the next two years is going to be government spending,” Tanners said. She added that things may be a bit “sad” and “depressing” in the private sector, “but government spending is going to save the day,” or at least offset private sector weakness.

However, she noted that a lot of that spending will be on rebar and plate, and to a lesser extent on structurals.

Tanners said that warehouse spending is down sharply and that makes up 40%+ of nonresidential construction starts in recent years. Also, nonresidential and automotive can be vulnerable to higher interest rates.

For her price forecast, Tanners said, “Sheet shenanigans aside, a good HRC range around $750-800 per short ton.”

She noted that a wild card would be if Cleveland-Cliffs was able to buy U.S. Steel, which would leave the combined company in a “dominant position in at least four markets.”

Still, she said a lot of variables exist. For example, if the Federal Trade Commission gets involved, or if end-customers protest.

Another wild card that could affect forecasts is a potential United Autoworkers (UAW) union strike. The labor contracts for the Detroit 3 automakers expire on Sept. 14 at 11:59 p.m. When asked, all three analysts said they expect a labor action.

“We think there will be a strike,” Tanners said, with just one company, as is usually the case. One of her colleagues thinks it will be Stellantis. Analysts at Wolfe Research have calculated a short strike would have an estimated 90,000-ton-per-month impact on steel.