Market Data

October 18, 2023

Housing Starts Surprise, Recover in September

Written by David Schollaert

US housing starts increased in September despite high interest rates, according to the latest estimates from the US Census Bureau.

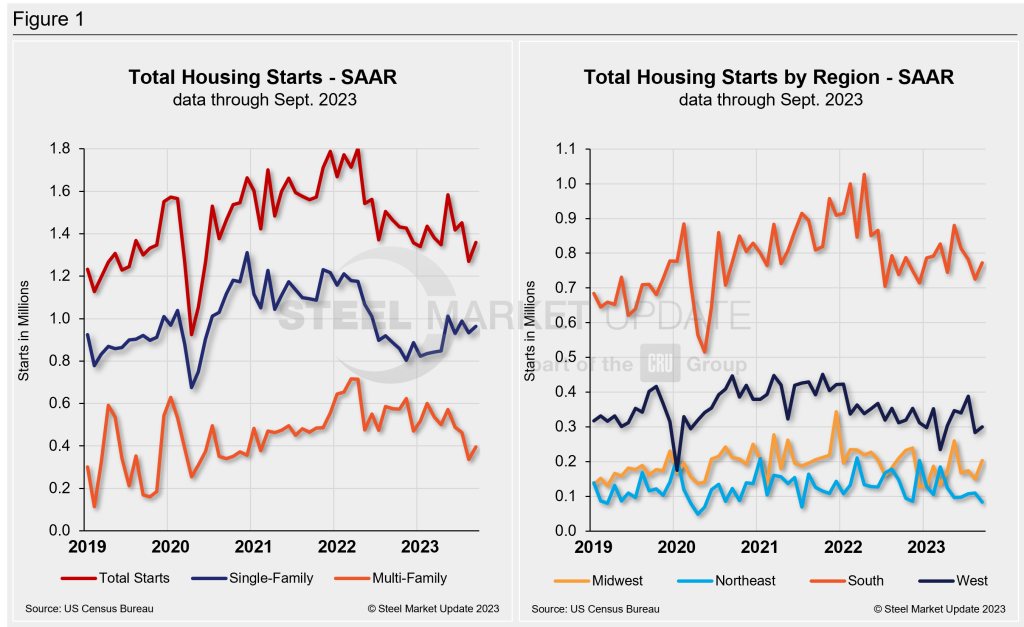

Total privately owned housing starts were at a seasonally adjusted annual rate of (SAAR) of 1.36 million in September, a 7% gain over the revised August estimate of 1.27 million, Census said.

Despite the month-on-month improvement, September’s total was still down 7.2% vs. September 2022.

The result was a surprise given elevated mortgage rates, but the result is likely due to more buyers “turning to new homes because of a dearth of inventory in the resale market,” the National Association of Home Builders (NAHB) said.

“The uptick in single-family production was somewhat unexpected as our latest builder surveys indicate that starts are likely to weaken in the months ahead due to recent higher mortgage rates that were near 7.6% in mid-October,” Alicia Huey, NAHB’s chair, said in a statement.

Single‐family housing starts in September were at a rate of 963,000, up 3.2% vs. the revised August figure of 933,000. The September rate for units in buildings with five units or more was 383,000.

Huey cautioned, however, that builders continue to struggle with persistent labor shortages, a lack of buildable lots, and higher financing costs among other headwinds.

“Despite ongoing challenges in the market, the housing deficit of resale inventory continues to provide some market support for builders,” said Robert Dietz, NAHB’s chief economist.

New construction accounted for 31% of all available homes for sale, a staggering boost from a historical average between 12-14%. The result is due to a growing housing deficit, noted Dietz. Despite the inflated number, higher interest rates have slowed the market.

“The number of single-family homes under construction in September was 674,000, which is almost 15% lower than a year ago,” he cautioned.

Regionally, combined single-family and multi-family starts are down in all four regions, with the largest decline being in the Northeast and the lowest in the South.