Market Data

January 7, 2016

Steel Mill Lead Times Move Out and Negotiations More Difficult (for buyers)

Written by John Packard

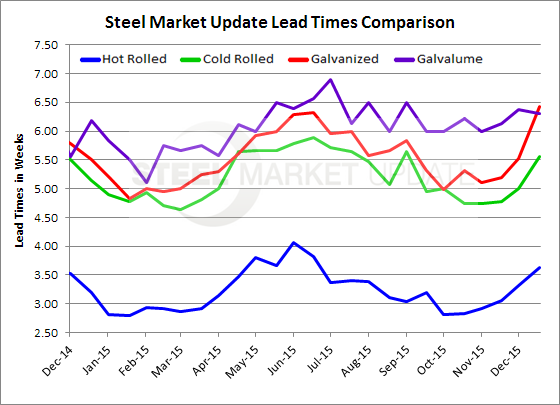

We discussed mill lead times a little earlier this week based on the first two days of data received by our flat rolled steel market analysis (survey). We also reported on what we were seeing from the mills themselves last week when we went through and analyzed a number of the lead times being published by the mills or given to their customers verbally. The net result is we are seeing lead times beginning to extend. As lead times move out, the ability of the mills to temper their need to negotiate prices increases.

As you can see from the graphic above, lead times have been “moving up” or beginning to extend meaning that as orders are placed today with the domestic mill suppliers the amount of time it takes to produce and ship those orders has increased from the amount of time it took just a few weeks ago. The one product that has not moved out as quickly or dramatically has been Galvalume although we have heard from a couple of AZ producing mills that they are pleased with where their order books are right now and do not need to discount their book in order to collect orders.

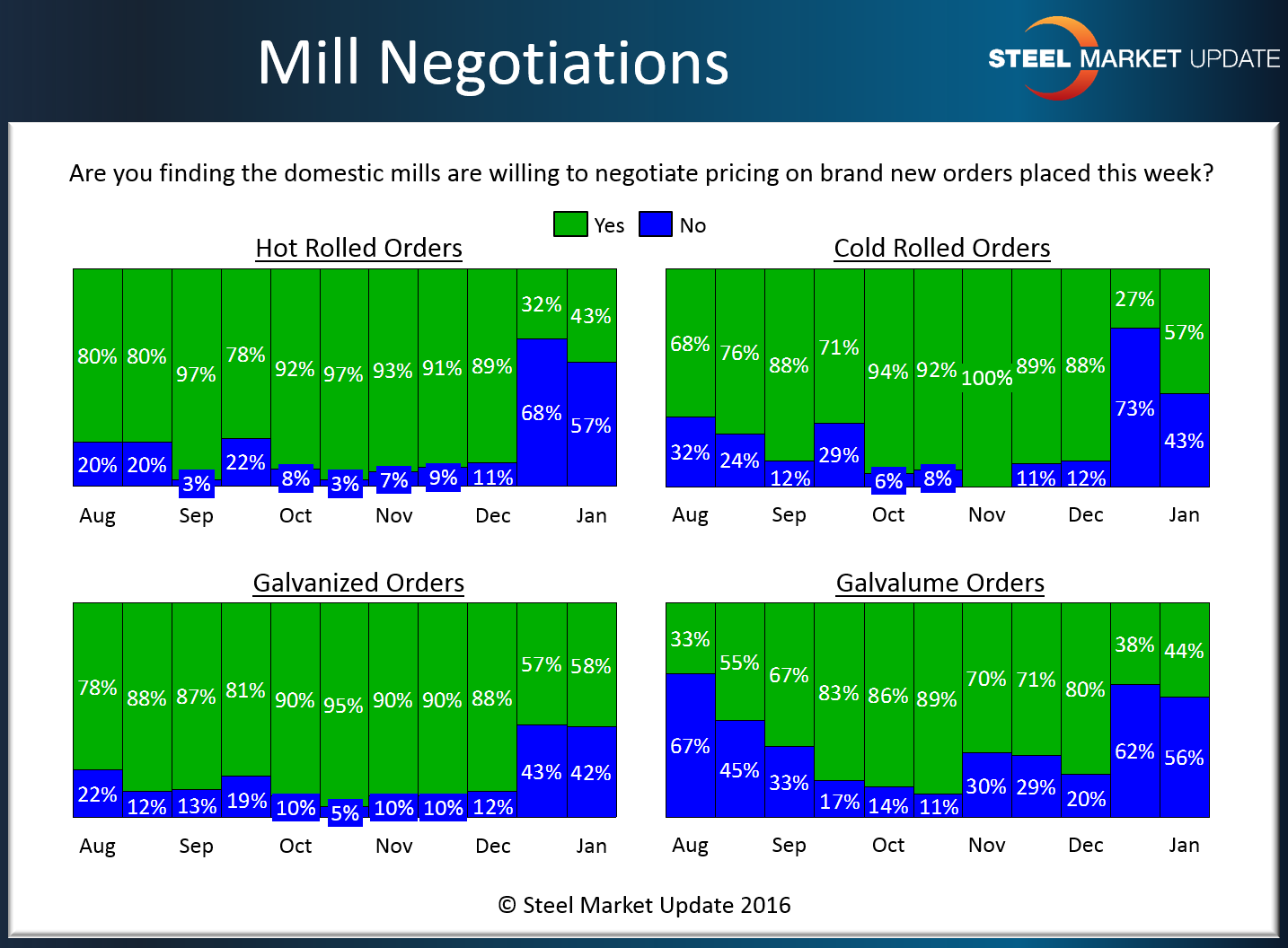

As we mentioned, as lead times begin to move out the percentage of buyers who are reporting the domestic mills as willing to negotiate pricing has been shrinking. The graphic below puts this into historical perspective and you can clearly see the change which began in mid-December and continues in early January.

It will be interesting to watch both lead times and negotiations over the next few weeks to see if we are witnessing another “dead cat bounce” or if the books are indeed strong enough to sustain pricing.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.

To see an interactive history of our Steel Mill Lead Time data, visit our website here.