Market Data

September 19, 2013

Mill Lead Times Flat While Price Negotiations Becoming More Prevalent

Written by John Packard

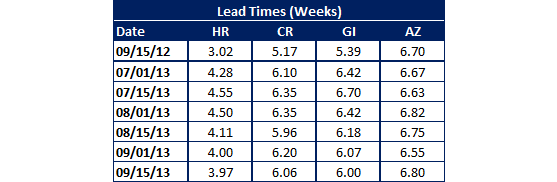

SMU found lead times essentially remaining the same on hot rolled (negligible change from 4.0 weeks to 3.97 weeks) and galvanized (6.0 weeks vs. prior 6.07 weeks). Cold rolled lead times dropped from 6.2 weeks to 6.06 weeks while Galvalume lead times moved out slightly from 6.55 weeks to 6.80 weeks.

Lead times are based on the average of the manufacturing and service center responses received during our steel market survey which concluded earlier today (Thursday).

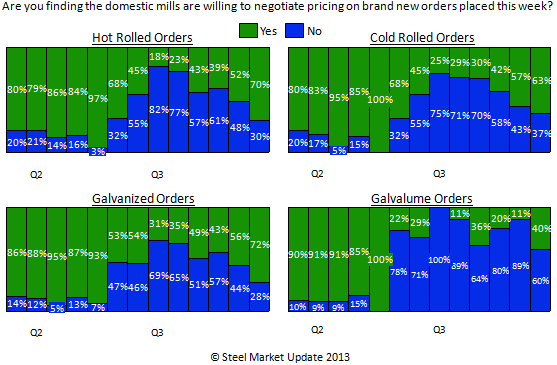

According to the results from our latest survey, the domestic mills have become more willing to discuss/negotiate pricing on virtually all flat rolled products. In early July we found the lowest percentage of mills willing to negotiate pricing (according to our survey). Lead times were the most extended at that time and prices had been moving higher over a number of weeks. As we moved into August the lead times began to shrink and the willingness of the mills to be more flexible began to grow.

Since the beginning of September we are seeing the percentages reaching levels which would suggest prices could begin dropping faster from here – especially on hot rolled and galvanized steels. The product with the most strength is Galvalume. Our data is broad based (OEM’s and distributors and the mills are scattered about the country) and whether or not a mill will negotiate with your company will depend on your relationship, the need of the mill for orders by product, the tonnage requested and your ability to pay timely.

Here is what was reported to SMU this week during the survey process: