Analysis

May 3, 2024

CRU: Brazil proposes quotas on steel imports, with tariff back up

Written by Diego Giangreco

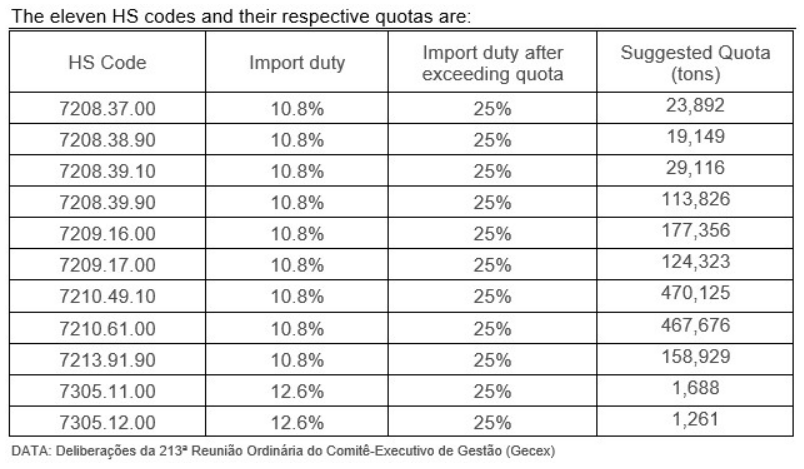

Brazil’s chamber of foreign trade, Camex, has approved quotas on imports of 11 steel products and a 25% levy on shipments 30% above a product’s average import volume between 2020 and 2022.

The changes are expected to take effect in about 30 days and are subject to review by Mercosur trading partners Argentina, Paraguay, and Uruguay. If accepted, the measures will last for 12 months.

Camex is also evaluating the status of four other steel products, which may receive similar treatment, business newspaper Valor reported.

In recent months, Brazilian steel producers have argued for tariffs, saying cheap imports harm their business. However, automotive, machinery, electronics, and equipment manufacturing companies counter that higher import duties would increase the price of their products.

Will the new quota system increase prices in the Brazilian market?

The Brazilian market saw a significant increase in Chinese steel sheet imports in 2023. The surge has continued this year, with a rise of 34% y/y in Q1’24. For many years, Brazil has had import tariffs of 9-12.6% for most steel products, including material from China. China is Brazil’s main source of steel sheet imports, and the recent low Chinese export prices have put pressure on domestic producers in Brazil.

The proposed quota system will be applied to 11 HS codes, including HR coil, CR coil, and HDG. The proposed quotas are 30% higher than the average imported volumes of 2020-2022.

As Brazilian domestic prices have been under pressure from high import volumes, CRU expects this quota system to support an increase in domestic prices. The proposed quotas are lower than the 2023 imported volumes, and, as we expect apparent demand to increase this year, more supply will be needed. This extra supply will come from higher-cost domestic producers as the quotas will constrain imports coming from China. CRU’s view is that the quotas will support prices at some point during the 12-month period that they will last.

Learn more about CRU’s services at www.crugroup.com.