Market Data

May 5, 2016

SMU Steel Buyers Sentiment Index: Cooling Off or Still Hot, Hot, Hot?

Written by John Packard

SMU canvasses buyers and sellers of steel to see how they feel about their company’s ability to be successful in both the existing (Current) market conditions as well as what they perceive those conditions will be three to six months into the future (Future). All of our participants are involved in the flat rolled steel market and the measurement takes place during our twice monthly flat rolled steel market trends analysis survey.

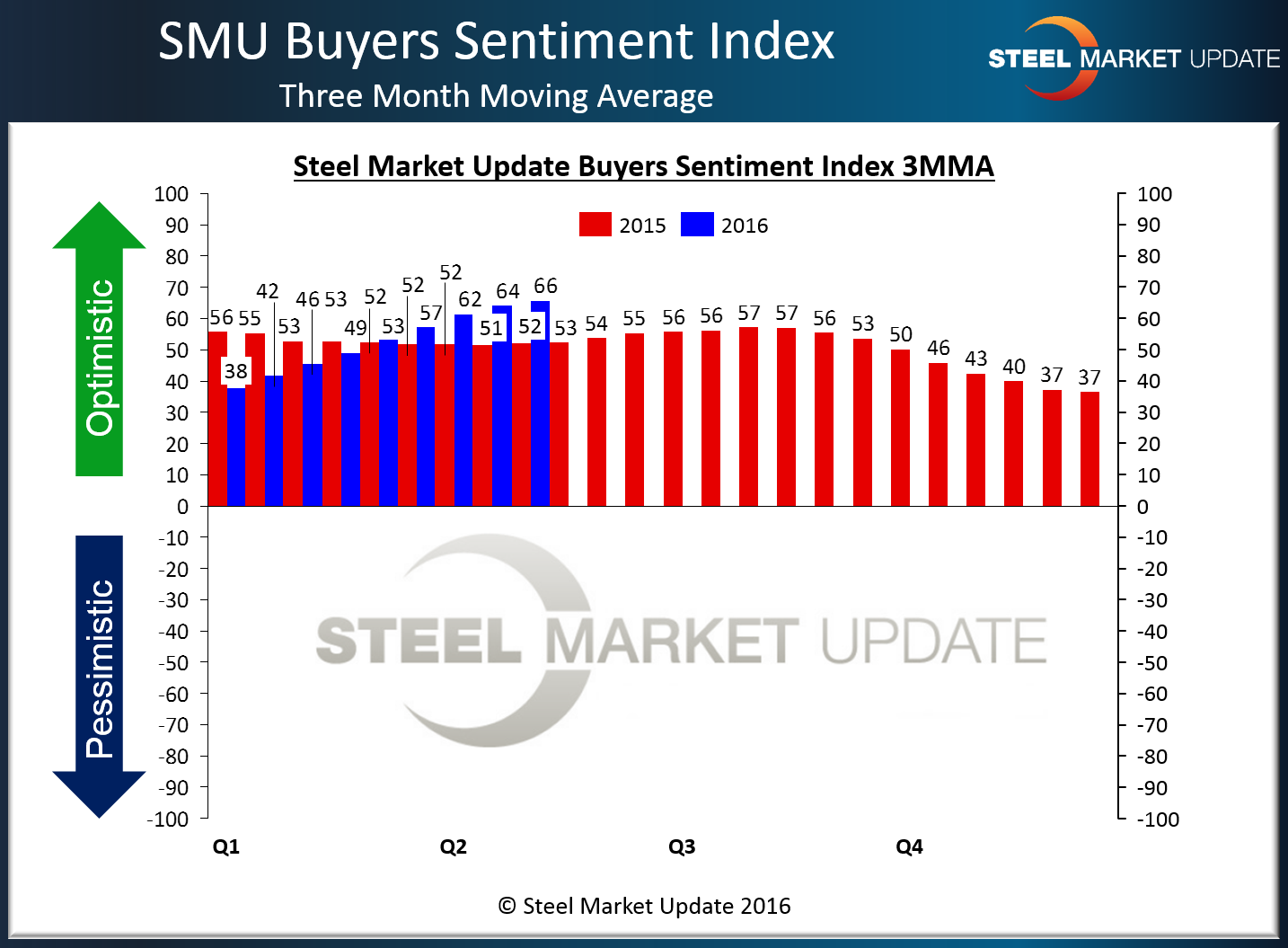

Buyers and sellers of steel continue to be quite optimistic as our Current Sentiment Index came in at +68. This is down 3 points from our mid-April analysis which at +71 was the most optimistic reading we have seen since we began measuring Sentiment in 2008.

We try to take single data points out of the equation and prefer to reference our three month moving average (3MMA) as providing the most accurate trend analysis. Our Current Sentiment 3MMA is now +65.50, a new high for the Index. One year ago our 3MMA was +50.

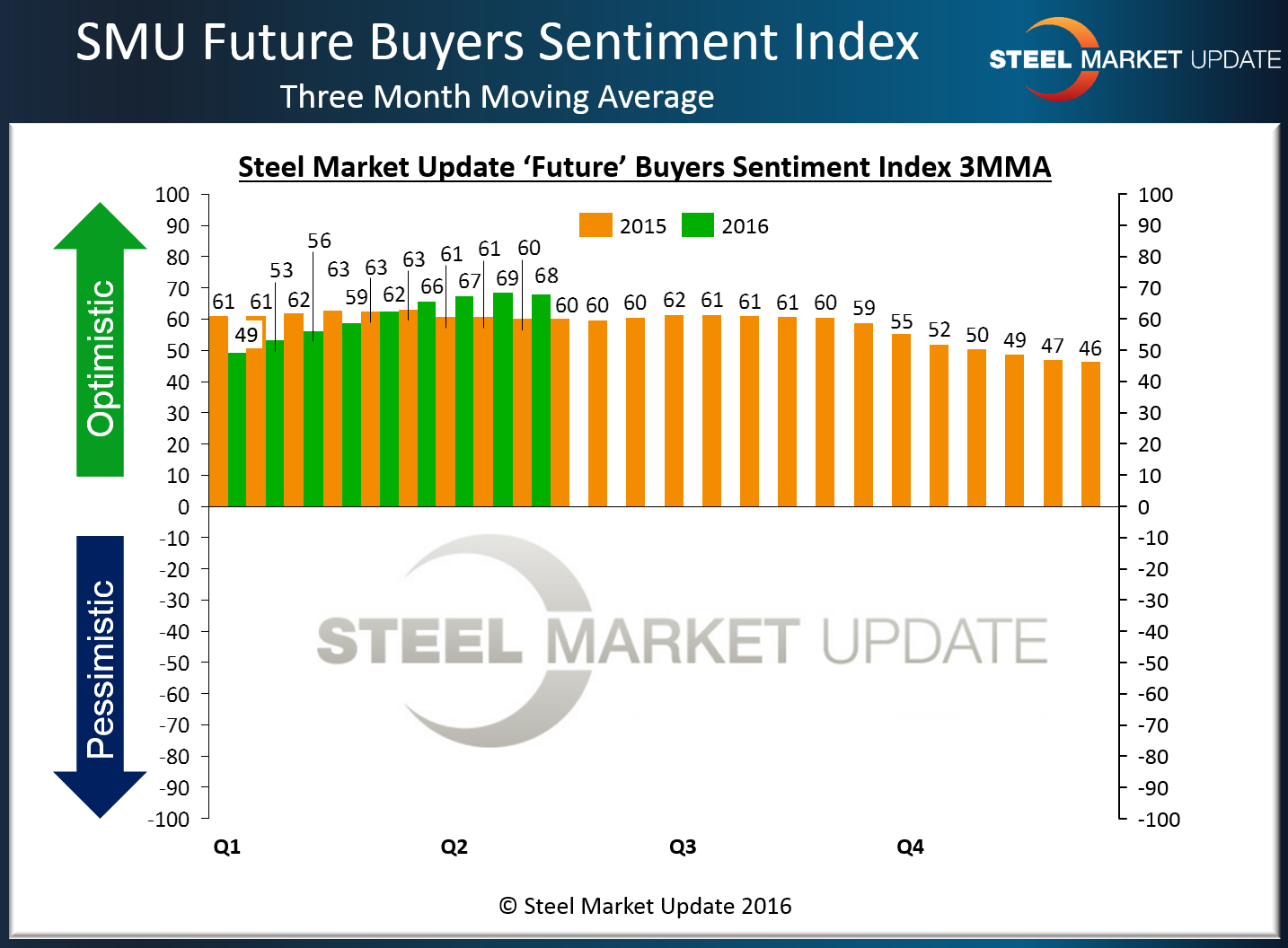

Future Sentiment Index 3MMA Slips from High Set in Mid-March

Our Future Sentiment Index dropped 5 points this week and is now being reported at +66. Since the middle of March our Future Sentiment Index had been treading water and moving sideways at +71. One year ago Future Sentiment was measured at +60.

When looking at Future Sentiment based on a three month moving average (3MMA) our index is now at +68.0 just off the record high achieved during the middle of April of +68.67. One year ago the Future Sentiment 3MMA was +60.17.

We explain what the points mean at the end of this article. Essentially, buyers and sellers continue to be very optimistic about their company’s ability to be successful. We attribute this optimism to better market conditions (demand), steel prices which are consistently moving higher with little short term downside risk, inventory values increasing as well as seasonal factors coming into play. For most buyers and sellers of flat rolled steel it appears to be a good time to be involved in the industry.

What Our Respondents Are Saying

“We are getting the tons, at spot numbers, but availability is primary, price is secondary. 2008?” Service center

“[Business is Excellent] but only if we receive all / most of the steel we have on order with CSN Brazil.” Manufacturing company

“When will the bubble burst? It feels like the market has gone up way to much way to fast. Will this have an impact on the final determination of the trade cases? If offers keep going up I guarantee you non-traditional import sources will be licking their chops.” Service center

“What goes up must come down.” Service center

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 100-170 companies. Of those responding to this week’s survey, 43 percent were manufacturing and 42 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.