Product

February 27, 2013

Galvanized Coating Mills Complain of Cost Squeeze

Written by John Packard

Combination of higher zinc spot prices, competitive extras and higher zinc premiums are squeezing coating lines

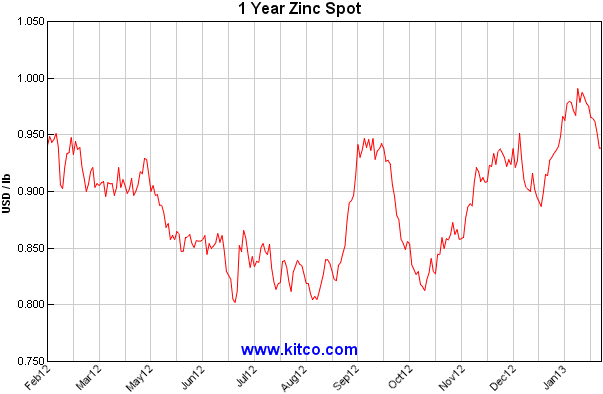

Galvanized converters are struggling to compete against mills with lower coating extras as LME Zinc spot prices have climbed from the low $.80’s per pound to recent high’s close to $1.00 per pound. Over the past few trading days spot pricing has dropped to approximately $.94 per pound.

Galvanized converters are struggling to compete against mills with lower coating extras as LME Zinc spot prices have climbed from the low $.80’s per pound to recent high’s close to $1.00 per pound. Over the past few trading days spot pricing has dropped to approximately $.94 per pound.

The LME spot prices do not tell the full story, according to a couple of steel mills who spoke to Steel Market Update recently. “Zinc premiums are controlled in cartel like fashion; there’s really very few options for galvanizers. On the sell side, no one can make money on HDG using current extra sheets. This is more or less controlled by Nucor as they realize it hurts almost everyone else more than them…

…It’s also come to my attention that zinc premiums in the US market are much higher than almost anywhere else in the world, probably going to $0.08/lb in 2013; Europe is around $0.06/lb and Asia around $0.05/lb. One of the assorted excuses for this robbery by the zinc miners was summed up by a supplier (referring to the premium levels which have gone from under $0.03/lb in 2009 to $0.08/lb today): ‘this is due to a tightness of zinc metal in the USA and stable demand from the zinc consumers’. Actual zinc consumption has fallen since 2000, so not sure what they mean by this.”

The domestic steel mills have not made any published adjustments in galvanized extras since early 2012. When looking at lighter gauges (thinner steels) such as .016 material – there can be quite a difference in the extras from mill to mill. For example, Nucor charges $3.50/cwt to coat G30 in that thickness while U.S. Steel and a number of other mills publish a coating extra of $4.50/cwt for that particular product.

However, in a competitive world the light gauge mills – especially the conversion mills – must meet the low priced competition when and where necessary.

With zinc trading at $.9466 per pound ($2,087 per metric ton) the cost to coat .016 with a 3 percent overcoat is approximately $2.80/cwt leaving a margin of $.70 for those mills using a $3.50/cwt coating extra. (cost calculations are based on information shared with SMU by a domestic galvanizing mill)

However, the above calculation does not take into account the premium which is charged by the zinc suppliers for delivery to the mills and their margins. The premium for 2013 rose to $.08 per pound from $.07 per pound this past year. The premium adds an additional $178.37 per metric ton to the cost of the zinc and the impact to the cost of coating that same .016 G30 substrate is now $3.04/cwt leaving a margin of $.46/cwt prior to overhead, debt expense, etc.

Galvanized buyers need to be aware of the impact of the new premiums on the domestic mills as well as the rising costs of zinc.

We have supplied some examples of zinc extras for you to review – including those of California Steel which are lower than Nucor or any other mill. SMU encourages buyers to be aware of all extras when negotiating with your suppliers. At the same time, you also need to be aware of those conditions which may be causing your suppliers issues.