Prices

July 9, 2024

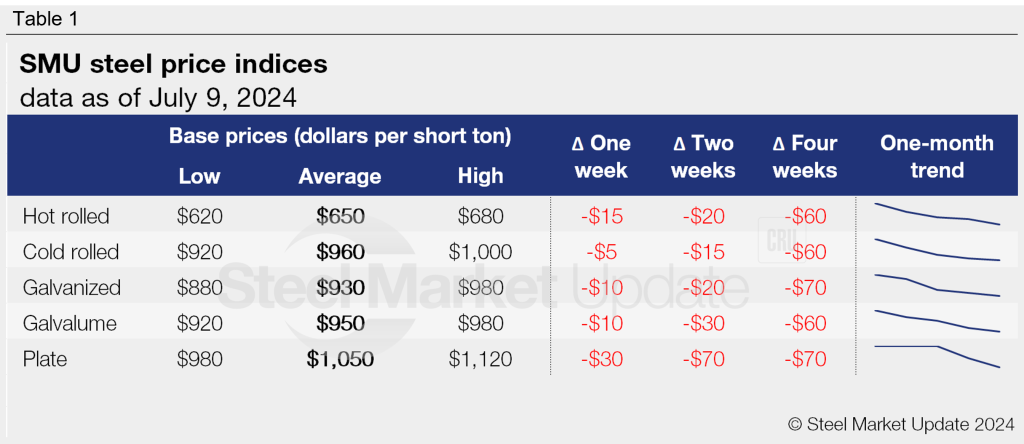

SMU price ranges: Sheet dips lower, more to come?

Written by Brett Linton & David Schollaert

US sheet prices saw a similar pattern this week, customary for much of the year – new week, lower prices. Domestic tags declined this week, aligning with the typically slower summer period – but maybe a further indication of dwindling demand.

The slowdown is highlighted by slipping input costs – scrap dealers have reported significant supply on hand and limited demand, positioning tags even lower in July. Add in shorter lead times, balanced inventories, and ample supply, and all signs point to a bottom remaining elusive for the time being.

SMU’s hot-rolled (HR) coil price stands at $650 per short ton (st) on average this week, down $15/st from last week. Hot band has dropped by nearly $200/st from a recent high of $845/st in early April and is nearly at a 10-month low.

The high end of our HR range is $680/st, while the low end is $620/st. Spot demand has been rather quiet again this week.

But sources said, to the surprise of few, that coming out of last week’s holiday the market is inching forward at snail’s pace. This is a detail many believe led Nucor to hold its weekly published HR spot price flat at $670/st on Monday.

The trend for tandem products was again similar this week. Cold-rolled (CR) coil prices were down $5/st week over week (w/w) to $960/st on average. Galvanized and Galvalume base prices were also down $10/st w/w to $930/st and $950/st, respectively.

Our plate price was $30/st lower this week, largely in response to Nucor’s sharp price cut announced last week. The move paralyzed much of the buying for the time being after inventories were widely devalued, sources told SMU. They cautioned that a long and hard summer is expected with limited sales.

SMU’s momentum indicators continue to point lower.

Hot-rolled coil

The SMU price range is $620-680/st, averaging $650/st FOB mill, east of the Rockies. The lower end of our range is unchanged w/w, while the top end is down $30/st. Our overall average is down $15/st w/w. Our price momentum indicator for HR remains at lower, meaning we expect prices to decline over the next 30 days.

Hot rolled lead times range from 3-6 weeks, averaging 4.7 weeks as of our July 3 market survey.

Cold-rolled coil

The SMU price range is $920–1,000/st, averaging $960/st FOB mill, east of the Rockies. The lower end of our range is unchanged w/w, while the top end is down $10/st. Our overall average is down $5/st w/w. Our price momentum indicator for CR remains at lower, meaning we expect prices to decline over the next 30 days.

Cold rolled lead times range from 4-9 weeks, averaging 6.5 weeks through our latest survey.

Galvanized coil

The SMU price range is $880–980/st, averaging $930/st FOB mill, east of the Rockies. The lower end of our range is unchanged w/w, while the top end is down $20/st. Our overall average is down $10/st w/w. Our price momentum indicator for galvanized remains at lower, meaning we expect prices to decline over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $977–1,077/st, averaging $1,027/st FOB mill, east of the Rockies.

Galvanized lead times range from 4-9 weeks, averaging 6.6 weeks through our latest survey.

Galvalume coil

The SMU price range is $920–980/st, averaging $950/st FOB mill, east of the Rockies. The lower end of our range is unchanged w/w, while the top end is down $20/st. Our overall average is down $10/st w/w. Our price momentum indicator for Galvalume remains at lower, meaning we expect prices to decline over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,214–1,274/st, averaging $1,244/st FOB mill, east of the Rockies.

Galvalume lead times range from 6-8 weeks, averaging 6.8 weeks through our latest survey.

Plate

The SMU price range is $980–1,120/st, averaging $1,050/st FOB mill. The lower end of our range is down $20/st w/w, while the top end is down $40/st. Our overall average is down $30/st w/w. Our price momentum indicator for plate remains at lower, meaning we expect prices to decline over the next 30 days.

Plate lead times range from 3-6 weeks, averaging 4.6 weeks through our latest survey.

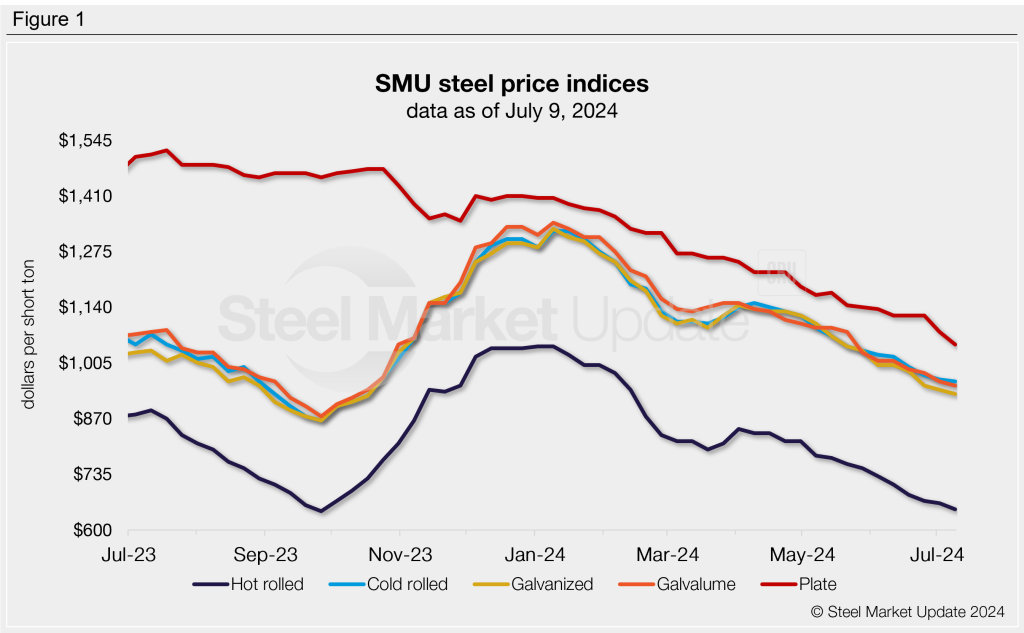

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

Brett Linton

Read more from Brett Linton