Market Data

December 5, 2013

Domestic Mill Lead Times & Negotiations

Written by John Packard

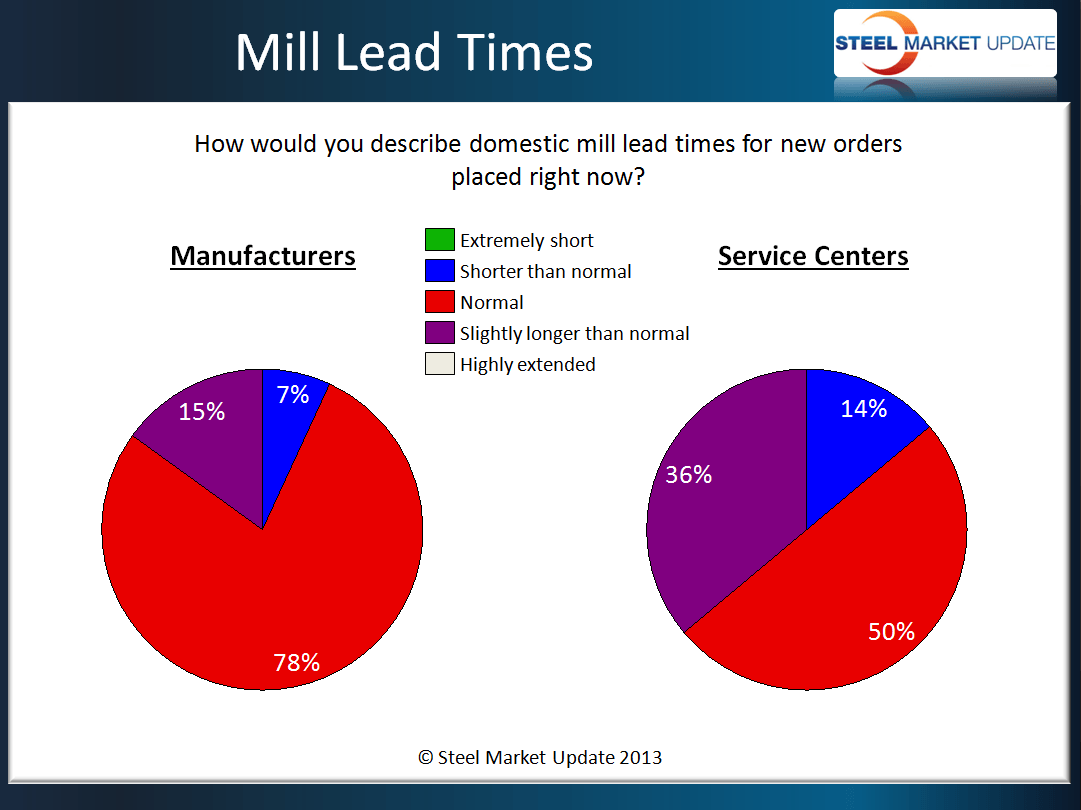

One of the keys when determining the strength and or weakness of the flat rolled steel markets is through what is being reported by buyers regarding mill lead times. We have found our analysis, through the use of our steel market survey, provides a better look at the average lead times and changes to those lead times.

During the survey process we actually ask questions about lead times in two ways – first, in their opinion are lead times shorter than normal, normal or longer than normal? We break this out by manufacturing companies and service centers. Here is a look at our most recent results:

Second, we ask those taking our survey to review and advise the average lead times they are seeing by product. Based on the latest survey results, lead times extended on hot rolled coil now being referenced as averaging 4.56 weeks. Cold rolled lead times also moved out and are now reported as averaging 6.55 weeks. Galvanized lead times came back in slightly and are now reported to be 6.30 weeks. Galvalume lead times moved out a tad from 6.22 weeks to 6.36 weeks. Compared to last year at this time lead times are much longer on all products with the possible exception of Galvalume.

As you can see by the interactive graph shown below, lead times are extended compared to one year ago. If you pass your mouse over the graphic the data points will be displayed. You also have the ability to adjust the time period if you would like to zero in on a specific point in time. The interactive graph is only visible to those who have logged into the new Steel Market Update website to read the article or full newsletter online.

{amchart id=”112″ SMU Lead Times by Product}

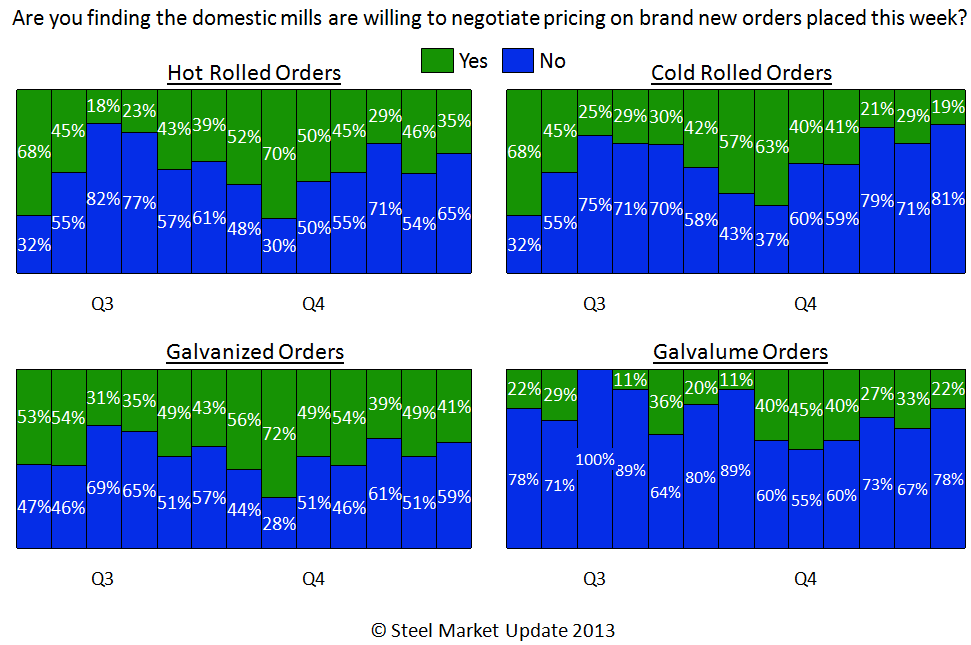

Once we have determined where lead times are we move to negotiations and the position being taken by the domestic mills when negotiating prices by product. This is also done by breaking out manufacturing from service centers but below is the combined response levels by product.

Based on our survey results from this week we found that the domestic mills are limiting the amount of negotiations on each of the flat rolled steel products followed by Steel Market Update. Thirty five percent of our respondents reported the domestic mills are willing to negotiate hot rolled pricing. This is down from 46 percent reported during the middle of November. Cold Rolled dropped from 29 percent to 19 percent which is the lowest level of the year.

Galvanized was the most negotiable of the flat rolled products. Even so, 41 percent of our respondents reported the mills as willing to negotiate galvanized pricing. This is down from the 49 percent measured in mid-November.

Twenty two percent of our respondents reported the domestic mills as willing to negotiate Galvalume pricing this week. This is down from the 33 percent reported during the middle of November.

We have an interactive graphic online regarding negotiations but we thought we would be well served to show you the graphic as you have become accustomed to seeing it. When you have some time you may want to go to the new SMU website and play with the interactive graph.