Prices

May 22, 2016

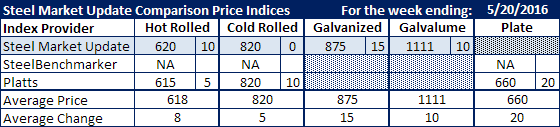

Comparison Price Indices: Variances in Steel Indexes Averages Shrink

Written by John Packard

We tend to see the various steel indexes become more “in tune” with one another once the steel mills decide to take a wait and see attitude about the market. Over the past few weeks, U.S. steel mills have (once again) managed to expand the spread between U.S. steel prices and those of foreign steel both in Europe and Asia. The U.S. dollar has been rising over the past two weeks, commodity prices in China are weakening and the expectation is for scrap prices to roll-over or drop by as much as $20 per ton once the June negotiations begin in earnest.

Benchmark hot rolled coil prices increased by modest amounts on both the SMU and Platts indexes. Steel Market Update saw HRC numbers as up $10 per ton and are now averaging $620 per ton ($31.00/cwt). Platts took their average up $5 per ton to $615 per ton ($30.50/cwt). SteelBenchmarker did not report prices this week.

Cold rolled prices averaged $820 per ton ($41.00/cwt) on both the SMU and Platts indexes.

Steel Market Update took our .060” G90 galvanized average up $15 per ton to $875 per ton ($43.75/cwt).

Galvalume price average for .0142” AZ50, Grade 80 was up $10 per ton to $1111 per ton ($55.55/cwt).

Plate prices rose the most with Nucor and SSAB raising prices this past week. Discrete plate was up $20 per ton to $660 per ton ($33.00/cwt).

Spread Widens Between U.S. & European/Asian HRC Pricing

According to Platts, European hot rolled prices now average $435 per metric ton ($395 per net ton) and Chinese domestic HRC has dropped from the mid $400’s per metric ton a couple of weeks ago to $378 per ($342 per net ton). Using $100 per net ton for freight, insurance, loading and unloading charges and traders margin the European number at $495 per net ton would be quite compelling for U.S. steel buyers. At the moment SMU is not aware of any foreign offers at those levels (there are very few, if any offers out there right now) but, the U.S. steel mills have to keep tabs on what their customers can handle before buying foreign from countries who can ship it here or worse, taking their production out of the country.

FOB Points for each index

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.