Prices

October 14, 2014

First Look at October 2014 Import Trend

Written by Brett Linton

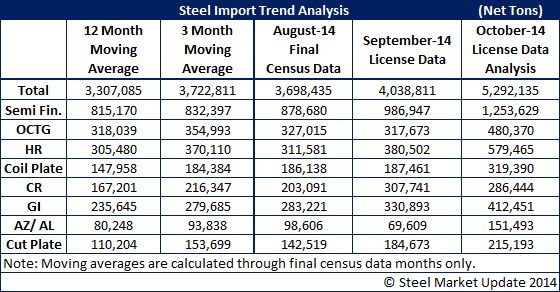

Steel Market Update (SMU) is changing the way we look at the import license data. As we have mentioned on numerous occasions, the steel import license data can only provide an idea as to how imports are shaping up for the current month. The licenses received have been tending to surge at the beginning of the month and then tailing off as the month progresses. So, we thought it might be better to look at steel import license data at this point in time against prior months to see if there is any significant change in the numbers.

The reason why is the preliminary data collected through the 14th of October is suggesting that we will have another blockbuster month and it may be a little early to make that prediction. If import licenses continued at the pace seen during the first 14 days of the month… well, we would exceed the 4.0 million net tons from September and beat out the high point for the year which was set in May. We don’t think we will see imports anywhere near the 5.2 million net tons suggested in our simple mathematical calculation (see table). However, we could very well see another month similar to September or about 4.0 million net tons.

At this same point of the month both August 2014 and September 2014 were mathematically suggesting imports of 4.8 million net tons. August ended up at 3.7 million net tons and August 4.0 million net tons.

In both cases part of the reason for the high early number was much of the semi-finished licenses came in early. By the time the month ended instead of 1.3 or 1.2 million net tons of semi’s the actual numbers were closer to 825,000 to 980,000 net tons.

We think the hot rolled number in the table is also being over-stated by approximately 200,000 net tons.

The one item which is interesting is Oil Country Tubular Goods (OCTG) as South Korea already has already equaled their license requests of September (and August). South Korea has requested 116,345 net tons of OCTG licenses. If they don’t request any more then they will be in line with the previous two months (dumping duties or no dumping duties).

Based on what we are seeing in the license data to date is suggesting October will be another large month – higher than the 12 month moving average and the 3 month moving average.