Prices

February 27, 2024

SMU price ranges: HR nears $800/st, prices continue to run downhill

Written by David Schollaert

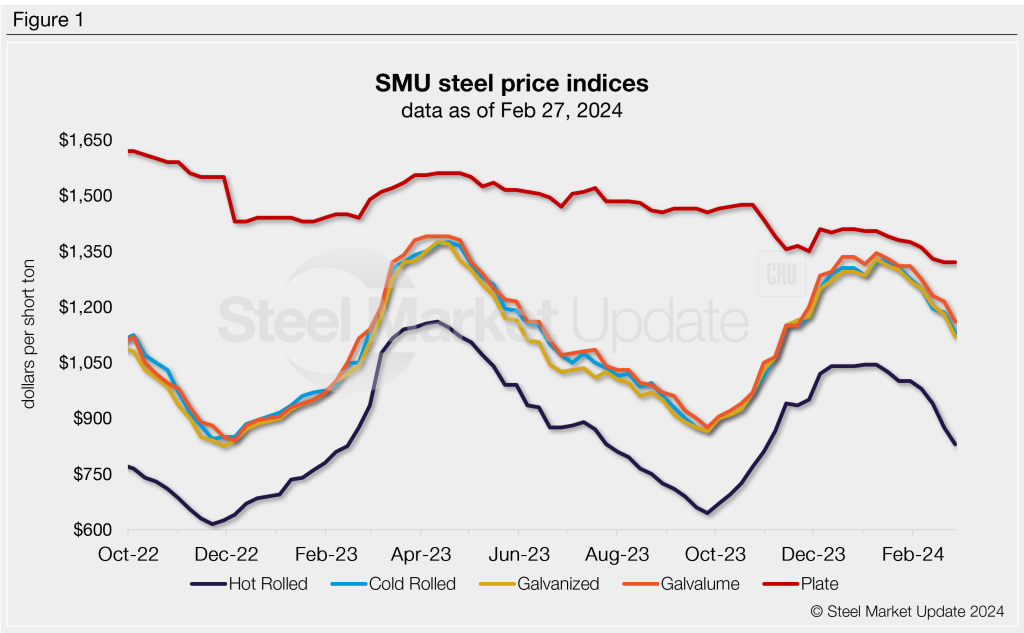

US hot-rolled (HR) coil prices have fallen further this week, working their way to $800 per short ton (st) on average – a mark not seen since late October.

SMU’s HR price stands at $830/st on average, down $45/st from a week ago and down $215/st from a recent high of $1,045/st at the beginning of the year.

Hot band is now down $170/st through February with indications of more declines ahead. Bloated service center inventories, easing scrap prices, increased imports, and shipments down roughly 9% year on year (y/y), continue to drive prices lower.

Domestic mills have reportedly been parting with product below $800/st for as little as 1,000 tons. But could spring mill outages – some reportedly being pulled forward – slow the bleeding?

It was a similar story for tandem products. Cold-rolled (CR) and coated prices declined at similar rates. SMU’s CR price stands at $1,130/st on average, down $55/st from a week ago. Galvanized base prices are at $1,120/st, down $60/st from last week. And Galvalume prices are at $1,160/st, down $55/st from a week ago.

Plate, meanwhile, stands at $1,320/st on average, unchanged from last week. While plate tags seemed to stagnate, the market is anxiously awaiting Nucor’s next plate price notice when it opens its April order book any day now.

SMU’s price momentum indicators for all sheet and plate products continue to point lower.

Hot-rolled coil

The SMU price range is $780–880/st, with an average of $830/st FOB mill, east of the Rockies. The bottom end of our range was down $40/st vs. one week ago, while the top end of our range was down $50/st week on week (w/w). Our overall average is $45/st lower from last week. Our price momentum indicator for HRC remains lower, meaning SMU expects prices will move lower over the next 30 days.

Hot rolled lead times: 3–8 weeks

Cold-rolled coil

The SMU price range is $1,040–1,220/st, with an average of $1,130/st FOB mill, east of the Rockies. The lower end of our range was $80/st lower vs. the prior week, while the top end of our range was down $30/st. Our overall average is down $55/st from last week. Our price momentum indicator for CRC remains lower, meaning SMU expects prices will move lower over the next 30 days.

Cold rolled lead times: 6–9 weeks

Galvanized coil

The SMU price range is $1,060–1,180/st, with an average of $1,120/st FOB mill, east of the Rockies. The lower end of our range was down $50/st vs. the prior week, while the top end of our range was $70/st lower w/w. Our overall average is $60/st lower than the week prior. Our price momentum indicator for galvanized remains lower, meaning SMU expects prices will move lower over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $1,157–1,277/st with an average of $1,217/st FOB mill, east of the Rockies.

Galvanized lead times: 5–10 weeks

Galvalume coil

The SMU price range is $1,140–1,180/st, with an average of $1,160/st FOB mill, east of the Rockies. The lower end of our range was $20/st lower, while the top end of our range was down $90/st from the prior week. Our overall average was down $55/st when compared to the previous week. Our price momentum indicator for Galvalume remains lower, meaning SMU expects prices will move lower over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,434–1,574/st with an average of $1,454/st FOB mill, east of the Rockies.

Galvalume lead times: 7–8 weeks

Plate

The SMU price range is $1,260–1,380/st, with an average of $1,320/st FOB mill. Both the lower end of our range and the top end of our range were flat w/w. Our overall average is, as a result, unchanged vs. one week ago. Our price momentum indicator for plate remains lower, meaning SMU expects prices will move lower over the next 30 days.

Plate lead times: 4-7 weeks

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.