Market Data

April 9, 2015

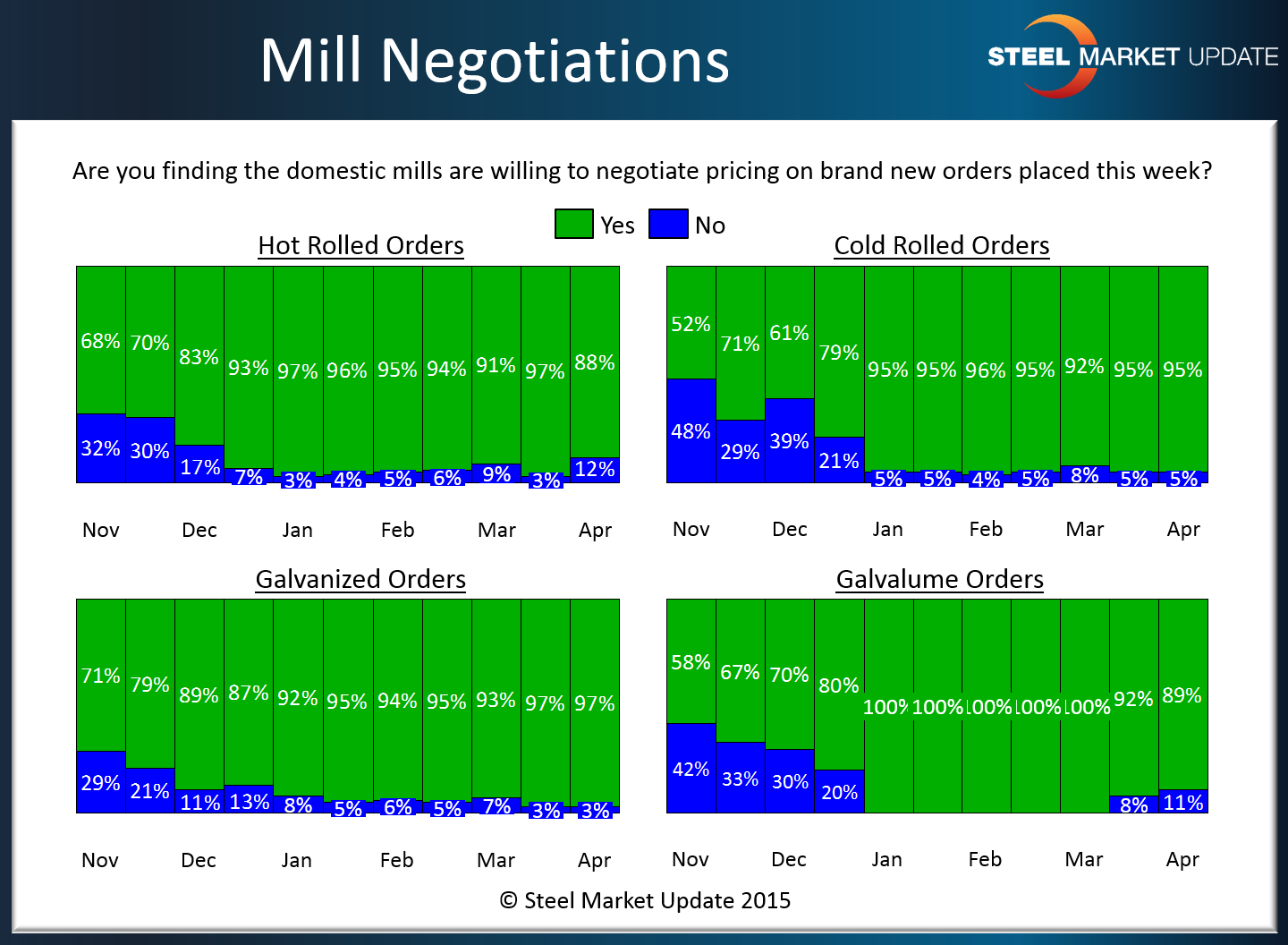

Steel Mills Still Willing to Negotiate Flat Rolled Steel Prices

Written by John Packard

According to our survey respondents not much has changed when it comes to how willing steel mills are to negotiate hot rolled, cold rolled, galvanized and Galvalume steel pricing.

Lead times continue to remain short and order books weak. This has created a situation whereby steel mills have to be competitively priced in order to book new spot orders. Especially when considering the $140 per ton drop in pricing (HRC) since the end of December 2014 to this week.

A coating mill provided some comments to Steel Market Update separate from our survey but they are germane to the subject of mill negotiations. We were told, ““Demand is a bit soft but more inquiries are in process now than in recent months. Everyone is digging for the best price. My take is that there is biz to be had for Q3, but that the range between lowest and highest base is narrowing. Not so much erosion on the low end of the base, but some on high end of the range as customers seem to be ready to actually place orders soon and they won’t unless they get a deal.”

As you can see by the graphic below all of the flat rolled products are “in play” and negotiable.

To view the interactive history of the graphic above, visit the Steel Mill Negotiations page on the Steel Market Update website here.