Prices

March 6, 2016

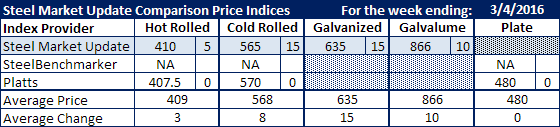

Comparison Price Indices: SMU Adjusts Prices Higher

Written by John Packard

One of the first things that happen as flat rolled steel prices begin to firm the lower end of the range of pricing available begins to move higher. This is what happened to our numbers this past week. In many cases the lower end of the range moved up while the upper end of the range may have remained the same. The net result is an increase in the price average. Over the next couple of weeks we will watch to see if the upper end of the range moves higher from here in reaction to the mill price increases announced last week.

Hot rolled prices barely moved this past week with SMU going up to $410 per ton while Platts kept their HRC price the same at $407.50 per ton. SteelBenchmarker did not report prices this past week as they only report twice per month.

SMU took our cold rolled average up $15 per ton to $565 per ton. Platts remained the same as the previous week at $570 per ton.

We also took our galvanized .060” G90 benchmark price up $15 per ton and our Galvalume .0142” AZ50, Grade 80 benchmark up $10 to $866 per ton.

Platts kept their plate prices steady at $480 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.