Market Data

October 8, 2015

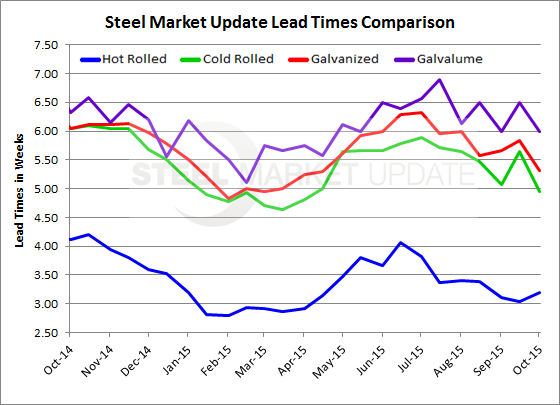

Steel Mill Lead Times: Still One Week Shorter than Year Ago Levels

Written by John Packard

Flat rolled steel mill lead times remain historically short as the domestic mills struggle to keep their mills full. Based on the results from this week’s flat rolled steel market analysis (survey) we are seeing lead times at least one week shorter than this time last year on all products with the exception of Galvalume.

Hot rolled lead times remained about the same as what has been reported over the last couple of months. The average lead time based on our respondents was 3.19 weeks compared to 3.04 weeks (statistically insignificant) two weeks ago and 3.11 weeks at the beginning of September.

Cold rolled lead times dropped by about a half a week from 5.65 weeks two weeks ago down to 4.95 weeks this week. One year ago CR lead times were 6.04 weeks.

Galvanized lead times dropped from 5.83 weeks two weeks ago to 5.32 weeks this week. One year ago GI lead times were averaging 6.05 weeks according to those responding to our survey.

Galvalume lead times dropped one half week compared to two weeks ago but are only a third of a week less than one year ago.

Here is what lead times have averaged over the past year based on the results of SMU flat rolled steel market survey.

To see an interactive history of our Steel Mill Lead Time data, visit our website here.