Prices

October 7, 2014

Final August Imports at 3.7 Million Tons

Written by Brett Linton

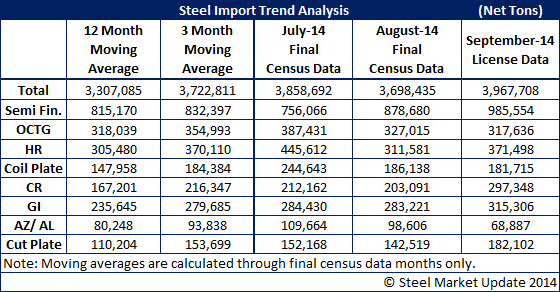

Final steel imports totaled 3,698,435 net tons (3,355,168 metric tons) for the month of August, down 4.2 percent from 3,858,692 tons in July but up 28.5 percent from 2,878,367 tons August of last year.

On a 12 month moving average (12MMA) basis, total steel imports through August are at the highest level recorded in our 7+ year history at 3,307,085 tons. The three month moving average (3MMA) of total imports through August is 3,722,811 tons, just shy of the July 2014 high of 3,834,450 tons.

Semi-finished imports were 878,680 tons in August, up 16.2 percent over July and up 33.6 percent over August 2013.

Imports of oil country tubular goods (OCTG) were 327,015 tons in August, down 15.6 percent over the month prior and down 9.6 percent over one year prior.

Hot rolled imports were 311,581 tons, down 30.1 percent over July but an increase of 5.9 percent compared to levels one year ago.

Plate in coil imports were 186,138 tons, down 23.9 percent from one month prior but up 92.6 percent from August 2013.

August imports of cold rolled products were 203,091 tons, down 4.3 percent over the previous month but up 70.1 percent over 2013 levels.

Galvanized imports were 283,221 tons, down 0.4 percent over July but up 44.8 over August 2013 figures.

Imports of other metallic coated products were 98,606 tons, down 10.1 percent over the previous month but up 37.6 percent over the previous year.

Plate cut length imports were 142,519 tons, down 6.3 percent over July but up 169.8 percent over one year ago.

In the next few days we will have imports by product, port and country available for our Premium Level members on the website.

Below is an interactive graphic of our steel imports history; note that our interactive graphics can only be seen when you are logged into the website and reading the newsletter online. If you need help logging in to the website or navigating it, feel free to contact us at info@SteelMarketUpdate.com or 800-432-3475.

{amchart id=”105″ Steel Imports- All Products, Final Data by Month}