Market Data

March 1, 2016

Manufacturing Continues to Contract While Economy Grows

Written by Sandy Williams

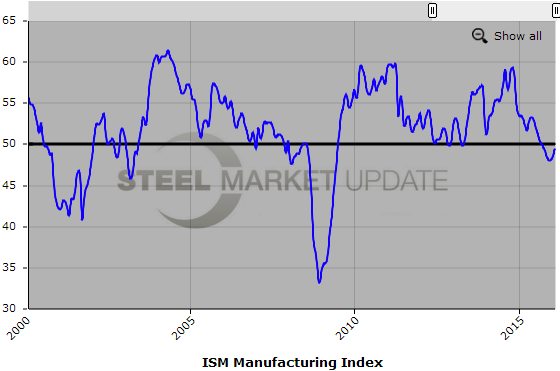

The U.S. manufacturing sector in February remained in contraction for the fifth consecutive month according to the latest Manufacturing ISM Report on Business. The PMI did better than expected by economists at Bank of America Merrill Lynch and Barclays who predicted a headline index of 48 and 47.5, respectively.

The February PMI increased 1.3 percentage points to 49.5 from 48.2 in January. A PMI above 43.2 percent, over a period of time, generally indicates an expansion of the overall economy. Therefore, the February PMI indicates growth for the 81st consecutive month in the overall economy, while still indicating contraction (below 50) for the manufacturing sector.

The new orders index was unchanged from January at 51.5. Demand appeared stronger in February’s survey; 12 of 18 industries reported an increase in new orders, while four reported a decrease. Primary metals, transportation equipment, and fabricated metal products were among the 12 industries reporting growth.

Production increased 2.6 points to 52.8 for a second consecutive month of growth. Supplier deliveries were faster in February, including those for primary metals. Backlog of orders contacted for the ninth month.

Inventories of raw materials contracted for the eight month as indicated by an increase of 1.5 points during February. Customer inventories were considered too low in February following six months of “too high” inventories. The index for customer’s inventories registered 47, a decrease of 4.6 points from January.

The price index increased 5 points to 38.5 in February, indicating a decrease in raw materials pricing for the 16 consecutive month, reports ISM.

The new import orders index dropped two points to register 49 in February after growing to 51 in January. New export orders also contracted, inching down 0.5 points to 46.5 percent in February. Primary Metals, Machinery, and Fabricated Metals were among the five industries reporting growth in new export orders.

The employment index increased 2.6 points to 48.5 percent, contracting for the third consecutive month but at a slower rate than January.

Respondents had the following comments:

– “Low oil prices and reduced activity continue affecting our business.” (Petroleum & Coal Products)

– “Business has to get better. And it appears it is. Healthy backlog for 2016.” (Fabricated Metal Products)

– “Very strong demand for product. Material availability very good and commodity pricing continues to be depressed.” (Machinery)

– “Airlines are still ordering planes and spare parts for plane galleys.” (Transportation Equipment)

– “Not seeing impact from global economic volatility or oil prices. Business is strong and growth projections remain the same.” (Miscellaneous Manufacturing)