Market Data

May 1, 2025

SMU Survey: More mills willing to deal on sheet prices, less so on plate

Written by Brett Linton

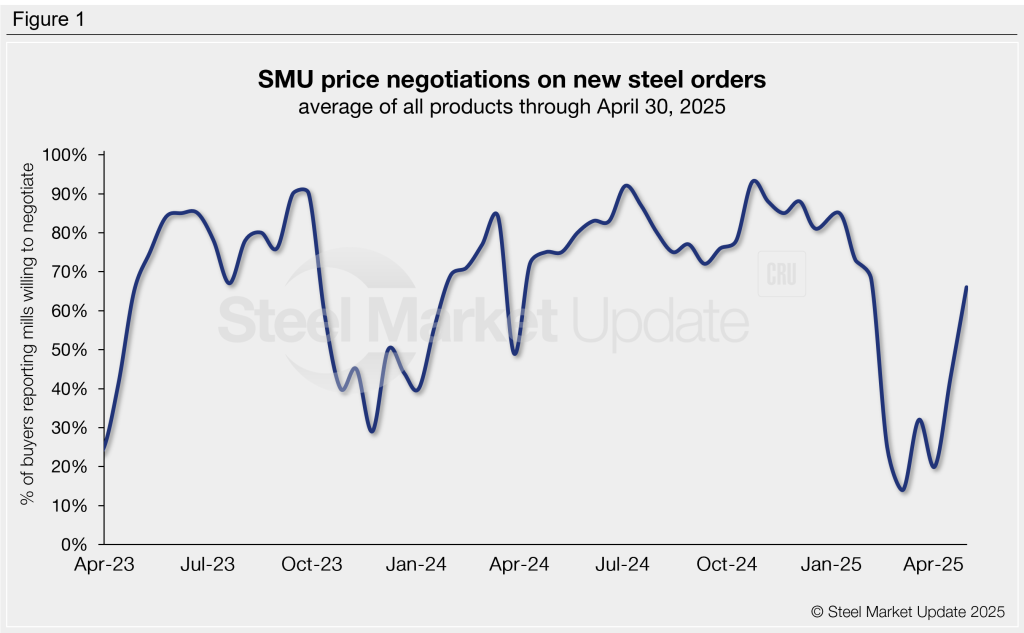

Nearly two-thirds of the steel buyers who responded to this week’s SMU survey say domestic mills are negotiable on spot prices. This increasing flexibility marks a significant shift from the firmer stance mills held in recent months.

Since February, when tariff headlines drove domestic prices higher, mills had largely held all of the pricing power. Before that, buyers had the upper hand for nearly a year. By early March, the percentage of mills willing to negotiate fell to a near two-year low. But the tables have turned yet again. We saw mill negotiability increase across April, with this week marking the highest negotiation rate seen in almost three months.

SMU polls thousands of buyers every other week, asking if domestic mills are negotiable on new order pricing. Through this week, 66% of respondents said mills were willing to talk price (Figure 1). This is up 23 percentage points from our previous survey and 46 points higher than early-April rates.

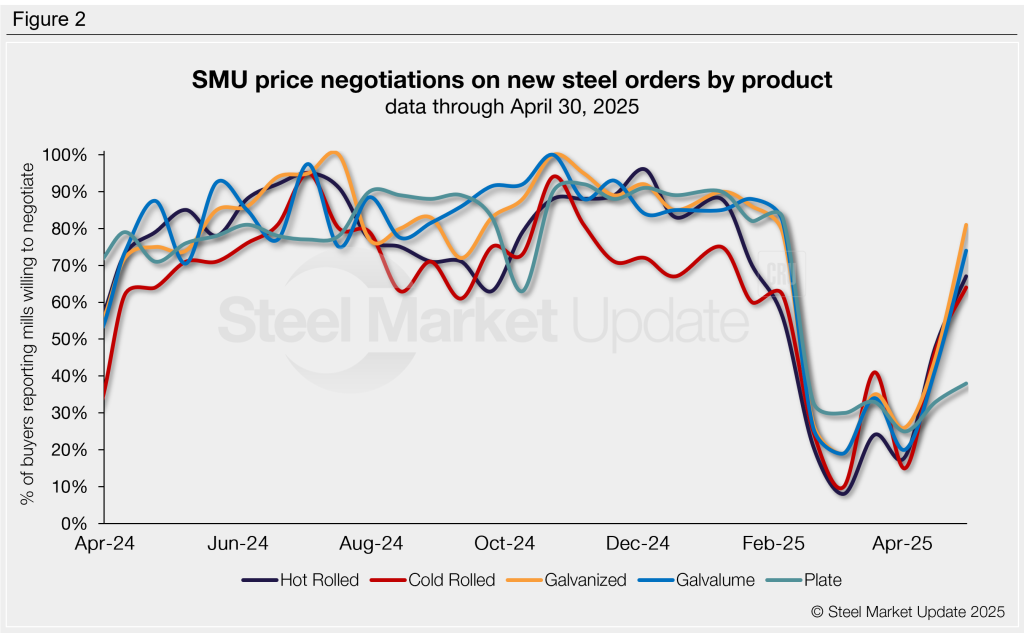

Negotiation rates by product

Negotiation rates rose for all five sheet and plate products we track, though some products saw steeper gains than others (Figure 2). Coated products experienced the most significant increases, while plate saw the smallest. Current rates are as follows:

- Hot rolled: 67% of buyers said mills are negotiable on price, up 19 percentage points from mid-April. This is a sharp rebound from the three-and-a-half-year low of 8% recorded in early March.

- Cold rolled: 64%, up 17 points.

- Galvanized: 81%, up 36 points.

- Galvalume: 74%, up 32 points.

- Plate: 38%, rising just five points and only 13 points above its early April low.

Steel buyer remarks:

“Higher [sheet] volumes are being rewarded with discounts.”

“Not all mills, but some, larger hot-rolled volumes can get a discount.”

“Mills are negotiable [on hot rolled] if you have a lot of tonnage you want to buy.”

“Some mills are negotiable [on hot rolled], a couple are not.”

“Not negotiable, mills are showing restraint.”

Note: SMU surveys active steel buyers every other week to gauge their steel suppliers’ willingness to negotiate new order prices. The results reflect current steel demand and changing spot pricing trends. Visit our website to see an interactive history of our steel mill negotiations data.