Market Data

July 18, 2024

SMU survey: Mills remain flexible on sheet and plate prices

Written by Brett Linton

Sheet steel buyers continue to report that mills are willing to talk price on new orders, according to our most recent survey data collected this week.

Every other week, SMU polls hundreds of steel buyers asking if domestic mills are willing to negotiate spot prices on new orders. Almost nine out of every 10 buyers reported mills are willing to talk price on new hot rolled orders. Every single galvanized buyer polled this week responded that mills were open to negotiating lower prices. Negotiation rates on cold rolled, Galvalume, and plate are all in the 75-80% range.

As shown in Figure 1, 87% of our service center and manufacturer buyers reported mills were willing to negotiate prices on new orders. This is slightly lower than the 92% level reported in our previous market check, which was the highest rate recorded in a year and a half.

Here’s what some survey respondents had to say:

“Seems to be a big range on pricing depending on mill and customer.”

“All based on tonnage and who you are.”

“I’ve said it here before, ‘But why buy today when you know it’ll be cheaper tomorrow?’”

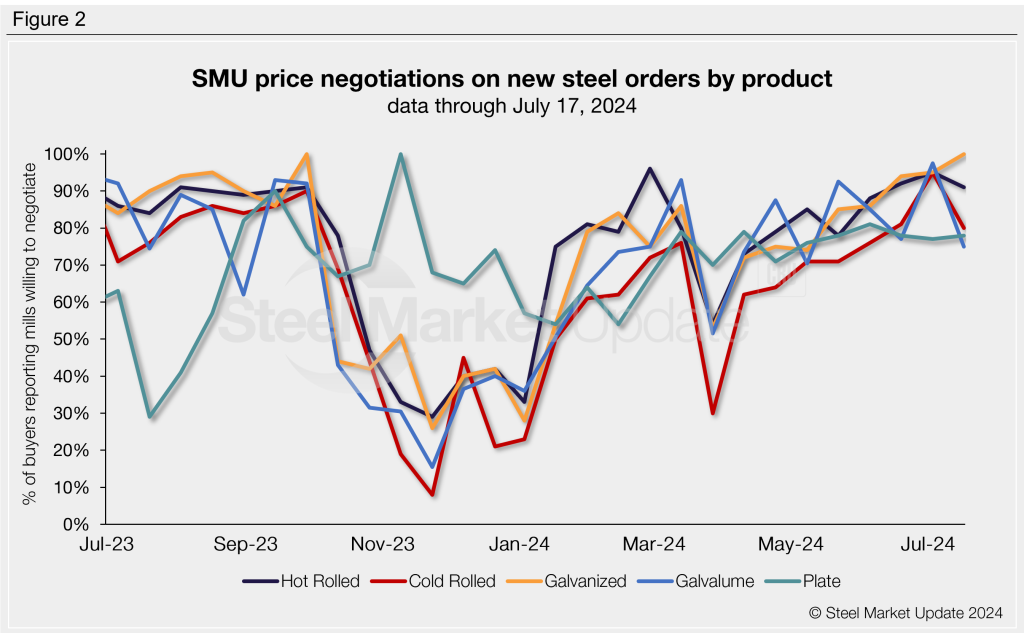

Figure 2 below shows negotiation rates by product. The rate for hot-rolled coil eased slightly to 91% this week, while cold rolled experienced a 15-percentage point reduction to 80%. Mill willingness to negotiate on galvanized products stood at 100%, a nine-month high. Our Galvalume negotiation rate eased to 75%, while plate rates held stable at 79%.

Note: SMU surveys active steel buyers every other week to gauge their steel suppliers’ willingness to negotiate new order prices. The results reflect current steel demand and changing spot pricing trends. Visit our website to see an interactive history of our steel mill negotiations data.