Prices

July 7, 2015

SMU Price Ranges & Indices: Still Struggling (is that about to change?)

Written by John Packard

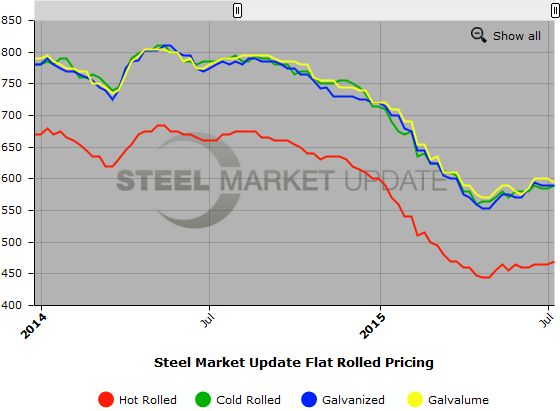

Flat rolled steel prices have been struggling to keep momentum and move higher. We have not yet seen full compliance with the second price increase and now we have a new round of price increases beginning with the $40 per ton announced by US Steel this morning. We did see some minor changes to hot rolled and cold rolled which both moved higher while galvanized was unchanged. Galvalume prices dropped by $5 per ton.

We expect things to change in the coming days. We spoke with one commercial manager for a steel mill this afternoon who advised SMU, “At 9 AM I would have said the same [steel prices compared to last week]. But at 10 AM that changed [USS announcement]…” He went on to say, “We are evaluating our position after this morning’s price increase announcements.” We are quite sure that other mill managers are doing the same this afternoon.

SMU asked the General Manager of a large service center group to give us his thoughts on whether the new price increase has a chance of sticking. We were told, “It seems to me that the market has absorbed only the first increase of $20-25/ton above the recent ave. monthly lows, for all 3 products. The general question in my mind is not whether a specific increase can take hold or not (the 2nd one clearly has not), rather are the dynamics on the ground pointing toward higher prices. The market is very split north vs. south at the moment. Northern mills are enjoying longer lead-times fueled by strong Auto which includes make-ahead tons (admitted by mills), while southern mills have normal to short lead-times. Between the 2 regions, we have a fairly “balanced” market.”

We were told by a number of buyers that there are conversations with the steel mills about a new round of trade announcements (probably cold rolled) coming soon which will help the mills achieve the new pricing.

At the same time we spoke with those in the futures markets and financial analysts who question how the U.S. can move pricing against the rest of the world as prices move lower in Asia and commodity prices drop by double digits over the past week.

Here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $450-$490 per ton ($22.50/cwt- $24.50/cwt) with an average of $470 per ton ($23.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged over last week while the upper end increased $10 per ton. Our overall average is up $5 per ton compared to one week ago. SMU price momentum for hot rolled steel is for prices to move higher over the next 30 to 60 days.

Hot Rolled Lead Times: 2-5 weeks.

Cold Rolled Coil: SMU Range is $580-$600 per ton ($29.00/cwt- $30.00/cwt) with an average of $590 per ton ($29.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to one week ago while the upper end remained unchanged. Our overall average is up $5 per ton compared to last week. We continue to believe that price momentum on cold rolled steel is for prices to move higher over the next 30 to 60 days.

Cold Rolled Lead Times: 4-7 weeks.

Galvanized Coil: SMU Base Price Range is $28.50/cwt-$30.50/cwt ($570-$610 per ton) with an average of $29.50/cwt ($590 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range were unchanged compared to last week. Our average is the same compared to one week ago. We continue to believe that price momentum on galvanized steel is for prices to move higher over the next 30 to 60 days.

Galvanized .060” G90 Benchmark: SMU Range is $639-$679 per net ton with an average of $659 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-8 weeks.

Galvalume Coil: SMU Base Price Range is $28.50/cwt-$31.00/cwt ($570-$620 per ton) with an average of $29.75/cwt ($595 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to one week ago while the upper end remained unchanged. Our overall average is down $5 per ton compared to last week. Our belief is momentum on Galvalume will be for higher prices over the next 30 to 60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $861-$911 per net ton with an average of $886 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-8 weeks.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.