Analysis

January 21, 2024

Final thoughts

Written by Michael Cowden

This latest SMU steel market survey is a snapshot of a sheet market inflecting lower.

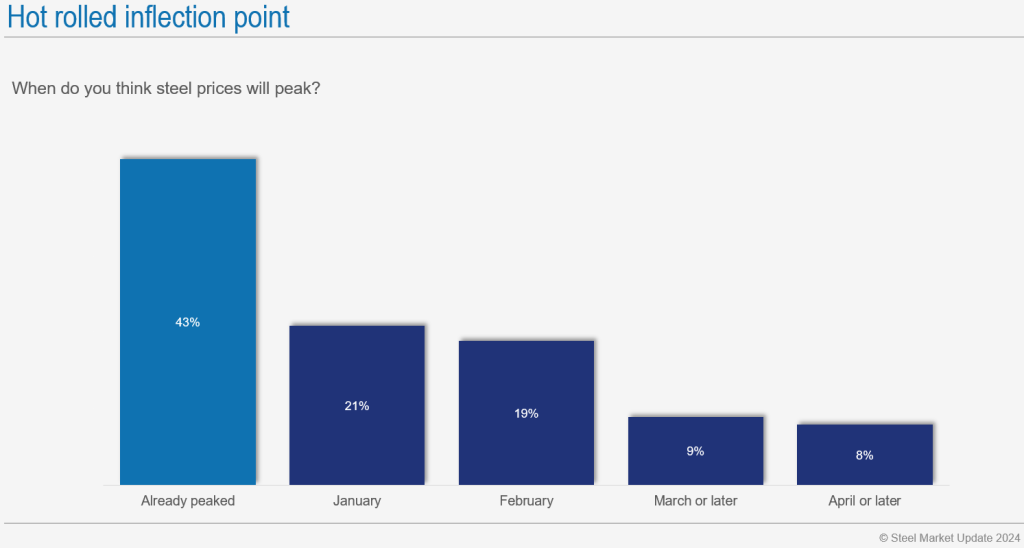

A significant 43% of survey respondents said that the hot-rolled (HR) coil market has already peaked:

Compare that to only 8% when we released our last steel market survey on Jan. 5.

Maybe that shouldn’t come as a surprise. As we’ve noted in prior issues, lead times have been (mostly) contracting since the beginning of the year and mills have become more willing to negotiate lower prices.

Also, a Cleveland-Cliffs’ price increase wasn’t followed by other mills, scrap subsequently settled softer than expected, and service center inventories are no longer declining. Finally, HR prices moved lower last week for the first time since late September.

Prices are expected to decline

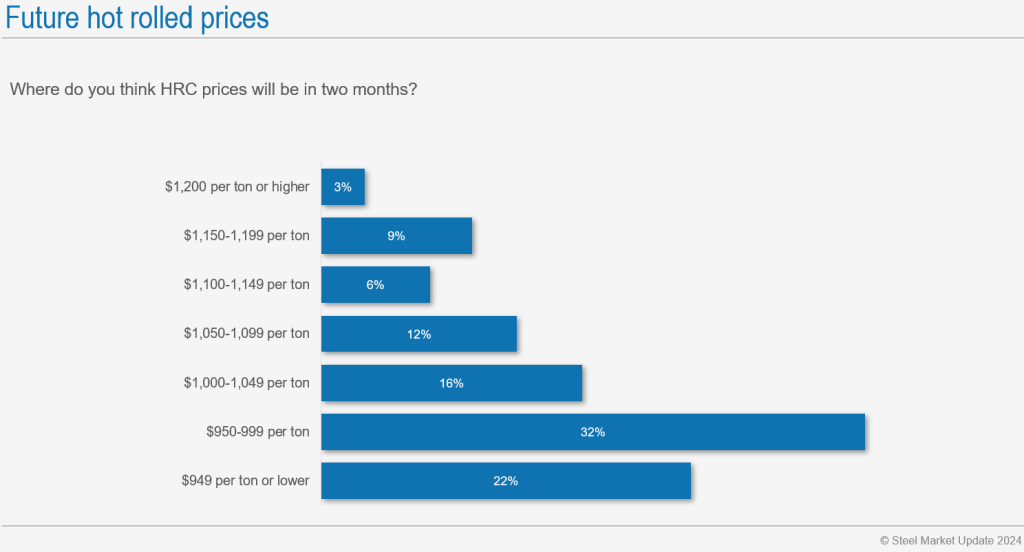

Another big shift: a majority of survey respondents (55%) now think HR prices will fall below $1,000 per ton in two months:

Compare that to early January, when only 24% thought hot band would fall below a grand in March.

That has me wondering whether the relative stability we saw from about mid-December through early January was more about prices being in a holding pattern because there simply wasn’t much spot activity over the holidays. And now that there is more business to be had, perhaps prices are adjusting downward as mills compete for it.

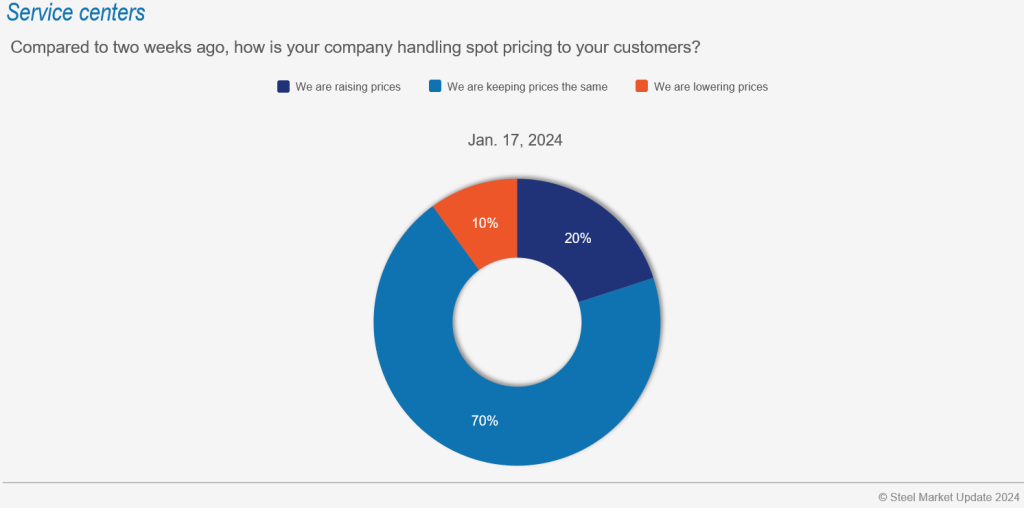

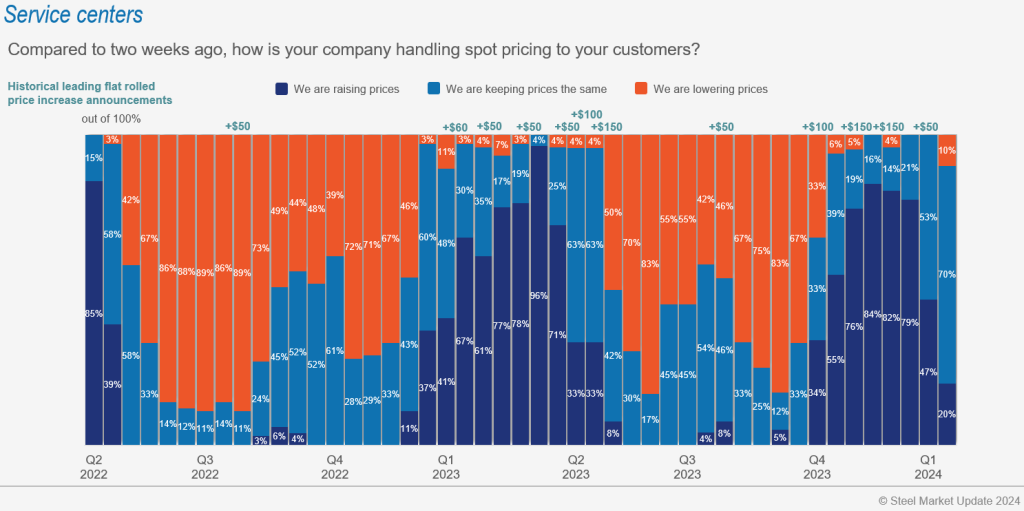

Service centers have also changed their approach to the market:

Only 20% say they are increasing prices, down from 47% at the beginning of the year. And 10% say they are decreasing prices.

That might seem like a small change. But we hadn’t seen that many service centers reporting lowering prices since early October:

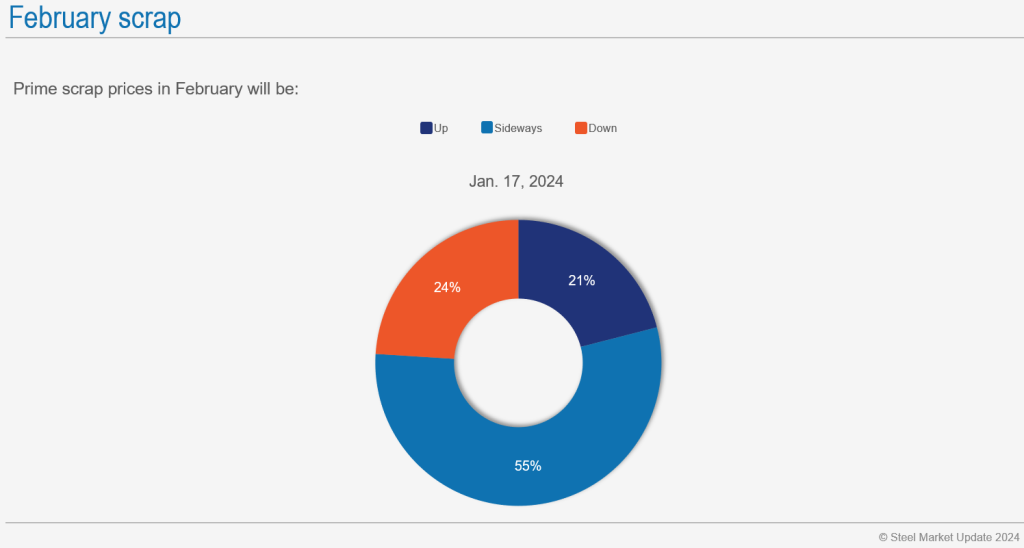

Turning back to scrap, what arguably got Q1’24 off to a wobbly start was a squishy prime scrap settlement this month.

What will happen with prime scrap in February?

A narrow majority of people (55%) expect that prime scrap prices will be sideways in February. The balance was about evenly split between “up” and “down”.

Commentary from survey respondents reflected that diversity of opinion:

- “Even with the mills probably needing more, I imagine buyers will look for a reduction that they did not get in January.”

- “Obviously automotive production has recovered making scrap more available.”

- “A few weeks ago, I would have said ‘up’. Now I am cautiously saying ‘soft sideways’.”

- “An appreciable increase in export tons coupled with weather disruptions could create narrative for up domestic market.”

- “Up slightly after January’s mixed bag. Intense cold weather in the bread-belt has to affect inflow.”

But sentiment is up and demand steady

To recap, most survey respondents think HR prices have peaked and will fall below $1,000 per ton by March. Most service centers are holding prices steady, a change from Q4 when most were increasing prices. And most survey respondents think prime scrap will be sideways in February.

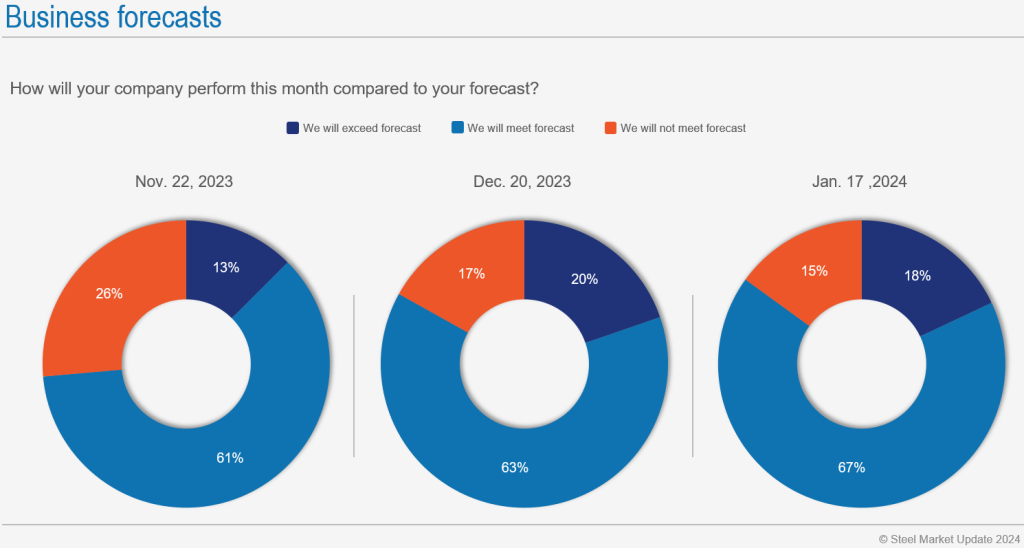

So how do we explain why sentiment improved?

Maybe it’s this: Most people (85%) continue to expect that they will meet or exceed forecast this month:

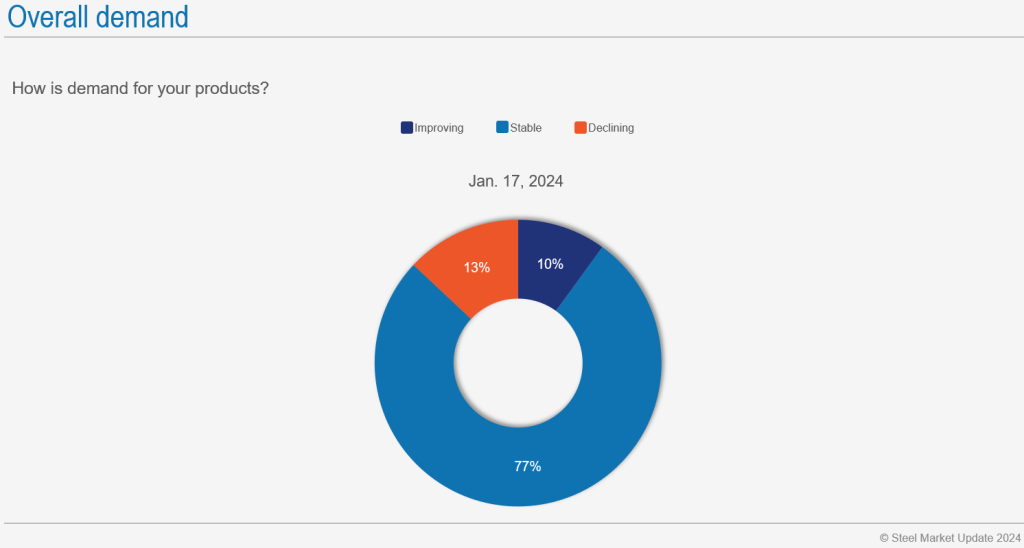

And most people (77%) report that demand is steady:

While there has been an inflection point when it comes to prices, there has been no appreciable change when it comes to questions about forecasts and demand. These percentages have been roughly steady for months. And comments in response to those questions weren’t as heated as those to questions about prices:

- “Auto is up.”

- “Spring backlogs will keep business moving.”

- “Weather has dampened a feel for ‘true’ demand.”

- “Good volume will help exceed forecast.”

You’d expect to see responses like that this time of year. And maybe that’s the takeaway. Despite predictions of an imminent recession going back to at least 2022, we haven’t had one. Maybe there really has been a “soft landing.”

Could US price slip as new capacity ramps up amid steady demand, sure. But barring any unforeseen events, perhaps we’re just seeing what used to be called “mini-cycles”. Even if they’re not so “mini” anymore given the volatility we’ve seen in the US HR market over the last few years.

What do you think?

Community Chat webinar: Jan. 24

Our next Community Chat will be on Wednesday, Jan. 24, at 11 am ET (10 am CT) with CRU Principal Analyst Erik Hedborg, an expert on iron ore and blast furnace pellets.

SMU doesn’t often dig deep into iron ore. And Erik’s expertise is worth your time. Reminder: The live webinar is free. A recording will be available to SMU subscribers. You can sign up here.

Tampa Steel Conference: Jan. 28-30

The Tampa Steel Conference is less than a week away. Nearly 500 people have registered. And we’ve already beat 2008 attendance, the prior record for the event.

Tampa Steel runs Jan. 28-30. Come down to Florida, get out of the cold, and find out why it’s become a must-attend conference for the steel industry.

You can learn more and register here.