Overseas

May 29, 2025

US and offshore HRC prices tick lower

Written by David Schollaert

Domestic hot-rolled (HR) coil prices moved lower again, maintaining the downward move seen in eight of the last 10 weeks. Offshore prices have also eroded in recent weeks, though not nearly as significantly as in the US.

The price gap between imports and domestic products, as a result, was largely unchanged for a third straight week.

Recall that tariff fears pulled forward buying in the US in the first quarter. Activity has since slowed, and prices have fallen.

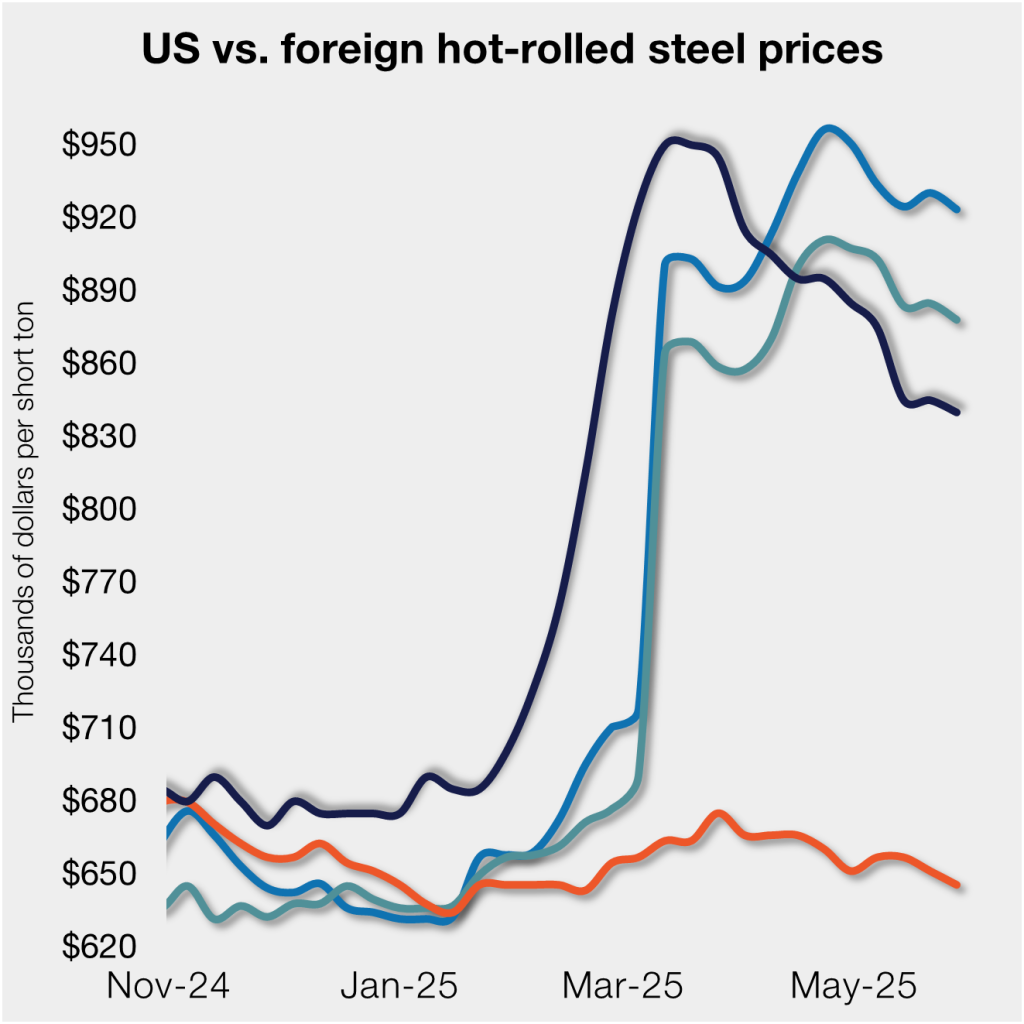

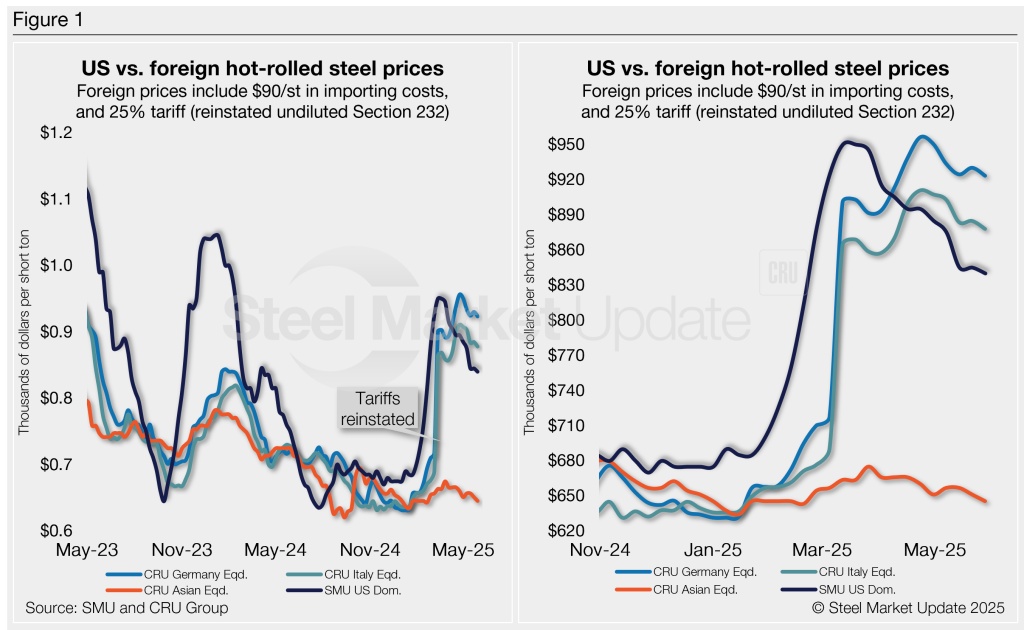

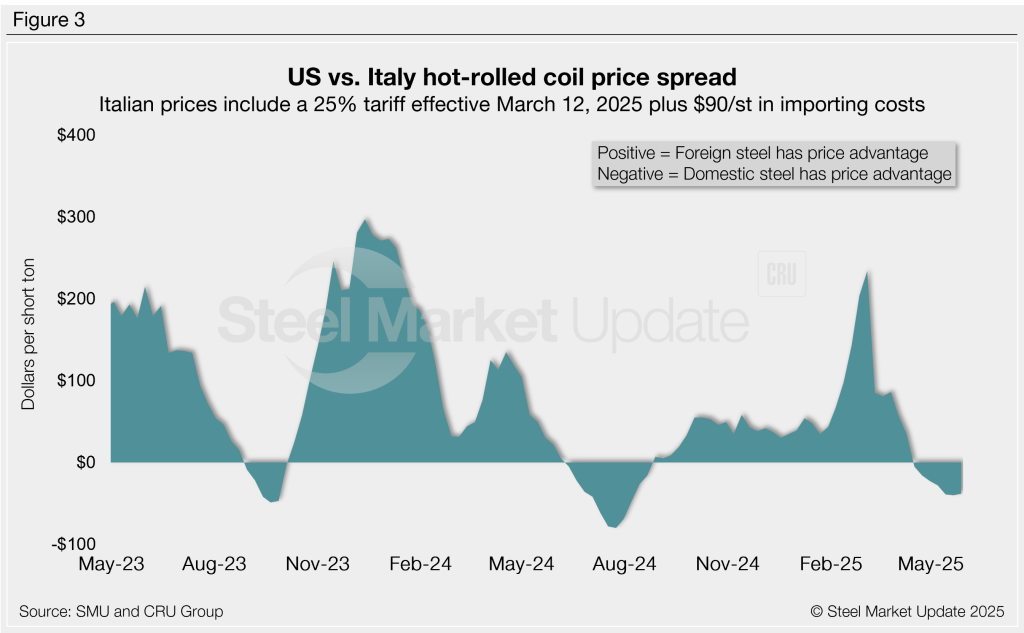

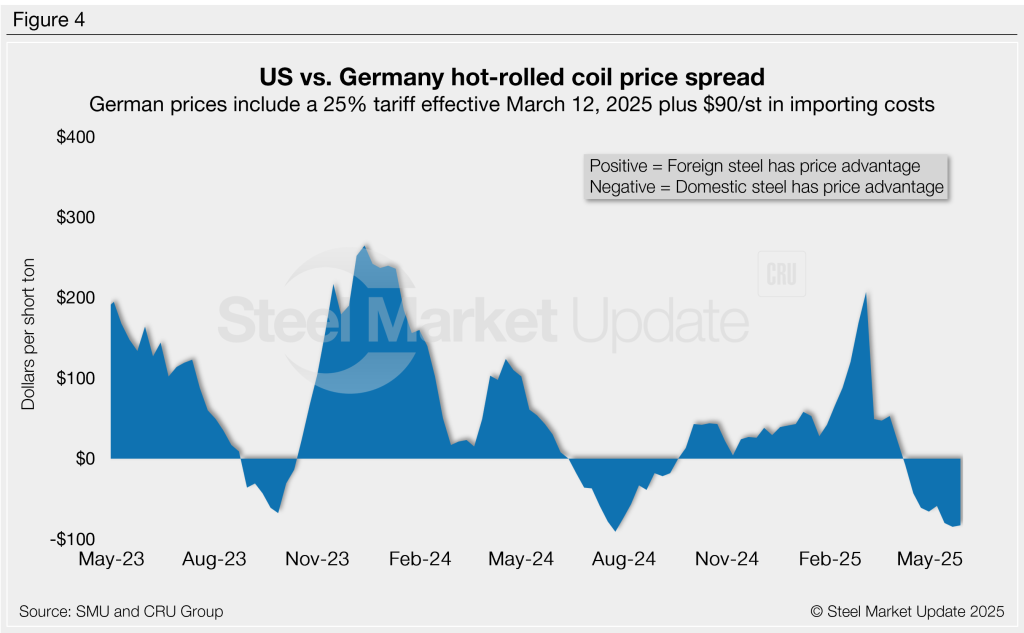

You’ll also note in the charts below that Section 232 returned on March 12. Since then, the price gap between European and US hot band has tightened. Before that date, allies like the EU faced quotas rather than the 25% tariff (See Figure 1.)

By the numbers

This week, SMU’s average domestic HR price was $840 per short ton (st), down $5/st vs. the previous week.

The result: Domestic HR is theoretically on average 2.9% more expensive than imported material, up from 2.7% last week.

If Asian prices weren’t at such a discount to US prices, stateside product would be roughly 7% cheaper than imports. German and Italian HR remain at a premium to US hot band on a landed basis. Just two months ago, domestic prices were 25.5% higher. That changed fast when S232 kicked in.

In dollar-per-ton terms, US HR is, on average, $24/st more expensive than offshore product. That’s up just $1/st when compared to the previous week.

The charts below compare HR prices in the US, Germany, Italy, and Asia. The left side highlights prices over the last two years. The right side zooms in to show more recent trends.

Methodology

SMU calculates the theoretical spread between domestic (FOB mill) and foreign (delivered to US ports) HR coil prices. We do this by comparing our weekly US HR assessment to CRU’s weekly HR indices for Germany, Italy, and Southeast Asian ports. This calculation is purely theoretical. Actual import costs can vary significantly and affect the true market spread.

To estimate the CIF price at US ports, we add a $90/st charge to all foreign prices to account for freight, handling, and trader margins, along with the 25% blanket tariff. This $90/st figure serves as a general benchmark — buyers should adjust it based on their specific shipping and handling expenses.

If you import steel and have insights on these costs, we’d love to hear from you. Contact the author at david@steelmarketupdate.com.

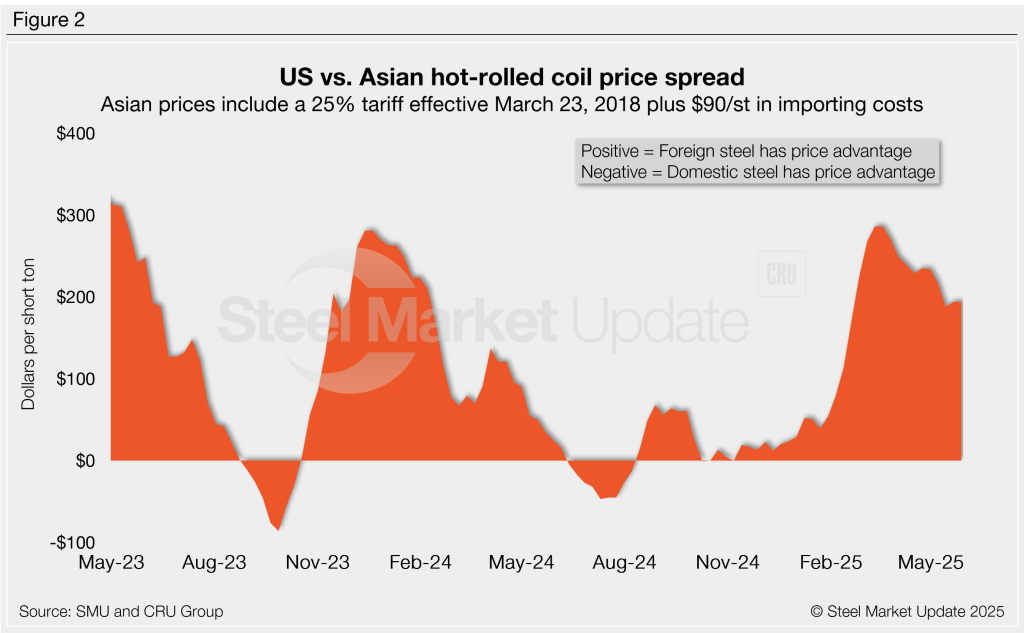

Asian HRC (Southeast Asian ports)

As of Wednesday, May 28, the CRU Asian HRC price was $445/st, down $4/st vs. the week prior. Adding a 25% tariff and $90/st in estimated import costs, the delivered price of Asian HRC to the US is ~$646/st. As noted above, the latest SMU US HR price is $840/st on average.

The result: Prices for US-produced HR are theoretically $194/st higher than steel imported from Asia, unchanged w/w as prices in both regions moved lower. Still, the premium continues to retreat from recent highs seen in 2023 when stateside tags were ~$300 /st more expensive than Asian products.

Italian HRC

Italian HR prices ticked lower by $6/st this week to $630/st, and about $24/st lower over the past four weeks, according to CRU. After reintroducing the 25% tariff and $90/st in estimated import costs, the delivered price of Italian HR is, in theory, $878/st.

That means domestic HR coil is theoretically $38/st cheaper than imports from Italy. That’s down $2/st w/w but a $73/st turn in just six weeks. It also represents a $272/st swing before S232 was reinstated. Without the 25% tariff, US prices in theory would be $120/st above Italian imports.

German HRC

CRU’s German HR price was down $5/st to $667/st this week. After adding a 25% tariff and $90/st in import costs, the delivered price of German HR coil is, in theory, $923/st.

The result: Domestic HR is theoretically $83/st cheaper than HR imported from Germany, a $104/st swing vs. eight weeks ago when stateside product was $21/st more expensive.

US hot band held a $207/st premium over German HR just about two months ago – which had represented the widest margin in 14 months. Without the 25% tariff, US prices in theory would be $83/st above German imports.

Editor’s note

Freight is important when deciding whether to import foreign steel or buy from a domestic mill. Domestic prices are referenced as FOB the producing mill. Foreign prices are CIF, the port (Houston, NOLA, Savannah, Los Angeles, Camden, etc.). Inland freight, from either a domestic mill or from the port, can dramatically impact the competitiveness of both domestic and foreign steel. It’s also important to factor in lead times. In most markets, domestic steel will deliver more quickly than foreign steel. Effective March 12, 2025, undiluted Section 232 tariffs were reinstated on steel. All steel imports and many derivative products now face a 25% tariff. Therefore, the German and Italian price comparisons in this analysis now include a 25% tariff. We do not include any antidumping (AD) or countervailing duties (CVD) in this analysis.