Product

January 18, 2013

SMU Steel Buyers Sentiment Index Shows Modest Improvement

Written by John Packard

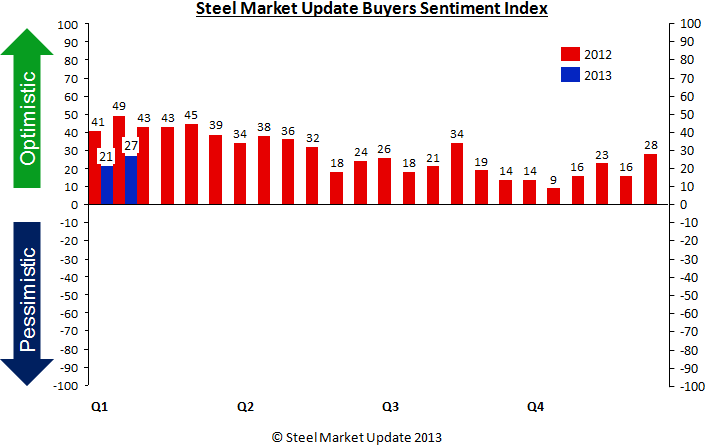

SMU Steel Buyers Sentiment Index improved to +27 this week, this is 6 points better than the +21 measured during the first week of January and is almost back to the levels achieved during the middle of December (+28). However, current Sentiment is well below the +49 measured during the middle of January 2012 – which was the highest reading recorded for our index since we began measuring Sentiment in 2008.

SMU Steel Buyers Sentiment Index improved to +27 this week, this is 6 points better than the +21 measured during the first week of January and is almost back to the levels achieved during the middle of December (+28). However, current Sentiment is well below the +49 measured during the middle of January 2012 – which was the highest reading recorded for our index since we began measuring Sentiment in 2008.

We have been seeing our SMU Steel Buyers Sentiment Index trending much the same as steel prices – sideways – over the past couple of months. The SMU Index has been range bound, floating between +16 and +28 for a number of weeks as steel buyers and sellers try to determine if demand will improve from here and whether the government will remain dysfunctional and an impediment to both existing and future business growth. Uncertainty has been a key component of this market for a number of months and has directly impacted our Sentiment Index.

SMU believes some of that uncertainty is beginning to fade based on the comments left behind in this week’s survey:

A service center who reported demand as improving told us during the survey process, “We have seen a notable pickup in orders and quotes since the 1st.”

A second service center who also reported demand as improving told us, “Certainly doubt and apprehension in the market, but we are extremely busy.”

Not all service centers reported a rosy picture. This distributor felt demand was declining and told us, “Not seeing the usual first of the year energy that we are used to seeing. Orders are flat!”

A manufacturing company told us their demand was improving and then told us, “We had an excellent year, but business conditions are challenging. The regulatory and legislative uncertainties are certainly not helping.”

A second manufacturing company also reported demand as improving but was concerned about pricing. They told SMU during the survey process, “Although there is a good deal of pricing pressure, the business is out there to be had. Although three of our competitors announced price increases last year that were to be effective January 2013, we have seen a slight erosion in pricing.”

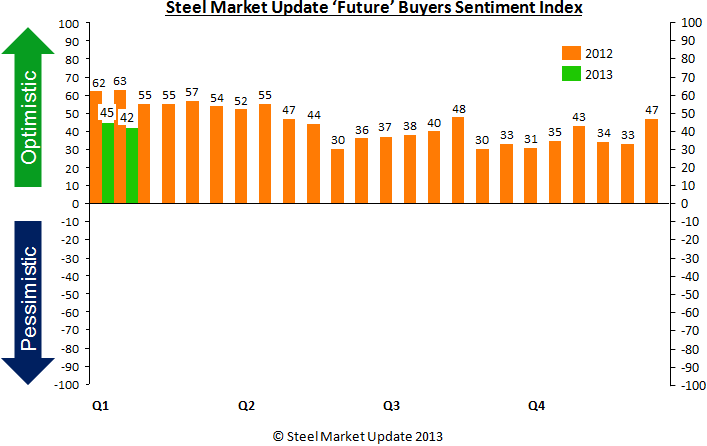

SMU Future Steel Buyers Sentiment Drops to +42

Our SMU Future Steel Buyers Sentiment Index continues to remain in optimistic territory with a +42, down from +45 measured during the first week of January and not at the levels seen one year ago when our index reached an all-time high of +63. Buyers and sellers continue to be optimistic about their company’s ability to be successful with the only reservations coming from those who have to deal with the U.S. government or are involved with commercial construction projects. These two areas seem to be the laggards in the U.S. economy at this point in time.

Our SMU Future Steel Buyers Sentiment Index continues to remain in optimistic territory with a +42, down from +45 measured during the first week of January and not at the levels seen one year ago when our index reached an all-time high of +63. Buyers and sellers continue to be optimistic about their company’s ability to be successful with the only reservations coming from those who have to deal with the U.S. government or are involved with commercial construction projects. These two areas seem to be the laggards in the U.S. economy at this point in time.

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from + 10 to + 100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently we send invitations to slightly less than 700 North American companies to participate in our survey. Our normal response rate is approximately 130-200 companies. Of those responding to this week’s survey 48 percent were manufacturing companies, 37 percent were service centers/distributors and the balance was made up of steel mills, trading companies and toll processors involved in the steel business.

Steel Market Update does canvass those being invited to participate in order to confirm their active participation in the flat rolled steel business. Our list is updated at least once per month and we are adding new companies on a continuous basis.