Market Data

February 16, 2014

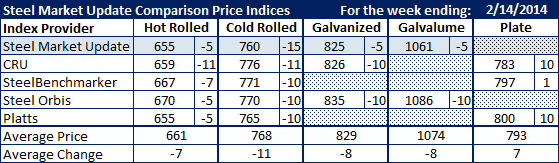

SMU Comparison Price Indices: Prices Dropping (except Plate)

Written by John Packard

The move by the domestic mills to reach $700+ per ton hot rolled is nothing but a blur in the rear view mirror according to the various steel indexes followed by Steel Market Update. Flat rolled steel prices fell across the board on hot rolled, cold rolled, galvanized and Galvalume steels this past week. The only product which bucked the trend was plate which rose by $10 per ton at Platts, SteelBenchmarker and CRU last week.

Steel Market Update (SMU) and Platts were at the low end of the range for benchmark hot rolled at $655 per ton. Both indices were down $5 per ton compared to the previous week.

Steel Market Update Price Momentum Indicator continues to point toward lower prices over the next 30 days. The question at this time is not if the mills can hit $700 per ton but can they hold $600?

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

SteelOrbis: Midwest Domestic Mill.

Platts: Northern Indiana Domestic Mill.