Market Data

May 5, 2016

Steel Mill Lead Times Continue to be Extended

Written by John Packard

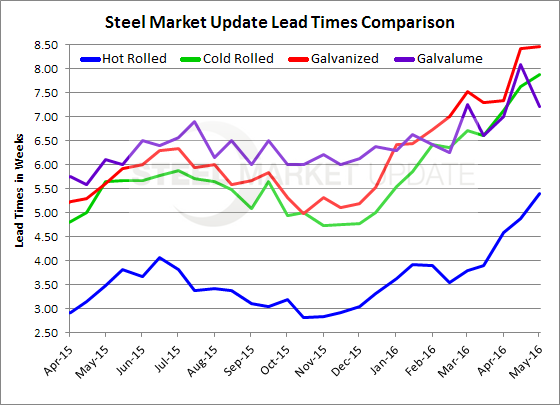

Domestic mill lead times: the amount of time it takes to receive flat rolled steel on an order placed this week, continue to be extended and are averaging at least one week longer than one year ago according to those participating in this week’s SMU flat rolled market trends analysis.

Earlier this week we began canvassing buyers and sellers about the flat rolled steel markets. One of the items we watch carefully are lead times on hot rolled, cold rolled, galvanized and Galvalume steels. We have been seeing lead times as being referenced as extended over the past couple of months and that trend continued this week as well.

This is an unusual time when it comes to reviewing lead times. There are a number of mills who are opening and closing their order books very quickly. When the book is closed it is difficult to provide an accurate assessment of exactly where that supplier’s lead times may actually be at any given point in time.

Based on the responses we received the following are the “average” lead times by product. Exact lead times can vary from mill to mill depending on the product, if the mill is trying to maintain short lead times (such as Steel Dynamics who have yet to open their June order book) or if they are just practicing “controlled order entry.”

Hot rolled lead times were reported to be averaging more than 5 weeks (5.39 weeks) and are about one week longer than what we were reporting at the beginning of April. One year ago lead times on HRC averaged 3.5 weeks.

Cold rolled lead times remain extended averaging almost 8 weeks (7.88 weeks). At the beginning of April CR lead times were approximately 7 weeks. One year ago CR lead times were reported to be averaging 5.65 weeks.

Galvanized lead times are also about one week longer than what was reported at the beginning of April. GI is now averaging 8 and a half weeks (8.47) and are almost two weeks longer than one year ago (5.61 weeks).

Galvalume lead times are now being reported as slightly longer than 7 weeks (7.22 weeks) or not too different than what we were reporting at the beginning of April (7.0 weeks). One year ago AZ lead times were one week shorter at 6.11 weeks. As an aside, earlier this week we heard from a mill that produces Galvalume, they advised SMU that there order book had slowed as many of their customers had covered their immediate needs through a combination of domestic and foreign suppliers.

To see an interactive history of our Steel Mill Lead Time data, visit our website here.