Market Data

November 3, 2013

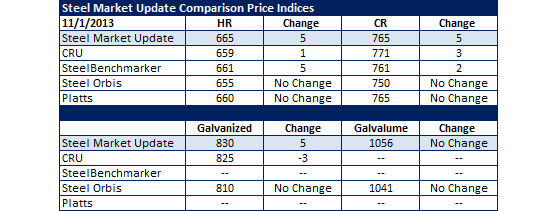

SMU Comparison Price Indices: Price Rise Slowing Down

Written by John Packard

The flow of higher pricing slowed this past week as a number of indices – including Platts – did not move their flat rolled steel price assessments compared to the previous week. The range between high and low on benchmark hot rolled coils shrunk to $6 per ton with Steel Market Update being in the unusual position of being the highest and CRU the lowest. The widest variance was the $830 galvanized number provided by SMU versus the $810 pricing delivered by Steel Orbis.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

SteelOrbis: Midwest Domestic Mill.

Platts: Within 200-300 mile radius of Northern Indiana Domestic Mill.