CRU

January 10, 2025

CRU: Renewed availability of Russian pig iron weighs on global prices

Written by Brett Reed

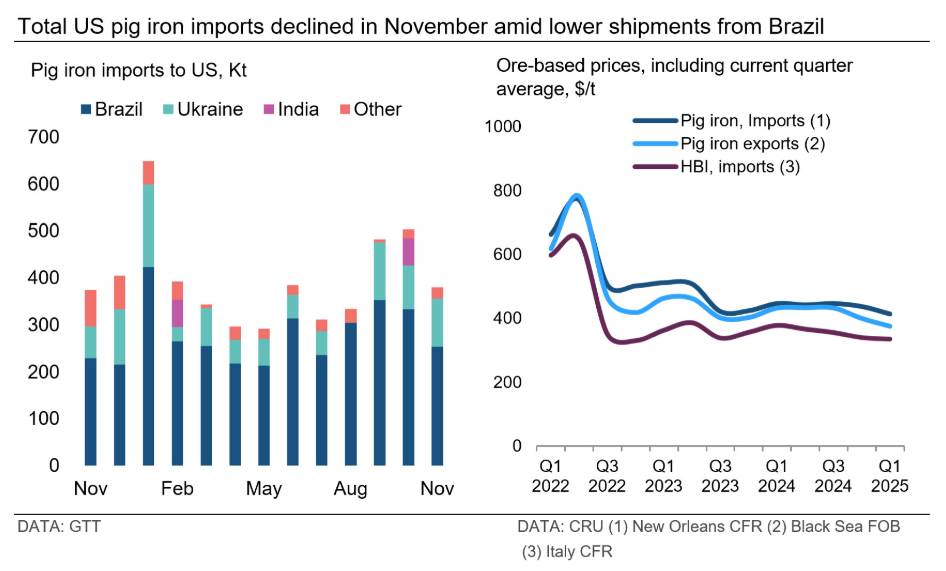

Pig iron prices declined in all regions as the EU’s 2025 import quota on Russian pig iron has begun, loosening global supply. In the US, lower-priced imports from India forced Brazilian producers to reduce prices to secure business.

US pig iron prices declined $30 per metric ton m/m to $430/mt CFR NOLA in January. Lower-priced imports from India continued to enter the market as soft demand in South Asia and the strengthening USD made the US an attractive export destination. In response, Brazilian exporters lowered export prices by $25/mt m/m to $430/mt and $400/mt FOB for the Northern and Southern markets, respectively, to secure business. Brazilian producers have also cut production amid soft demand and falling prices.

In Europe, the pig iron import price declined by $40/mt m/m to $380/mt CFR Italy, while the HBI import price was flat m/m at $330/mt CFR Italy. Pig iron demand in Europe is limited as some mills were shut down for the holiday season. Nonetheless, demand is once again being fulfilled by Russian material as the 2025 quota of 700,000 mt has been activated.

Meanwhile, CIS pig iron export prices declined by $2/mt m/m to $323/mt FOB Black Sea. In late 2024, Russian MPI producers intensified shipments to ports in the Black Sea ahead of the new EU import quota period. Despite soft demand in Europe, market participants report buyers in the EU have been aggressive in securing Russian material.

In Ukraine, MPI production remains elevated as producers prioritize MPI output over energy-intensive steel production. Russian missile attacks on Ukrainian energy infrastructure have created electricity shortages in the region. Higher logistical costs have put margins under pressure, while softer demand due to increased availability of Russian material to the EU has reduced export volumes.

To reach the author of this analysis, contact CRU Research Analyst Brett Reed at brett.reed@crugroup.com.