Mexico

March 19, 2024

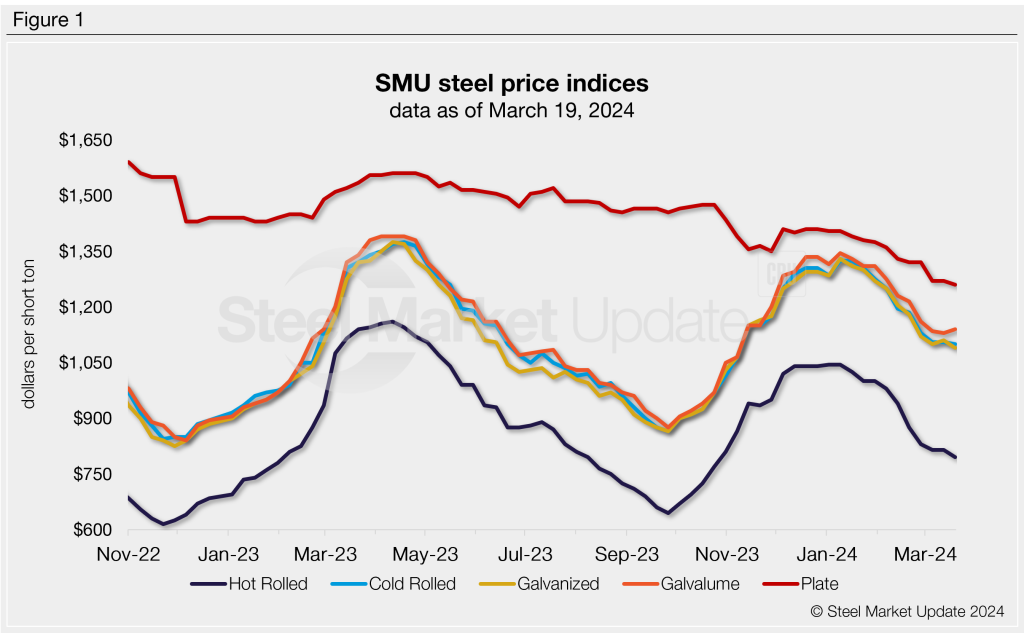

SMU price ranges: Sheet prices mixed, HRC below $800/st (for now)

Written by David Schollaert

Sheet and plate prices mostly moved lower this week after little change was noted the week prior. Despite edging down, sentiment is mixed, and many suggest a bottom may be near.

US hot-rolled (HR) coil prices have fallen below $800 per short ton (st) on average for the first time since early mid-to-late October.

SMU’s HR price slipped to $795 per short ton (st) on average, down $20/st from last week, and down $250/st from the beginning of the year. Tags for cold-rolled (CR) and tandem products saw similar dynamics week over week (w/w). Galvalume, however, saw a small bump.

SMU’s CR price is at $1,100/st on average (-$5/st w/w). Our galvanized base price is at $1,090/st on average (-$20/st w/w). And our Galvalume price stands at $1,140/st on average (+$10/st w/w).

The market is still “feeling it out” since Cliffs, Nucor, and ArcelorMittal all “officially” set new target minimums for HR nearly two weeks ago between $825-845/st, in an apparent “hold-the-line” move.

Reviews remain mixed. While some sense a price floor might be within reach, others note that scrap prices are still pointing lower as we near April. But like last week, big buyers were still able to secure product at lower levels, a trend that ties up order books ahead of more planned outages.

“I hope the announcements help create a floor but sense another round of decreases before a real bottom,” an OEM executive said. “But not much good out there for flat products at the moment.”

But there is a sense that the tags moved lower due to lingering “last minute” deals. New prices will be more strictly enforced going forward, sources said.

And then there are rumors of potential trade action against Mexico. Depending on who you speak with it’s either imminent, or others say brinksmanship. Regardless, something is poised to change – not necessarily a full re-imposition of 232, but it could still be a shock like we haven’t seen for a while.

SMU’s plate price now stands at $1,260/st on average, down $10/st from last week as the market is still reeling from Nucor’s publicly announced $90/st plate price cut at the end of February.

SMU’s sheet price momentum indicators remain at neutral as we’re unsure how prices will move over the next 30 days. Our plate price momentum remains pointing down.

Hot-rolled coil

The SMU price range is $760–830/st, with an average of $795/st FOB mill, east of the Rockies. The bottom end of our range was down $30/st vs. one week ago, while the top end of our range was down $10/st w/w. Our overall average is down $20/st from last week. Our price momentum indicator for HR remains at neutral, meaning SMU is unsure where prices will move over the next 30 days.

Hot rolled lead times: 3–6 weeks

Cold-rolled coil

The SMU price range is $1,020–1,180/st, with an average of $1,100/st FOB mill, east of the Rockies. The lower end of our range was flat w/w, while the top end of our range was $10/st lower vs. the prior week. Our overall average is down $5/st from last week. Our price momentum indicator for CR remains at neutral, meaning SMU is unsure where prices will move over the next 30 days.

Cold rolled lead times: 5-9 weeks

Galvanized coil

The SMU price range is $1,030–1,150/st, with an average of $1,090/st FOB mill, east of the Rockies. The lower end of our range was $10/st lower vs. last week, while the top of our range was down $30/st vs. the prior week. Our overall average is $20/st lower w/w. Our price momentum indicator for galvanized remains at neutral, meaning SMU is unsure where prices will move over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $1,127–1,247/st with an average of $1,187/st FOB mill, east of the Rockies.

Galvanized lead times: 5–10 weeks

Galvalume coil

The SMU price range is $1,100–1,180/st, with an average of $1,140/st FOB mill, east of the Rockies. The lower end of our range was $20/st higher w/w, while the top end of our range was up flat from the prior week. Our overall average was up $10/st when compared to the previous week. Our price momentum indicator for Galvalume remains at neutral, meaning SMU is unsure where prices will move over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,394–1,474/st with an average of $1,434/st FOB mill, east of the Rockies.

Galvalume lead times: 6-9 weeks

Plate

The SMU price range is $1,220–1,300/st, with an average of $1,260/st FOB mill. While the lower end of our range was down $30/st vs. the prior week, the top end of our range was $10/st higher w/w. Our overall average is down $10/st vs. one week ago. Our price momentum indicator for plate remains lower, meaning SMU expects prices will move lower over the next 30 days.

Plate lead times: 4-7 weeks

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.