Prices

January 26, 2014

What Does Fall of Turkish Lira Mean for U.S. Scrap Industry?

Written by Peter Wright

January 24th 2014. The Turkish Lira is in freefall. What does this mean for the US ferrous scrap industry?

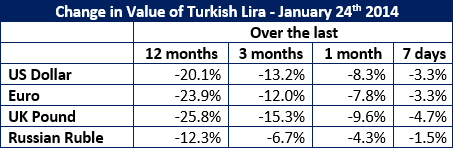

This is a hard question to answer because we don’t know what we don’t know. What we do know is that the Turkish Lira has declined by 20.1% against the US $ in the last 12 months and that this decline has recently gone into free fall (Figure 1).

Turkey has four primary choices when it comes to scrap purchases for its EAF sector. It can buy from the US, the EU, the UK or Russia or it can buy billets, blooms and slabs from Russia. The following table describes the decline of the Lira against its four trading partner options.

Turkey produced 35 million tonnes of steel last year, 70% of which was in electric arc furnaces and imported 18 million tonnes of scrap. Turkey’s scrap imports account for just over 20% of total global scrap trade making them the biggest global player and almost an equal and opposite match to the US, the largest global exporter. In the first eleven months of 2013, Turkey purchased 4.9 million tonnes of scrap in the US, down from 6.0 million in the same period in 2012. This was a declining trend throughout 2013. The collapse of the Lira against the US $ has favored the Eurozone slightly in the last three months but purchases in the UK are the worst of all options. Under the present circumstances Russia is the best choice for both scrap and semi finished.

Formerly a major exporter of steel scrap, Russia instituted an export tax combined with strict administrative policies in 2007 that resulted in a sharp decline in international scrap trade. However, upon joining the World Trade Organization, Russia agreed to substantially reduce tariffs on exported steel scrap. This occurred to some extent but Russian exports only recovered to one third of their previous level. Then in February 2012, Russia adopted a customs regulation that excluded Vladivostok, Nakhodka and St Petersburg from the list of permissible shipping points represents a clear effort by Russia to erect yet more administrative barriers to exports of steel scrap.

In the 3rd Q of 2013, Turkey imported 1,956,364 tonnes of scrap from the EU, (including the UK), 1,400,726 tonnes from the US and 433,357 tonnes from Russia. Shipments of semi finished from Russia at 573,567 tonnes exceeded their scrap shipments and based on the first month’s data of Q4, the Russia to Turkey semi finished trade is accelerating.

On December 6th a presentation on the outlook for the Turkish steel industry was made to the 75th session of the OECD Steel Committee by Dr. Veysel Yayan, Secretary General of the Turkish Steel Producers Association. Just as in the US, the performance of the Turkish steel industry follows GDP and is also more volatile than GDP. Turkish steel production grew steadily in 2009 through 2011, plateaued in the first three quarters of 2012 then declined by 3.8% in H2 2013. The imports of semi finished from Russia replaced domestic Turkish crude production rather than complimenting it so was a direct subtraction from scrap purchases.

As crude steel production declined 3.8%, finished steel production grew by 4% in the first 10 months of 2013. The trade balance of finished steel products also worked against Turkish domestic production in the first 10 months of 2013 when exports declined by 1.2 million tonnes or 8.9% year over year. 73% of Turkish exports are long products and only 16% are flat rolled. The Middle East and North Africa accounts for 54% of Turkish exports with only 6% coming to the US. Instability in Turkey’s largest export market is not helpful to steel producers.

On January 24th SMU received these comments from a friend in the East Coast scrap trade. “Well, John, the export situation off the USEC is pretty awful. But it’s been this way now for about two months. So the more recent deterioration in the Lira’s value vs. the US dollar isn’t changing much practically. Export has been at a standstill since December. The exporters saw this in late-December / early-January and consequently decided to sell what scrap they could into the domestic market. This put a hard stop on the domestic price increases we had experienced over the course of the end of 2013. I expect that will continue until the domestic price hits a level that makes export viable again. The continued devaluation of the lira is making that possibility pretty remote for now.”

Clearly the Turkish steel industry is facing severe headwinds which are impacting their purchase of scrap from the US East Coast. The decline of the Lira against the US dollar, the Euro and the Pound is reducing their options when it comes to sourcing scrap for electric arc furnaces. The situation in their primary market will not improve any time soon and it appears that sourcing of semi finished steel in Russia is compounding the decline in scrap imports.