Logistics

February 14, 2016

Logistics Report for Mid-February 2016

Written by Sandy Williams

Seaborne shipping market rates continue to plummet with the Baltic Dry Index reaching another new low this past week. The Index stood at 290 on Wednesday, Feb. 10; a year ago on that date the BDI stood at 556. To get a better perspective on how bad things are, the highest level ever reached was a temporary peak of 11,793 on May 20, 2008.

MID-SHIP reports revenue for ship owners has dried up, asset value crashed and the risk of counterparty default looms on a daily basis.

“A major Asian based ship operator was reported to have approached their head owners for reductions in charter hire of as much as fifty percent on some one hundred vessels,” writes MID-SHIP in their Feb. 11 newsletter. “Their explanation for this request was in the current environment their customers had in turn required rate reductions.”

Scrapping of older vessels continues and layups have port berth availability disappearing. Demand is heavily reliant on China and India, says MID-SHIP, and is expected to remain subdued in 2016. The question MID-SHIP asks is whether scrapping of vessels and bankruptcies will be enough to reduce oversupply and balance the market when conditions improve.

River Shipments

High water and ice are slowing river navigation in parts of the U.S. waterways. The barge freight market is relatively flat right now due to seasonality. Slowing import of steel and export of coal has contributed to reduced barge traffic.

Trucking

Trucking capacity is abundant and low diesel fuel rates have driven freight rates downward, a plus or minus depending on what side of the logistics chain you are on. Diesel fuel dropped 2.3 cent per gallon last week to $2.008, the lowest rate in seven years. MID-SHIP expects fuel surcharges to be in the range of 23-25 cents per one way mile.

DAT Solutions reported improved demand for flatbed trucks in the week of Jan. 31 – Feb. 6. Rates for flatbed trucks held steady at an average of $1.85 per mile. The national load-to-truck ratio increased 6 percent to 8.7 loads per truck.

Rail

The Association of American Railroads reported weekly freight traffic was down 1.4 percent in the week ending Feb. 6, 2016 compared to the same week in 2015. Carloads totaled 241,680, down 11.17 percent year-over year, while intermodal volume increased 10.5 percent to 262,830 containers and trailers. So far in the first five weeks of 2016, rail volume Is down 15.7 percent from the same period in 2014.

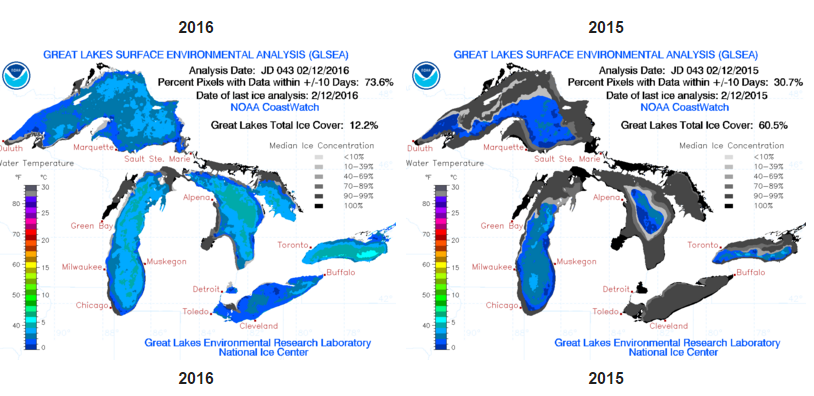

Great Lakes

The shipping season is at a lull right now on the Great Lakes and will resume with the re-opening of the Soo Locks on March 25, 2016. Ice coverage is well below that of 2015 at 12.2 percent compared to 60.4 percent on Feb 12, 2014. The milder than usual winter, barring a persistent and severe cold snap, may mean no delay to the start of the shipping season this year.

The Lake Carriers’ Association reports iron ore trade on the Lakes and Seaway was down 8.5 percent in 2015 to 54.4 million tons. Compared to the five year average, shipments were down 7.8 percent.

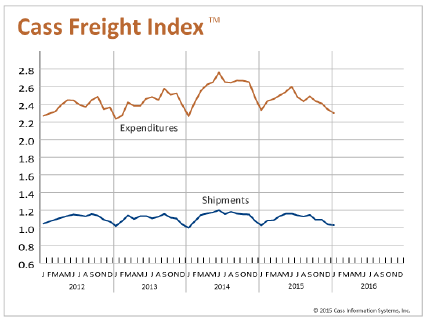

Cass Freight Index

Overall freight volumes fell in January according to the Cass Freight Index but within normal parameters.

Writes Cass: “The number of freight shipments and the dollars spent on freight have been in a typical seasonal decline since September 2015. Our shipment index opened the year just 0.2 percent below last January, while the expenditures index is down 1.4 percent. The economy grew much more slowly in the second half of 2015, so January freight shipments are down 11.6 percent and dollars spent are down 11.5 percent from the June 2015 high. The declines in the fourth quarter and again in January are normal seasonal trends and are not necessarily signs of further weakening.”