Analysis

June 2, 2015

US Auto Sales Blast Estimates

Written by Sandy Williams

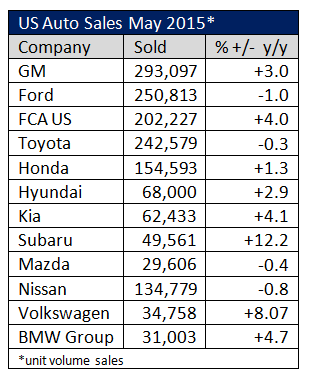

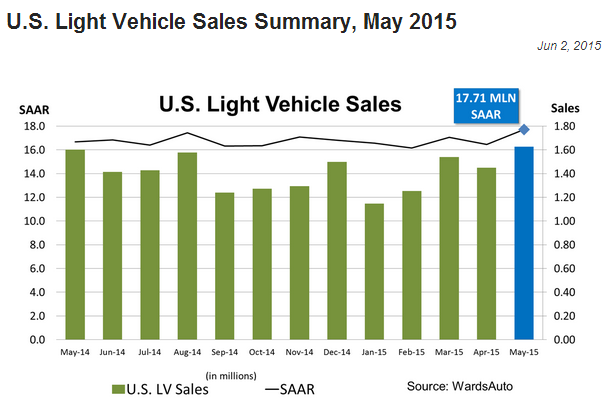

May U.S. automotive sales exceeded expectations with a seasonally adjusted annual rate of 17.71 million vehicles, according to the final tally by WardsAuto. Predictions ranged from Bloomberg’s consensus of 17.0 million to GM’s prediction of 17.5 million. May sales were at the highest single-month level since July 2005. The final tally for April was 16.5 million.

Most US automakers exceeded April sales and those who did not were very close. Ford sales slipped 1 percent in May partly due to low inventory levels.

“Right now we’re going through our lowest inventory period as we had planned, for F-150, as we bring our Kansas City assembly plant up to full line speed,” said Ford Sales Analyst, Erich Merkle.

Ford announced it will shorten its summer shutdown from the traditional two-weeks to one week to meet customer demand. Six of its assembly plants and ten supporting powertrain and stamping plants will be affected. The extra capacity will add 40,000 units to the inventory supply.