Analysis

August 10, 2025

Final Thoughts

Written by Ethan Bernard & Stephen Miller

Just when you thought they were going to tariff Brazilian pig iron… a last-minute exemption. Is a Mexican trade deal in the offing as we speak, or will the standoff continue?

When it comes to tariffs, the scrap market has seen a series of tariff close calls and reversals. But on the prices front, we’ve seen a lot of “sideways” – and that trend continued into August.

When will this doldrums cycle be complete? Like any good blockbuster, you’ve got to have a good plot to rest your special effects on. Well, you at least have to have some kind of plot. That said, this current administration seems pretty good at the special effects.

I asked SMU’s Stephen Miller, who has over 40 years in the industry, what some possible scenarios might be to break scrap out of the doldrums. Will any breakout lead up or down, and is it all just a question of seasons and tariffs?

Can we shake the doldrums?

One possibility for the scrap market to improve would be if the heightened tariffs on steel imports increased industrial activity and spurred demand for finished steel. The lagging demand for steel, especially hot-rolled coil (HRC), has stagnated demand for scrap. How likely this option is remains in question.

Without the above happening, another possible scenario is for both flows of industrial and obsolescent scrap to continue to weaken while scrap demand stays flat. This tends to happen in drawn-out declining or stagnant markets.

Lastly, let’s consider the seasonal behavior of scrap flows.

As we go into Q4, there is usually a strengthening of scrap prices as winter approaches. Vacation schedules and the deer hunting season restricts scrap generation. Mills try to lower inventories for their year-end balance sheets. Dealers hold back scrap to build inventory for the winter months.

Such activity often leads to sharp increases in scrap prices in December/January. And this year should be no exception. In fact, it’s what we’ve seen for the last two years, according to our interactive pricing tool – which catalogues both steel and scrap prices.

But could the scrap market weaken from here?

One thing that could affect demand adversely is steel mill outages, which are common as we approach the fall months. It would only take perhaps two or three major outages to weaken scrap needs and result in lower prices. So far, just two have been announced. But, again, it’s something to watch out for.

Survey says

Just as the August scrap market was shaping up, we got the results for our latest scrap survey. What were survey respondents seeing?

In the first place, they called the sideways move. Seventy-nine percent of respondents saw the market settling flat this month. Also, 21% were more optimistic, anticipating a price rise, and none saw prices falling.

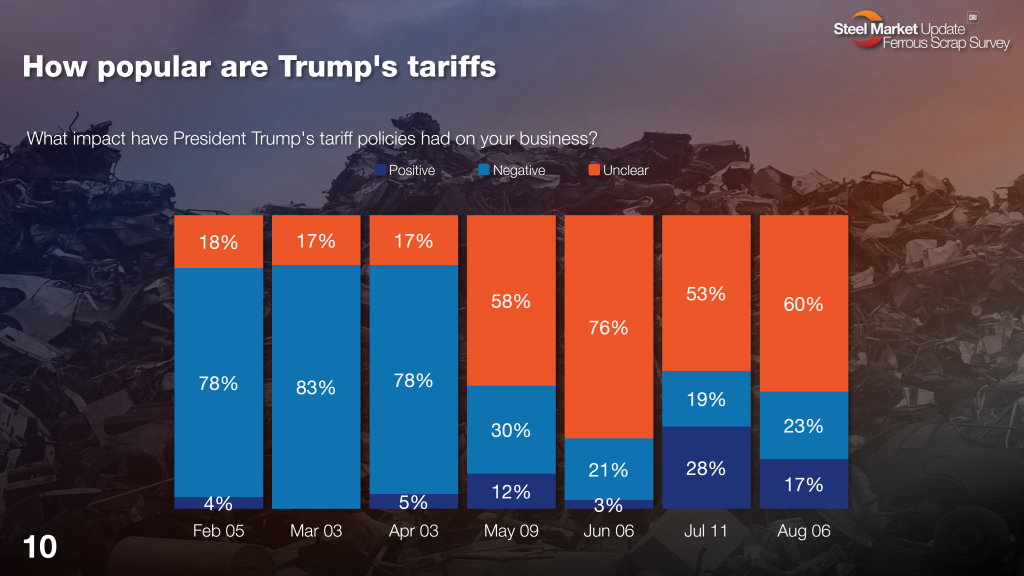

Of course, as I stated earlier, tariffs remain front and center in the market. In our flat rolled survey, we’ve seen that Trump’s tariffs are unpopular among steel buyers. But what about among the scrap market participants we survey? (Editor’s note: The page numbers below refer to where in SMU’s scrap market survey you can find these results.)

How popular are Trump’s tariffs?

As you can see, most people are uncertain about the impact of tariffs on their business. Negative vibes are mounting. And fewer view tariffs as a positive for business.

We will have to stay tuned to see if there will be any more surprises on the tariff front or if we might finally see some stabilization.

Speaking of forecasting, where do survey respondents see near-term scrap pricing?

Two months from now, how do you see ferrous scrap pricing behaving?

Two months from now seems like an eternity given the pace of events this year. That said, most people SMU surveyed see the market strengthening (52%) or stabilizing (45%). Only a small minority (3%) expect ferrous scrap to weaken in the fall.

Here is what some survey respondents had to say:

“Incremental increase in price, but not dramatic.”

“Demand should start to pick up this fall, and supply feels tight at the moment – especially on prime.”

“Improving economy.”

“Tariff impact is wildcard.”

Summing up

That last comment really wraps it all up. Will the tariff wildcard be played again, and is it the only wildcard in the deck? Or could we see a surprise reaction to US policy from other nations?

Ethan Bernard

Read more from Ethan Bernard