Market Data

February 1, 2024

SMU survey: Mills more willing to talk price on spot deals

Written by Ethan Bernard

Steel buyers said mills this week were much more willing to negotiate spot pricing on all products SMU surveys, according to our most recent survey data.

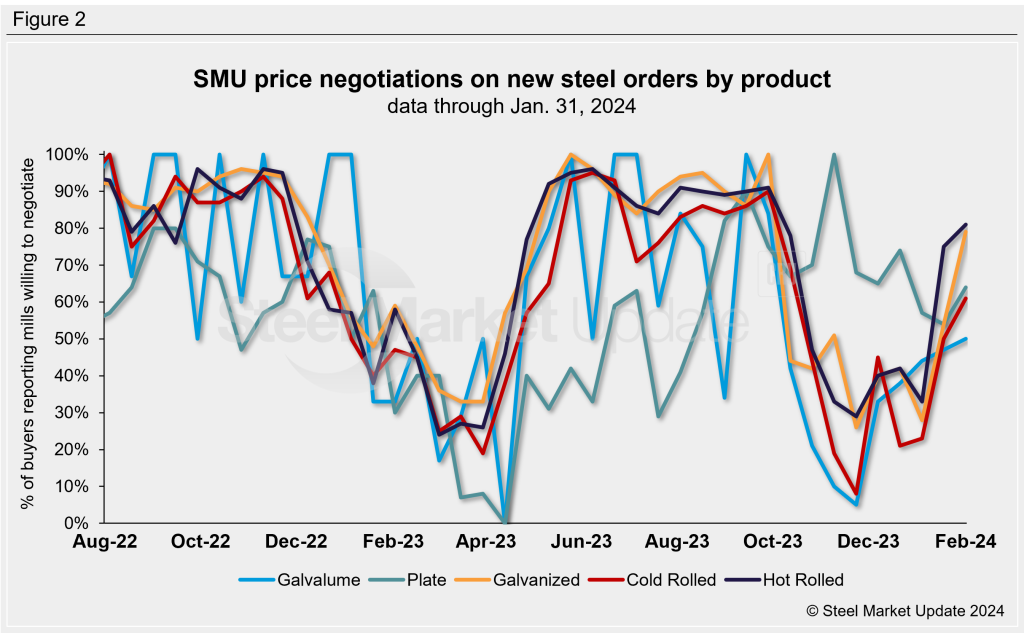

The biggest jump came in galvanized’s negotiation rate, which leapt 25 percentage points to 79% of domestic buyers saying mills were willing talk price vs. 54% two weeks earlier. Just a month ago, the rate was 28%.

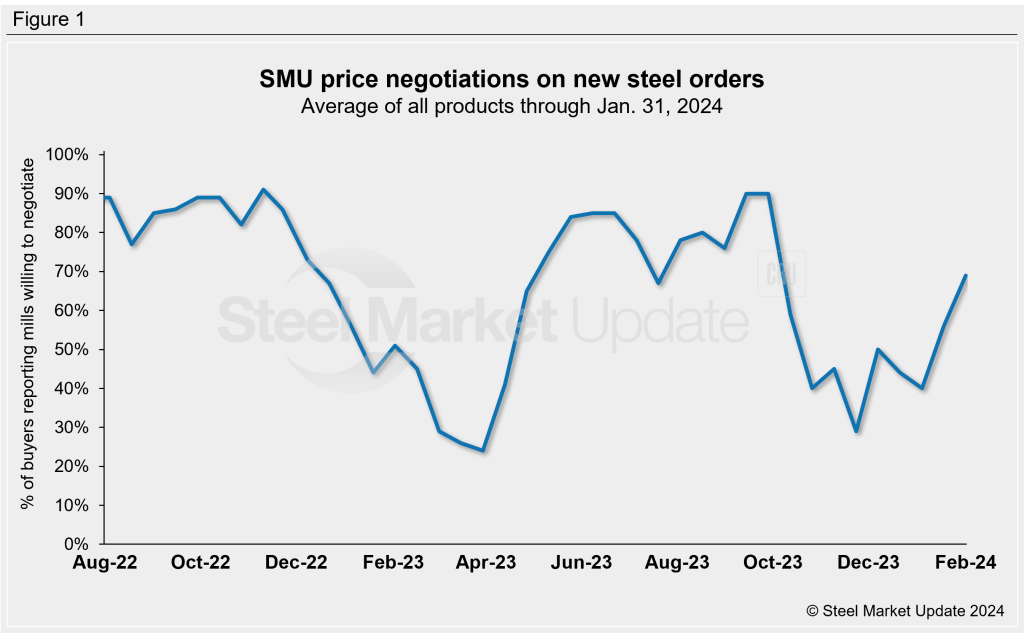

Every two weeks, SMU asks steel buyers whether domestic mills are willing to negotiate lower spot pricing on new orders. This week, 69% of participants surveyed by SMU reported mills were willing to negotiate prices on new orders, up from 56% at the last market check (Figure 1). This is the highest reading since the end of September. Recall that the rate stood at only 40% just after the new year began.

Figure 2 below shows negotiation rates by product. The rate for hot rolled rose six points to 81% compared with the last market check; cold rolled increased 11 percentage points to 61%; Galvalume was up three percentage points to 50%; and plate jumped 10 percentage points to 64%. Recall that the rate for Galvalume is more volatile because of fewer market participants for that product in our survey.

Here’s what some survey respondents had to say:

“Spot is still short in most mills for Galvalume. Book might open up in March for spot.”

“(Mills more willing to negotiate on galvanized) if there is volume greater than 400 tons.”

“I do not think the range is big (on HRC), but buyers are demanding something better than what they see on an index.”

“(Not willing to negotiate on HRC) unless it’s 5,000-ton lots, and then it’s not under $1,000 per ton.”

“Mills will selectively negotiate (on plate orders).”

Note: SMU surveys active steel buyers every other week to gauge their steel suppliers’ willingness to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our steel mill negotiations data, visit our website.