Prices

December 23, 2013

Global Steel Production in November

Written by Peter Wright

Production declined by 5.0 percent from October to 127,364,000 tonnes, partly due to less days in the month but this was also the lowest monthly tonnage since February.

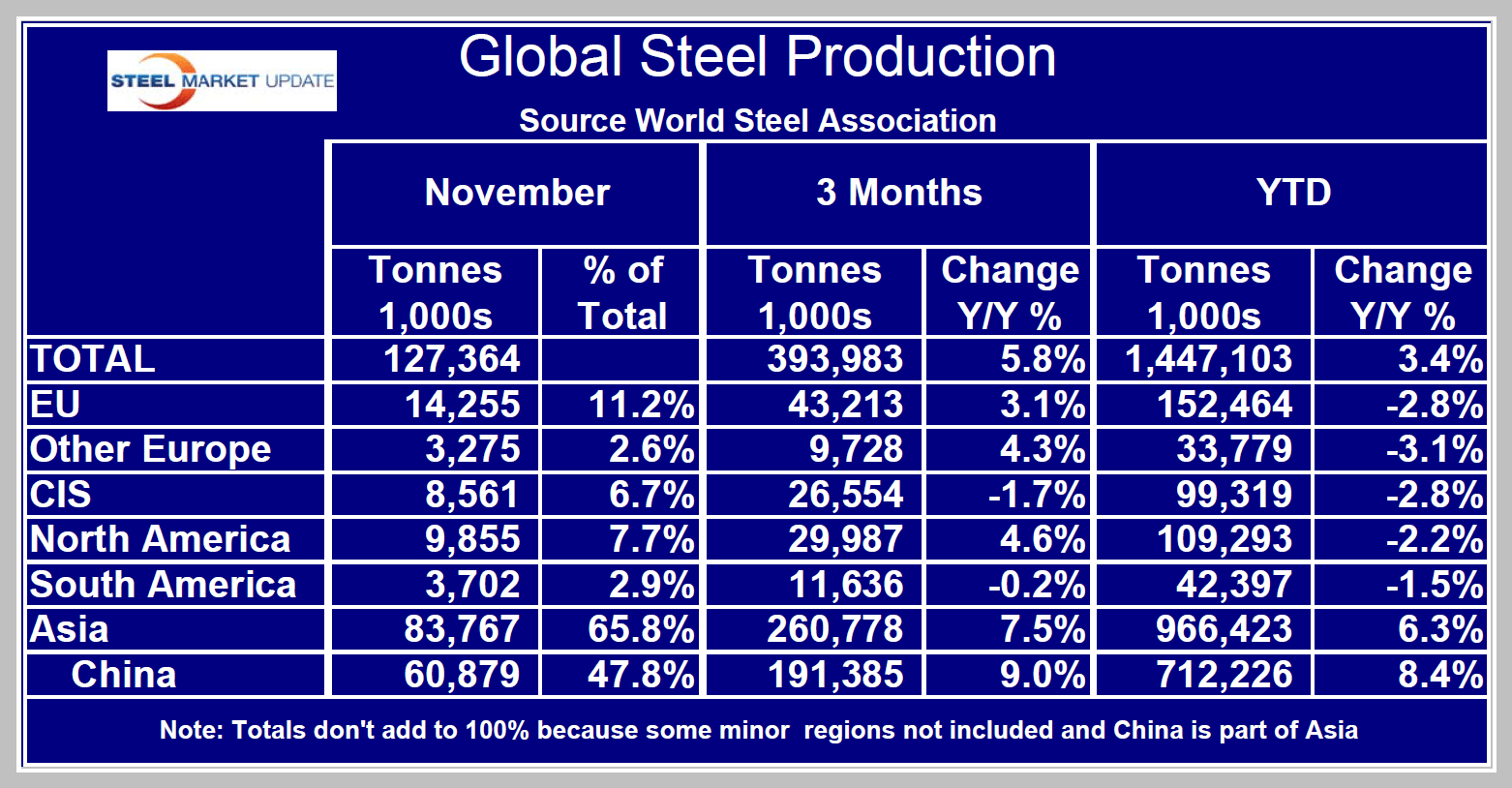

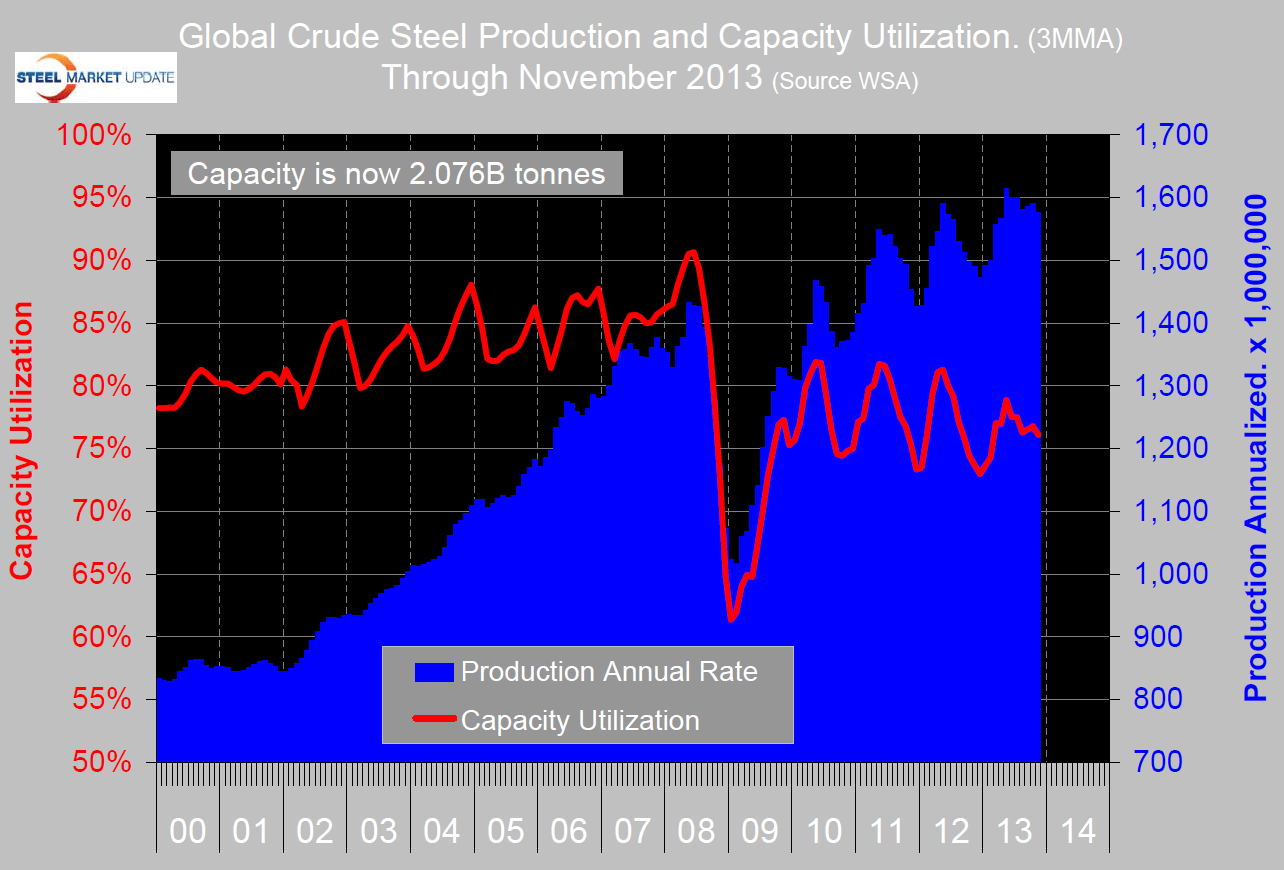

Capacity utilization was 74.0 percent. The annualized three month moving average production was 1.576 billion tonnes through November (Figure 1). Capacity is now 2.076 billion tonnes. Global production this year has deviated from the pattern of the last three years by holding onto the gains made in the first half year. In three months through November global production grew by 5.8 percent year over year and year to date production was up by 3.4 percent compared to the first 11 months of 2012. The fact that the last three months growth rate was stronger than the YTD result means that momentum is increasing. This was true of all regions, even for the CIS and South America where the decline lessened. China grew 9.0 percent in 3 months through November and by 6.4 percent year to date, both year over year (Table 1). In the month of November, North America and China produced 7.7 percent and 47.8 percent of the global total respectively. November was China’s lowest production month since January.

Capacity utilization was 74.0 percent. The annualized three month moving average production was 1.576 billion tonnes through November (Figure 1). Capacity is now 2.076 billion tonnes. Global production this year has deviated from the pattern of the last three years by holding onto the gains made in the first half year. In three months through November global production grew by 5.8 percent year over year and year to date production was up by 3.4 percent compared to the first 11 months of 2012. The fact that the last three months growth rate was stronger than the YTD result means that momentum is increasing. This was true of all regions, even for the CIS and South America where the decline lessened. China grew 9.0 percent in 3 months through November and by 6.4 percent year to date, both year over year (Table 1). In the month of November, North America and China produced 7.7 percent and 47.8 percent of the global total respectively. November was China’s lowest production month since January.

SMU Comment: Reports of a global economic slowdown are not being reflected in the steel production statistics. We keep waiting for China’s growth of steel production to slow as has been predicted elsewhere. Hopefully the November result is a pre-cursor of that change. (Source: World Steel Association)