Market Data

February 4, 2014

Flat Rolled Steel Demand is Key as We Move into 1st Quarter

Written by John Packard

Essentially all of the domestic steel mills have finished maintenance on their blast furnaces. U.S. Steel is bringing back online their Fairfield furnace, Berkeley has completed the expansion of its hot strip mill and other domestic steel mill maintenance projects from 4th Quarter 2013 have been completed. Supply is available and now it is time to see if demand will support supply.

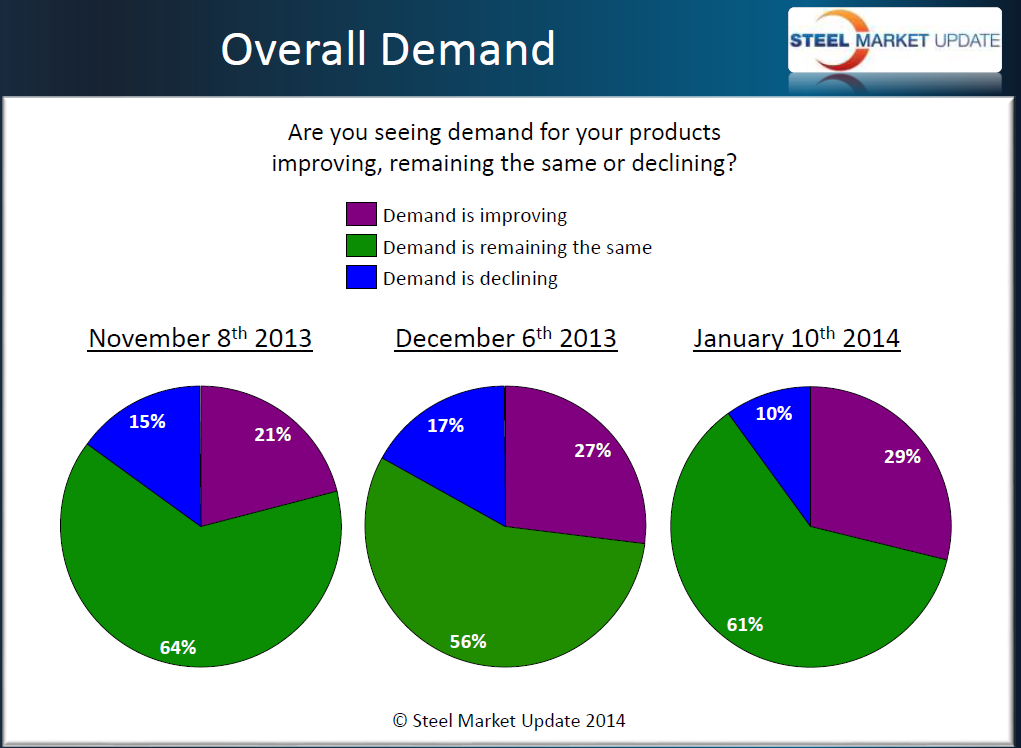

Steel Market Update has been canvassing the flat rolled steel markets to see if we can identify pockets of strength and weakness within the carbon sheet markets. We continued that process with our mid-January flat rolled steel market analysis. We began by asking our survey respondents to provide their thoughts regarding demand. As a group (all respondents combined) we found demand has been modestly improving over the past two months. As you can see by the graphic below, 29 percent reported demand as improving (up from 21 percent at the beginning of November) while those reporting demand as in decline dropped to 10 percent – 7 percent lower than the beginning of December and 5 percent better than early November.

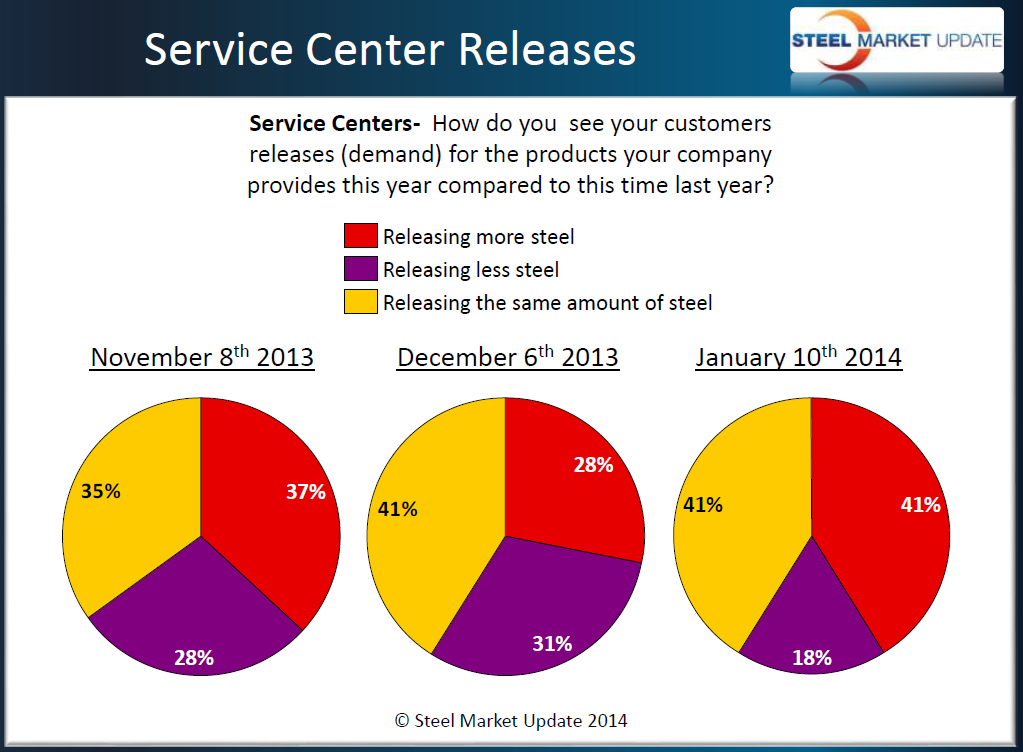

Steel Market Update (SMU) asked the service centers if their customers have increased steel releases compared to this time last year. We saw an uptick in distributors reporting their customers as releasing more steel–an increase to 41 percent of respondents this past week compared to 28 percent during the first week of December and 37 percent during the first week of November. Perhaps more telling is how many companies were reported as releasing less steel, a drop to 18 percent in January compared to 31 percent and 28 percent in the prior months.

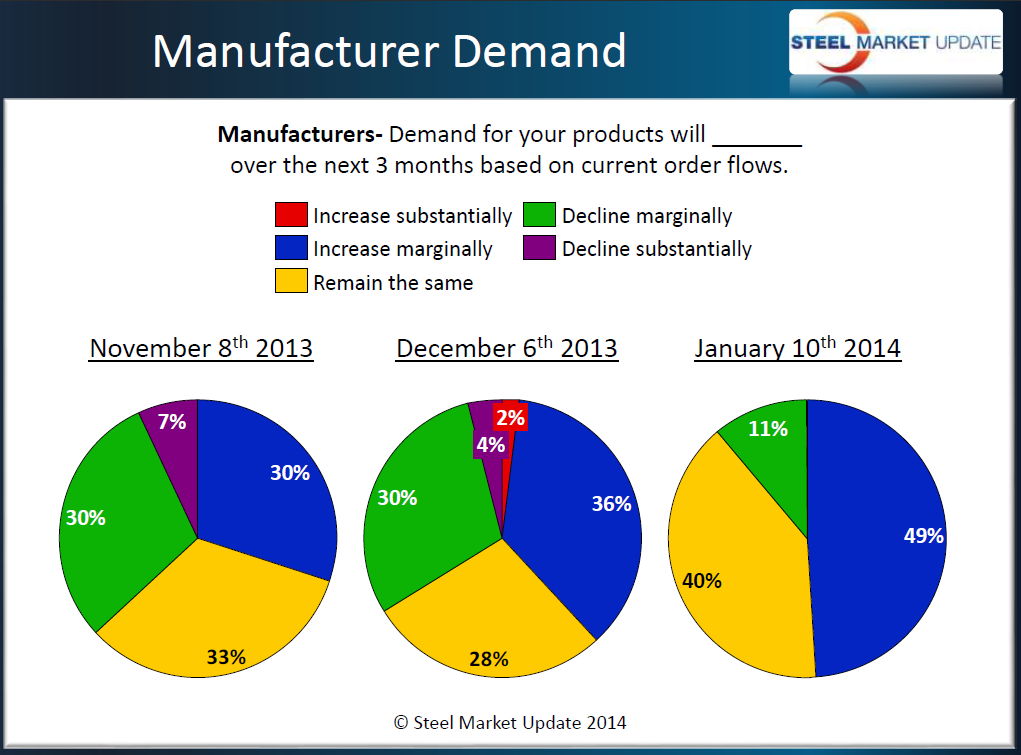

Manufacturing companies also reported a better demand scenario in last week’s survey than during previous months. The percentage of manufacturing respondents responding that demand for their products over the next 3 months would improve (based on current order flows) jumped during this past weeks survey. The percentage of manufacturing respondents reporting demand as increasing marginally moved from 30 percent in November to 36 percent in December and last week was measured at 49 percent. At the same time, those companies reporting demand as declining marginally dropped to 11 percent from the 30 percent response rate we saw during our early December and November analysis.

There were a number of comments left behind during this segment of our steel market questionnaire.

“We continue to see a lot of customers come back into the market that did not sign up for 2014 agreements or who have been waiting for prices to fall.” Midwest Service Center

“Based on holidays and weather things are fairly quiet but we do anticipate improved activity over the next week to ten days.” Midwest Service Center.

“Crystal ball is very cloudy, tough to get customers to move since most feel recent price increase will not be collected due to foreign steel pricing.” Midwest Service Center.