Market Data

January 3, 2016

It’s a New Day

Written by John Packard

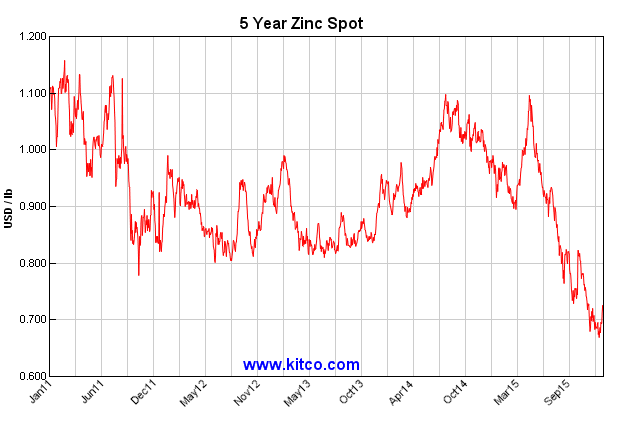

The flat rolled steel price roller coaster did not do the steel mills or companies holding inventory any favors this past year. We saw hot rolled prices drop from just below $650 per net ton (average) at the beginning of the year to the low point of $360 per ton achieved the week of December 8th. Hot rolled prices dropped $290 per ton ($14.50/cwt) from the beginning of the year.

When looking at it from the beginning or peak of the cycle, which SMU has at $685 per ton as May 13, 2014, hot rolled prices dropped $325 per ton.

As you review the graphic below the one thing that should hit you is the steepness and relentless drop in prices since May 2014. We had two minor “dead cat bounces” between May 2014 and December 8, 2015 but otherwise the direction was down.

Commodities had a tough time getting through the year as the strength of the U.S. dollar, weakening demand in China and price pressures on steel prices throughout the world (partially caused by China, essentially, doubling their exports of steel to the rest of the world).

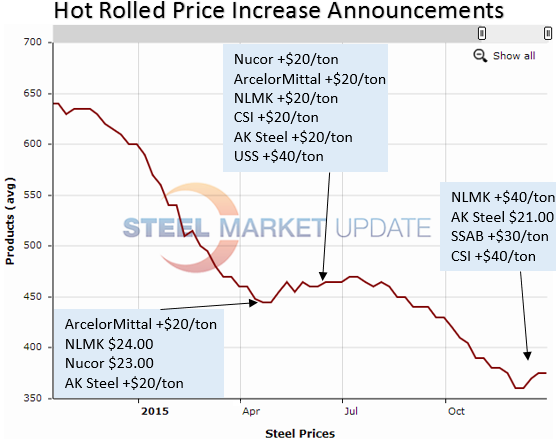

Iron ore prices have been on a three year decline and are a long way from the $158.5/dmt reported by The Steel Index (TSI) for 62% Fe fines on January 7, 2013. Iron ore, much like steel, achieved its lowest point on December 10, 2015 when TSI reported 62% Fe fines at $37.5/dmt Tianjin Port, China. Notice that iron ore went through a little “dead cat bounce” of its own about the same time as prices bounced here in the United States. Like the U.S., ore prices are now beginning to rise in China.

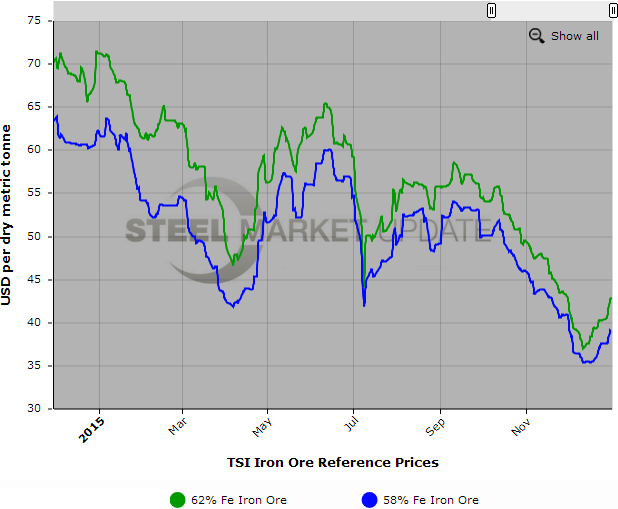

Another commodity SMU wanted to put in front of our readers is the price of zinc which has plummeted from a high of just below $1.10 per pound in the spring of 2015 hitting $0.6684 per pound just before Christmas (December 17th). The metal has since bounced to just over $0.71 per pound but is well below the $1.10 number from earlier in 2015.

The year 2015 is now behind us.

Most will say “good riddance” to the year 2015 and are welcoming 2016 with open arms. We anticipate the year to begin much like the previous year ended – demand a little weak through the first quarter 2016 before we start to see construction making its mark on the economy. We expect 2016 to be better than 2015 but not by leaps and bounds.

We expect foreign pricing stress to continue as world prices will be slow to rebound with Chinese mills continuing to over-produce and to export their problems to the rest of the world. However, China will have a smaller and smaller world to dump their over-production as countries put barriers up against the Chinese material.

For 2016 to go from being “OK” and a little better than 2015 we would need to see a rebound in the oil and gas markets. Most analysts are forecasting oil prices to only rise modestly from today’s levels. Alan Beaulieu of the Institute for Trend Research is on the optimistic side as he is forecasting oil to rebound to $50-$55 per barrel by the end of 2016.

Oil is, of course, a political commodity and something happening in the Mideast that disrupts the flow of oil would impact the world’s prices and maybe light an early fire here in the United States as well as Canada. It can also go the other way as Iran is expected to be a player in the world oil markets this year.

Other items we are watching carefully as we enter the New Year:

Lead times – we have seen a bump in all but hot rolled lead times based on the documents being sent to the market by the domestic mills last week. If the lead times remain extended, we should see a bit of a bump in the order books as service centers (and end users) increase their purchasing to reflect the longer lead times and what they are trying to accomplish for inventory turns.

Steel Prices – our Price Momentum Indicator is currently set a “Higher” as we anticipate prices to continue to move higher from here. How much more will depend on demand, supply and what kind of offers are going to be made by the foreign steel suppliers. If there is little price movement on the foreign side, this will cap how far the domestic mills will be able to take prices.

Trade Suits – 2016 will be the year when we get final resolution to all of the flat rolled trade suits. The mills want China out of the U.S. market and it appears they will get that wish. However, the rest of the world may end up smelling sweet when all is said and done.

Supply – will the steel mills remove enough supply from the market to tighten up lead times (and pricing)?

Demand – 1st Quarter 2016 demand is expected to be weak before bouncing back later in the New Year.

Inventories – will service centers finally balance what have been bloated inventory levels?

Labor Negotiations – will ArcelorMittal and ATI accept the contract negotiated by US Steel with the USW (and will the USW members ratify the USS agreement)?

Foreign Steel Imports – will imports drop to a more historic 22-24 percent of the Apparent Steel Supply versus the high 20’s to low 30 percent range seen this past year?

Pricing Power – who will have pricing power by this time next year?