North American auto assemblies tumble in July

North American auto assemblies declined in July, down 16.4% vs. August. But, according to GlobalData, assemblies were 2.4% ahead year on year (y/y).

North American auto assemblies declined in July, down 16.4% vs. August. But, according to GlobalData, assemblies were 2.4% ahead year on year (y/y).

US light-vehicle (LV) sales increased to an unadjusted 1.37 million units in July, 8.7% over June and 6.6% above year-ago totals, according to US Bureau of Economic Analysis data.

With so much happening in the news cycle, we want to make it easier for you to keep track of it all. Here are highlights of what’s happened this week and a few things to keep an eye on.

Business activity in New York state improved modestly in August. It was just the second positive reading for the general business conditions index in six months.

While boarding Airforce One on Friday, US President Donald Trump stated that he would be setting more steel tariffs and putting ~100% tariffs on semiconductors and chips.

Oil and gas drilling in the US was unchanged this past week following three straight weeks of declining activity. Canada saw another gain, reaching a 22-week high.

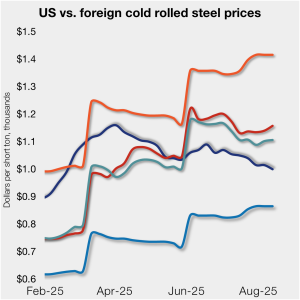

Cold-rolled (CR) coil prices continued to decline in the US this week, while prices in offshore markets diverged and ticked higher.

The CRUmpi rose by 0.8% month over month (m/m) to 286.1 in August, following four consecutive months of decline. Scrap prices showed mixed trends across major regions, largely influenced by local supply-and-demand dynamics, government policies, and the relative strength of finished steel markets. US prices were stable while Europe and Asia saw price increases, but […]

The US scrap export market has traded sideways or slightly less for about 60 days, with no real firmness in sight.

We're getting ready to initiate the 10-day countdown until Steel Summit 2025 in Atlanta. Liftoff is on Aug. 25, and the conference goes through Aug. 27. With the speed at which things have moved this year, it will be great to take a breath and reflect on what's happened so far.

A tour of the economy as it relates to hot-rolled coil futures.

Market participants said they have high hopes that the stable hot-rolled spot market will improve as the year rolls on.

On Monday and Tuesday of this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to tariffs, imports, and evolving market events.

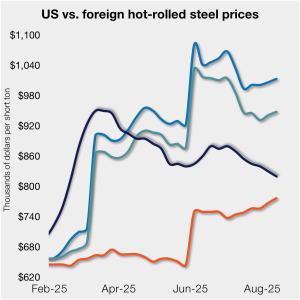

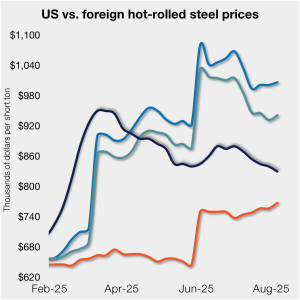

Hot-rolled (HR) coil prices in the US declined again last week, while offshore prices ticked higher again week over week (w/w).

Canada has launched an investigation into the alleged dumping of imports of oil country tubular goods (OCTG) by five countries – Korea, the Philippines, Turkey, Mexico, and the United States.

All five of SMU's steel sheet and plate price indices declined this week, falling to lows last seen in February.

Sources in the carbon and alloy steel plate market said they are less discouraged by market uncertainty resulting from tariffs or foreign relations, but are instead, eager to see disruption to the flat pricing environment.

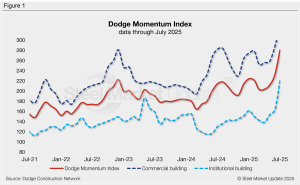

The Dodge Momentum Index (DMI) jumped 20.8% in July and is now up 27% year-to-date, according to the latest data released by Dodge Construction Network.

What are our scrap survey participants saying about the market?

The administration continues to negotiate deals with US trading partners, and the reciprocal tariff program appears poised for further modification. This week, we focus on other important developments that may have received less media attention.

Hot-rolled (HR) coil prices in the US declined again last week, while offshore prices increased week over week (w/w).

Oil and gas drilling in the US slowed for a third consecutive week, while activity in Canada hovered just shy of the 19-week high reached two weeks prior.

This week’s SMU survey reveals that a growing number of steel market participants are weary of tariffs and are awaiting evidence of progress reshoring. At the start of 2025, now-second-term President, Donald Trump, pronounced that his plan to implement tariffs would result in increased revenue for the US.

Both SMU Sentiment Indices continue to show that buyers remain optimistic for their company’s chances of success, though far less confident than they felt earlier in the year.

The volume of steel shipped outside of the country in June fell 3% from the prior month to 618,000 short tons (st), according to recently released data from the US Department of Commerce.

What the word "sideways" means can depend on where you sit on the procurement spectrum.

Since the last writing of this article, CME hot-rolled coil (HRC) futures have been largely steady and lifeless, though there’s been some brief bouts of intraday volatility.

Following January’s pre-tariff surge, imports have remained low since February compared to post-pandemic volumes

SMU’s Monthly Review provides a summary of our key steel market metrics for the previous month, with the latest data updated through July 31.

Mill production times for sheet products are holding just above multi-year lows, while plate lead times remain elevated.