Steel market chatter this week

What's being talked about in the US steel market this week?

What's being talked about in the US steel market this week?

Steel Dynamics Inc.’s (SDI’s) top executive sees hot band demand remaining strong in 2024, which should support pricing.

SMU’s Jan. 24 Community Chat, featuring CRU's Principal Analyst Erik Hedborg, provided viewers with an update on the current state of the global iron ore market.

JSW Steel USA has teamed up with Primetals Technologies to upgrade its slab casting capabilities at the company's Mingo Junction, Ohio, slab and hot-rolled sheet mill.

Steel Dynamics Inc. (SDI) reported lower fourth quarter 2023 earnings on Tuesday but predicted good times ahead in 2024. The Fort Wayne, Ind.-based steelmaker posted a Q4’23 profit of $424.3 million, down 33.2% from a profit of $634.9 million in Q4’22 on sales that fell 12.3% to $4.2 billion.

This earnings season will hit a little different. U.S. Steel has announced that it won’t be hosting an earnings call. While this silence is normal during an acquisition process, it does alter a staple of the earnings landscape.

Canadian flat-rolled steelmaker Algoma Steel said its blast furnace could be down for approximately two weeks following an incident at its coke batteries over the weekend. “We expect some impact on shipments, the extent of which will depend on the timeline to resume blast furnace operations,” the Sault Ste. Marie, Ontario-based company said

CRU principal analyst Erik Hedborg, who has deep experience in iron ore and in pellets, will be the featured speaker on our next SMU Community Chat.

India-based Tata Steel is to close down the two blast furnaces at its loss-making Port Talbot works in South Wales, UK, during a four-year switch to EAF-based steel making. Under the proposals, 2,800 jobs are at risk.

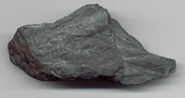

The capacity for EAF steelmaking is growing both in the US and abroad. Ferrous scrap supply has never been more important. A lot of people have viewed the scrap industry as old-fashioned and resistant to change. However, the same forces affecting the steel and other industries are also at play in recycling.

Domestic production of raw steel edged lower for a second straight week, according to the most recent data from the American Iron and Steel Institute (AISI).

Algoma Steel Group has halted coke production in Sault Ste. Marie, Ontario, after an incident at its coke-making facility this past weekend.

This latest SMU steel market survey is a snapshot of a sheet market inflecting lower. A significant 43% of survey respondents said that the hot-rolled (HR) coil market has already peaked. Compare that to only 8% when we released our last steel market survey on Jan. 5.

We’re just a week away from the 35th annual Tampa Steel Conference! It’s one of the premier domestic steel conferences and the first can’t-miss event of 2024. If you haven’t already registered, there is still time but make sure to book now!

CRU forecasts that global demand for steelmaking raw materials will fall month over month (m/m) between mid-January and mid-February. The major downward pressure on raw materials demand will come from China, where steel end-use demand will fall toward the Chinese New Year (CNY) holiday (Feb. 10–17).

While oil and gas drilling in the US and Canada rose in the week ended Jan. 19, less drilling is happening than at this time last year, Baker Hughes’ latest data shows.

The premium plate has held over hot-rolled coil (HRC) has been narrowing but remains elevated compared to historical levels.

When I started in the scrap business many years ago as a rookie trader in Luria’s Cleveland office, I saw an industry composed of family-owned businesses stretching across a great industrial nation.

SMU’s Current Steel Buyers Sentiment Index jumped this week, while the Future Sentiment Index remained flat, according to our most recent survey data.

This time of year my thoughts often turn to the weather. Specifically yesterday, heat cranked up, as I sped to a café because of an Internet service outage. I

Worthington Industries recently completed its separation into two distinct companies: Worthington Steel and Worthington Enterprises. SMU sat down this week with Geoff Gilmore, president and CEO of Worthington Steel, to find out how the separation process went, and what’s on the horizon for the Columbus, Ohio-based company.

The slipping lead times for flat-rolled steel were not just due to the holiday slowdown, it seems, as production times for four out of five products contracted again this week.

US hot-rolled coil (HRC) prices edged down this week while import prices moved higher on average. Domestic hot bands’ premium over cheaper imports declined as a result. But overall, US product remains substantially more expensive than overseas material. All told, US HRC prices are 21.4% more expensive than imports, a premium that is down three […]

What are people in the steel marketplace talking about this week?

Domestic buyers of steel sheet said mills were much more willing to negotiate spot pricing this week, according to our most recent survey data.

US steel exports were flat from October to November, but November took the prize for the fewest monthly exports year to date in 2023.

The spread between hot-rolled coil (HRC) and prime scrap prices narrowed slightly this month, according to SMU’s most recent pricing data.

Both the United Steel Workers (USW) union and a number of politicians oppose the deal. The USW supports Cleveland-Cliffs’ offer. That offer is almost half of what Nippon Steel has proposed and what has been accepted by U.S Steel. I don’t understand the USW opposition to Nippon Steel buying U.S. Steel and the union favoring Cleveland-Cliffs. If Cleveland-Cliffs were to acquire U.S. Steel, it would likely mean the end of a headquarters in Pittsburgh.

There seems to be a growing consensus that the US sheet market has peaked at a high level and could begin losing ground from here. Whether declines happen quickly or whether sheet prices bop around at current levels for a few weeks more is the primary question.

Raw steel production in the US decreased marginally in the second week of 2024, according to the most recent data from the American Iron and Steel Institute (AISI). Domestic steel output totaled an estimated 1,699,000 net tons in the week ended Jan. 13. That’s down 0.5% from the previous week, and comparable to the same […]