Prices

July 11, 2014

Koreans Hit With OCTG Dumping Margins

Written by John Packard

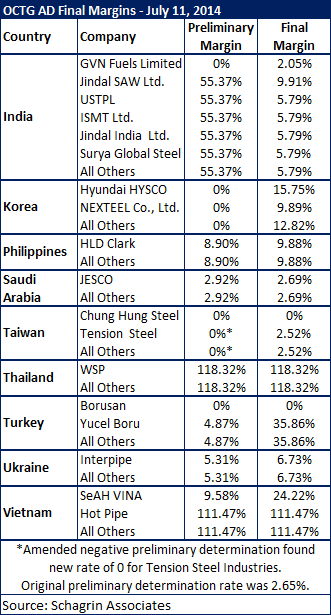

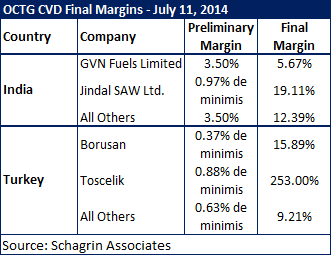

The International Trade Commission and Commerce Department issued the following determination on antidumping relief on OCTG imports from South Korean steelmakers:

“Today, the Department of Commerce announced its affirmative final determinations in the AD investigations of imports of OCTG from India, Korea, the Philippines, Saudi Arabia, Taiwan, Thailand, Turkey, Ukraine, and Vietnam, and CVD investigations of imports of OCTG from India and Turkey. The investigations cover certain OCTG, which are hollow steel products of circular cross-section, including well casing and tubing, of iron (other than cast iron) or steel (both carbon and alloy). The investigations also cover OCTG coupling stock and unfinished green tubes. OCTG are primarily used in oil and gas wells. Casing is a circular pipe that serves as the structural retainer for the walls of the well and is used in the drill hole to support the walls of the hole to prevent caving during drilling and after well completion. It also serves as a surface pipe designed to prevent contamination of the recoverable oil and gas. Tubing is typically a smaller-diameter pipe installed inside casing and is used to conduct the oil or gas from the subsurface strata to the surface.” The International Trade Administration full report can be found by clicking on this link.

Steelmakers, led by United States Steel Corp., filed a petition with the Department of Commerce in July 2013 seeking relief from dumping of OCTG products from nine countries that included South Korea, India, the Philippines, Saudi Arabia, Taiwan, Thailand, Turkey, Ukraine, and the Socialist Republic of Vietnam.

The ITC preliminary findings did not find evidence of dumping in the case of tubular products from South Korea which exports all of its OCTG products. Over 214,000 nets tons found its way to the U.S. in May alone—an increase of almost 78 percent from the monthly average of 27,000 net tons of OCTG from South Korea in 2012. The finding was a surprise to steel industry leaders and supporters who quickly undertook a campaign to urge the Department of Commerce to amend its final decision and include South Korea among the offenders.

We will have more on the ruling in Sunday night’s issue of Steel Market Update.