CRU

October 11, 2024

CRU: Open interest in December HR futures contract surges

Written by Josh Spoores

Price changes in the HR coil futures market have been minimal in the past month with values recorded on Monday, Oct. 7, near steady with our Sept. 9 analysis. This lack of change in the futures market is not surprising given the relative stability in physical prices over the past four weeks.

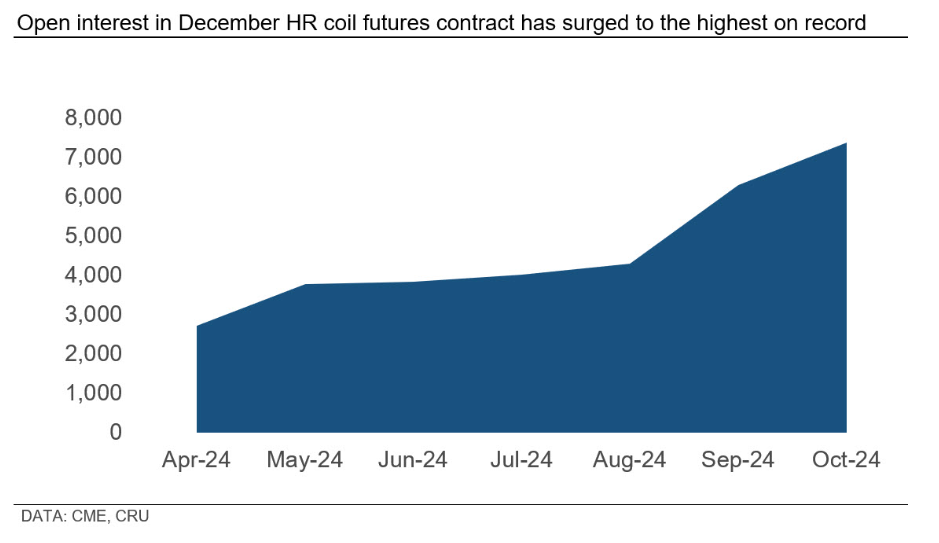

What has changed in the futures market has been a 10% rise in open interest, with a substantial increase in the December 2024 contract. Open interest is the number of 20-st contracts active in the market, representing both a buyer and seller. As of this past Monday, there were just over 24,000 contracts, representing nearly 500,000 st of volume. The December contract alone stood at 7,375 contracts or just over 30% of all open interest. In reviewing this futures data over the past several years, the most visible increase of open interest has come at times before futures prices associated with this volume fell.

As of Oct. 7, the December contract was priced at $772/st, nearly steady with the price in early August. However, open interest has jumped by 72%. While mills continue to target prices near the mid-$750/st level, we have recently seen a return of competition in the physical market, likely due to the temporary outages ending while new capacity continues to ramp up. The value associated with the December contract bears watching as does the full 2025 forward curve, particularly as the upcoming US election unfolds over the next four weeks.

Learn more about CRU’s services at www.crugroup.com.