Market Data

March 3, 2016

SMU Steel Buyers Sentiment Index Posts Strong Gains

Written by John Packard

Earlier this week Steel Market Update (SMU) began canvassing the flat rolled steel markets in order to better appreciate how buyers and sellers of steel are viewing their company’s ability to be successful in the market today (Current) as well as out three to six months (Future). Their responses result in the publication of the SMU Steel Buyers Sentiment Index.

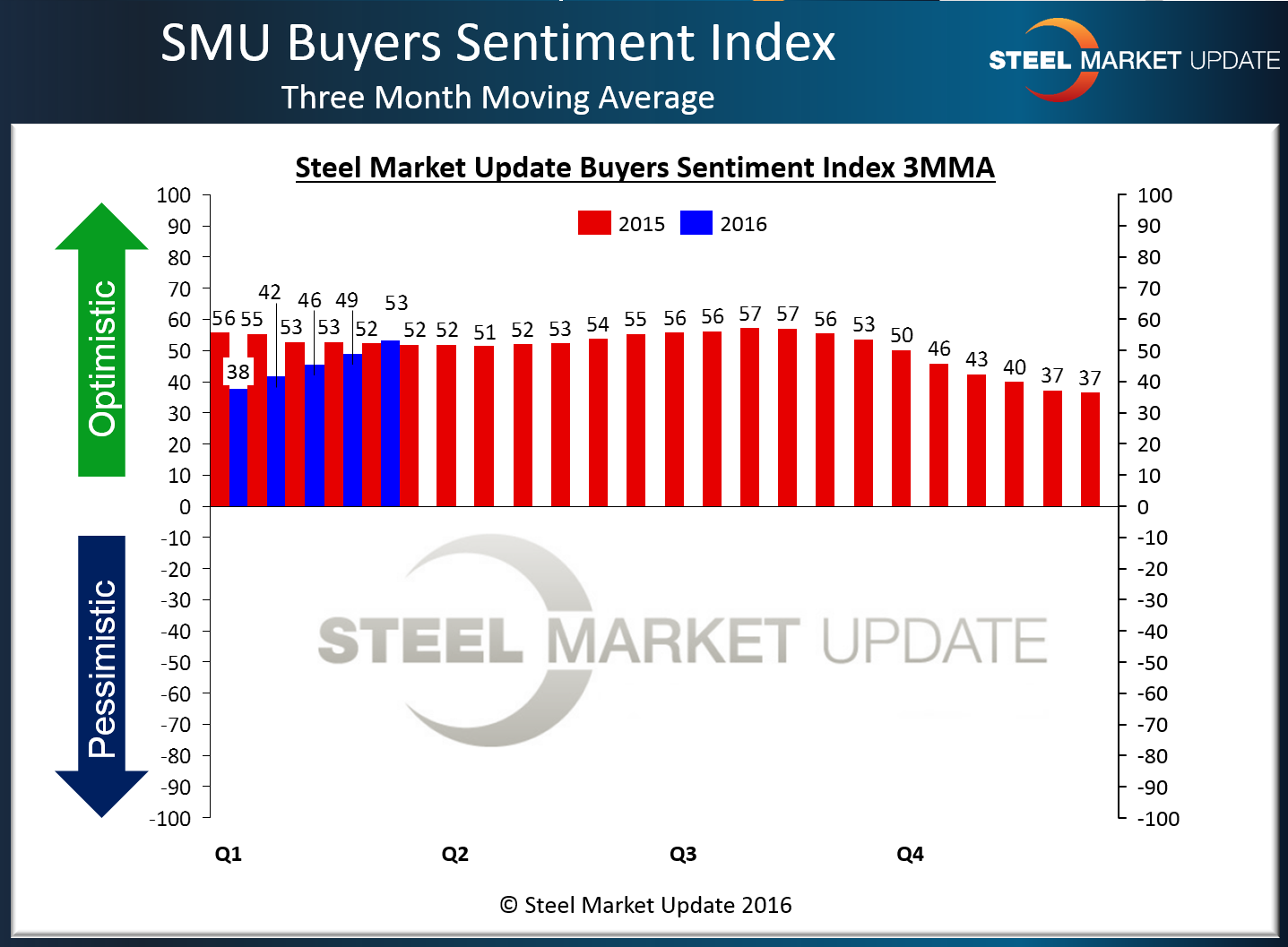

This week we saw our Current Sentiment Index improve by +1 over the middle of February and is +15 points higher (more optimistic) than what we recorded during the first week of January of this year. We also looked at our Current Sentiment Index from a three month moving average (3MMA) viewpoint as the 3MMA smoothes out any bumps in the data. Our 3MMA on Current Sentiment rose +4.17 points and is now at +53.17. An explanation of the index “points” system is at the end of this article.

Future Steel Buyers Sentiment Index

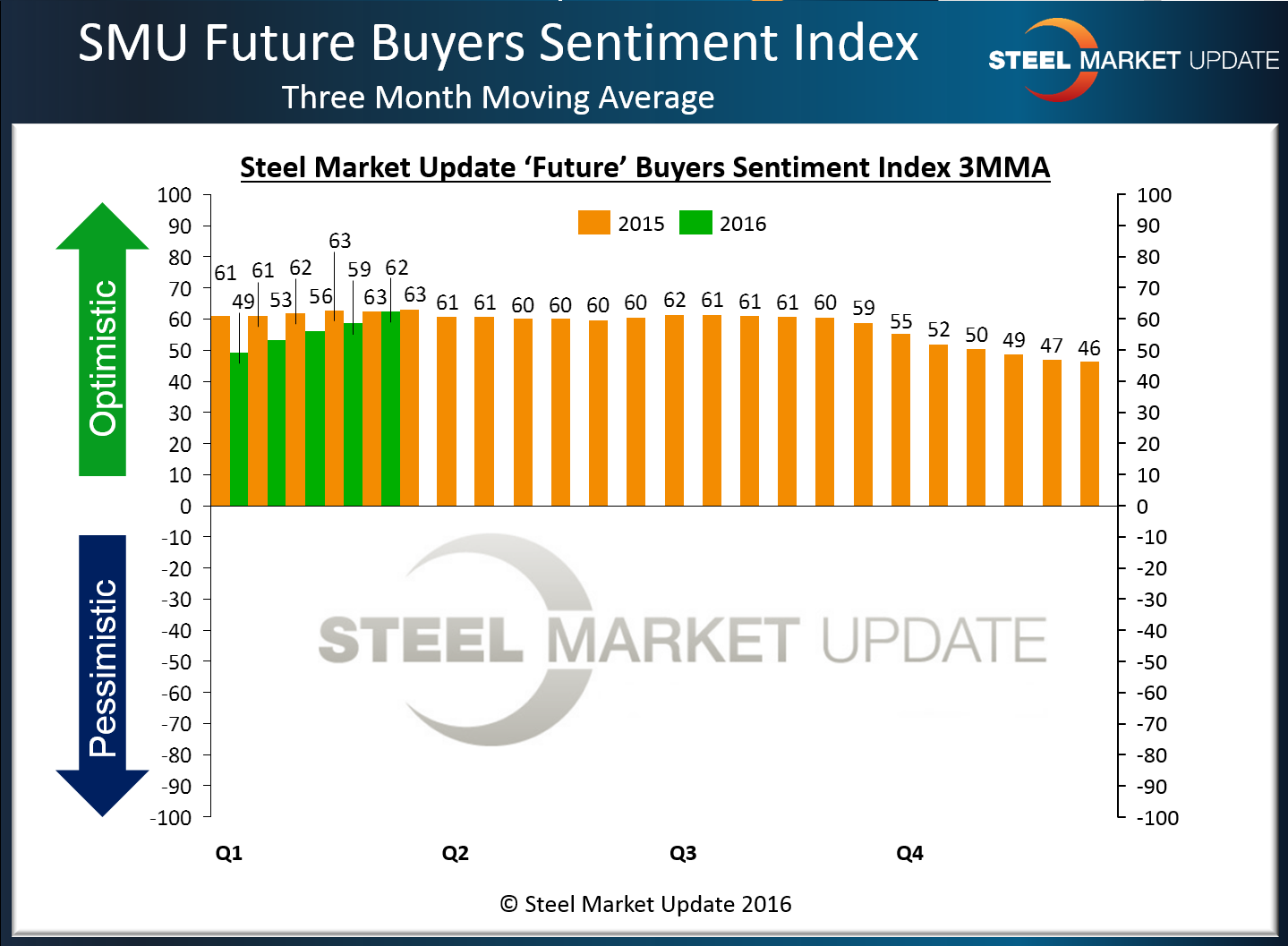

SMU Future Steel Buyers Sentiment rose by +7 points compared to two weeks ago and is +7 points more optimistic than what we reported during the first week of January of this year. Looking at Future Sentiment from a three month moving average viewpoint we saw the average improve +3.66 points to +62.33. One year ago our Future Sentiment Index 3MMA was +62.50 and peaked at +63 two weeks later.

It is Steel Market Update’s opinion that buyers and sellers of steel continue to report confidence in the steel industry and their companies’ ability to be successful both now and out into the future. We believe the higher prices supported by lower inventories (watch for our Service Center Apparent Excess Deficit report later this month), extended lead times on cold rolled and coated and shrinking imports are all net positives. Furthermore, our surveys have been showing a positive trend in demand for flat rolled steel products used by those participating in our market analysis.

What Our Respondents Are Saying

“We had a record February for our Steel Sales portion of our business.” Manufacturing company

“It is normal for demand for our products to increase as we move into spring.” Manufacturing company

“Winter is nearly behind us and key market indicators are improving expect upturn.” Manufacturing company

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 100-170 companies. Of those responding to this week’s survey, 46 percent were manufacturing and 40 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.