Market Data

September 5, 2013

Mill Lead Times & Negotiations: Trends are Reversing Themselves

Written by John Packard

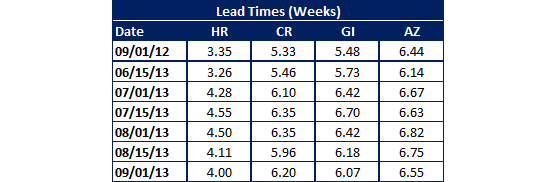

Mill lead times, as reported through our proprietary steel market survey, are shrinking on three of the four flat rolled product categories followed by Steel Market Update. Hot rolled lead times which were referenced on a weighted average basis at 4.5 weeks at the beginning of August are now at 4.0 weeks. However, the 4.0 weeks is still much better than what we saw one year ago when buyers and sellers pegged HR at 3.35 weeks.

Galvanized lead times shrunk from 6.18 weeks to 6.07 weeks but better than the 5.33 weeks of one year ago. Galvalume lead times moved from 6.75 weeks down to 6.55 weeks which continues to be better than the 6.44 weeks referenced one year earlier.

The one item which bucked the trend was cold rolled which came in at 6.20 week lead times up from 5.96 weeks two weeks ago and well above the 5.33 weeks of one year ago.

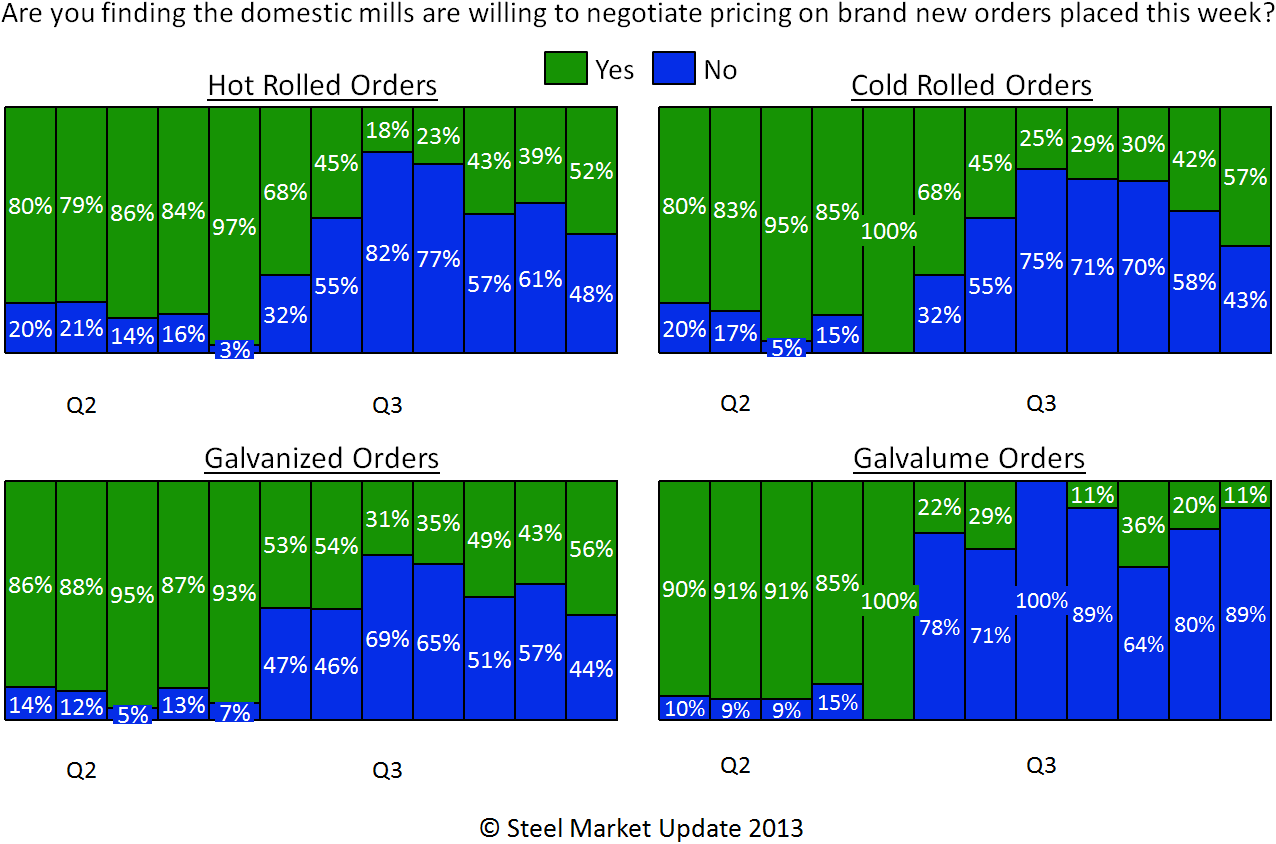

Negotiations Break Through 50% Levels

On every product but Galvalume, buyers and sellers of steel reported mills as being more willing to negotiate spot prices with their customers. Hot rolled, cold rolled and galvanized were all reported as having exceeded 50 percent of the customers reporting mills as willing to negotiate on those products. The one exception was Galvalume where our survey found only 11 percent of the customers reporting mills as willing to negotiate pricing.